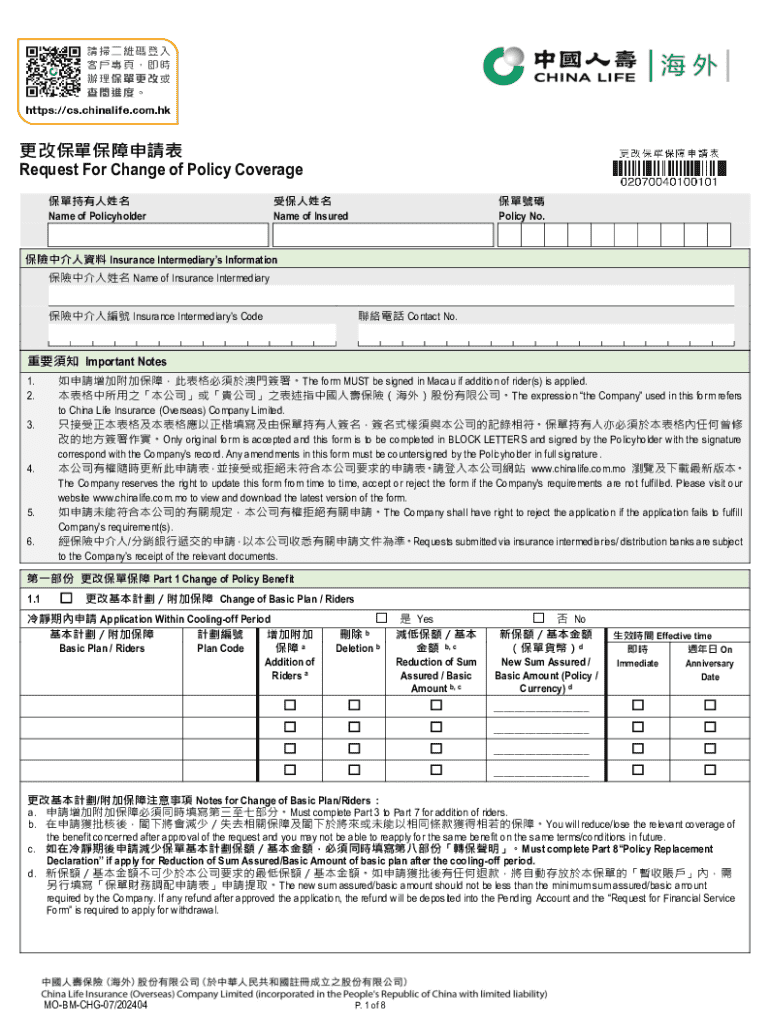

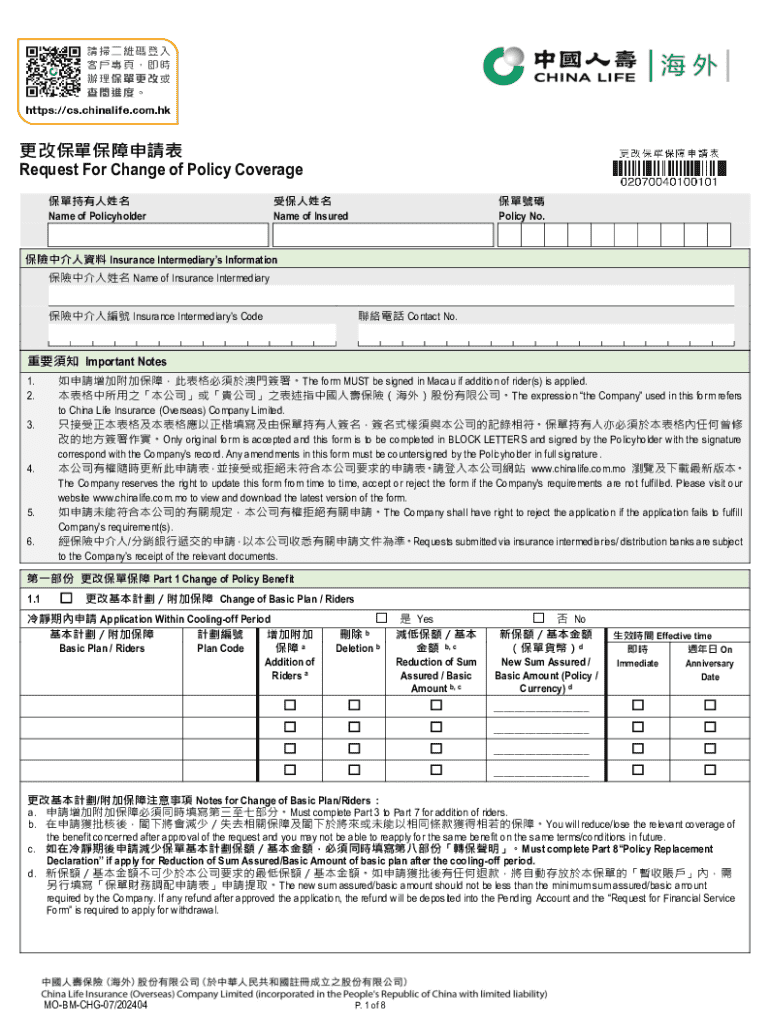

Get the free Name of Insurance Intermediary

Get, Create, Make and Sign name of insurance intermediary

How to edit name of insurance intermediary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out name of insurance intermediary

How to fill out name of insurance intermediary

Who needs name of insurance intermediary?

Insurance Intermediary Form - How-to Guide

Overview of insurance intermediary forms

Insurance intermediary forms serve as essential legal documents facilitating the process of insurance intermediation. These forms allow intermediaries such as brokers and agents to operate within regulatory frameworks while ensuring compliance with industry standards. The use of the correct insurance intermediary form is crucial, as it directly affects both the legal standing of the intermediary and the satisfaction of clients. Any mistakes or omissions can lead to delays, compliance issues, and potential legal challenges.

Various types of forms are utilized by insurance intermediaries, each catering to specific needs. These include application forms for licenses, renewal notifications, and different specialized documents. Understanding the landscape of these forms is key for successful operation in the insurance field.

Types of insurance intermediary forms

The world of insurance intermediary forms can be diverse, comprising several types tailored to meet particular requirements.

Detailed application process for retail intermediaries

The application process for retail intermediaries can often seem daunting. However, breaking it down into manageable steps can simplify the experience.

Understanding the regulatory landscape

Navigating the regulatory landscape as an insurance intermediary is vital for successful operations. Regulations not only dictate how intermediaries conduct business but also establish timelines for compliance and reporting.

