Get the free Home - ITC Properties Group Limited

Get, Create, Make and Sign home - itc properties

Editing home - itc properties online

Uncompromising security for your PDF editing and eSignature needs

How to fill out home - itc properties

How to fill out home - itc properties

Who needs home - itc properties?

Complete Guide to the Home - ITC Properties Form

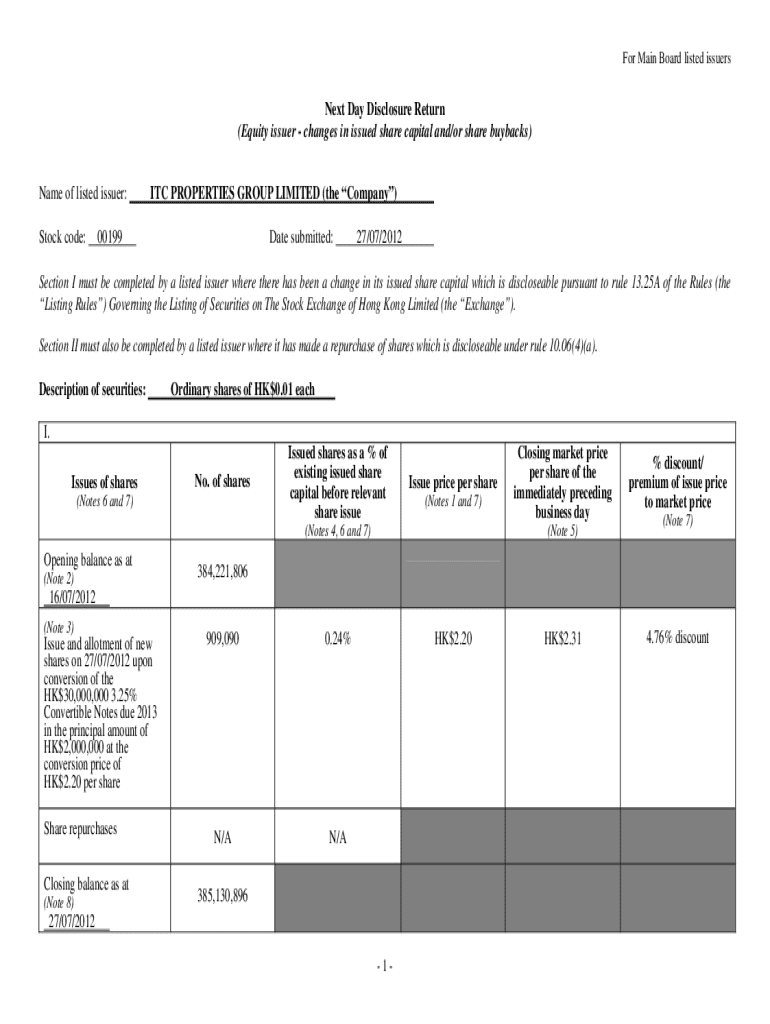