Tools and resources for managing forms

The complexity of managing insurance intermediary forms necessitates reliable tools for efficiency. Platforms like pdfFiller provide various resources to assist in optimizing workflows.

FAQs about insurance intermediary forms

Common queries arise during the application process for insurance intermediary forms. Addressing frequently asked questions can alleviate stress and streamline the experience for intermediaries.

Best practices for successful intermediary operations

Implementing best practices can elevate the effectiveness and efficiency of insurance intermediary operations significantly.

Contact information for further assistance

For specific inquiries and assistance in navigating insurance intermediary forms, reaching out through pdfFiller’s platform can connect you with dedicated support.

Additionally, having useful links to regulatory bodies will provide direct access to the resources needed to manage forms properly.

Latest trends and changes in insurance intermediation

The insurance sector is continuously evolving, especially in regulatory practices and document management technologies. Staying informed about recent regulatory updates will enhance your operations.

Innovation in document management technology, particularly platforms like pdfFiller, ensures that insurance intermediaries can handle forms seamlessly while adhering to compliance standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my name of insurance intermediary in Gmail?

How can I send name of insurance intermediary for eSignature?

Can I edit name of insurance intermediary on an iOS device?

What is the name of insurance intermediary?

Who is required to file name of insurance intermediary?

How to fill out name of insurance intermediary?

What is the purpose of name of insurance intermediary?

What information must be reported on name of insurance intermediary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.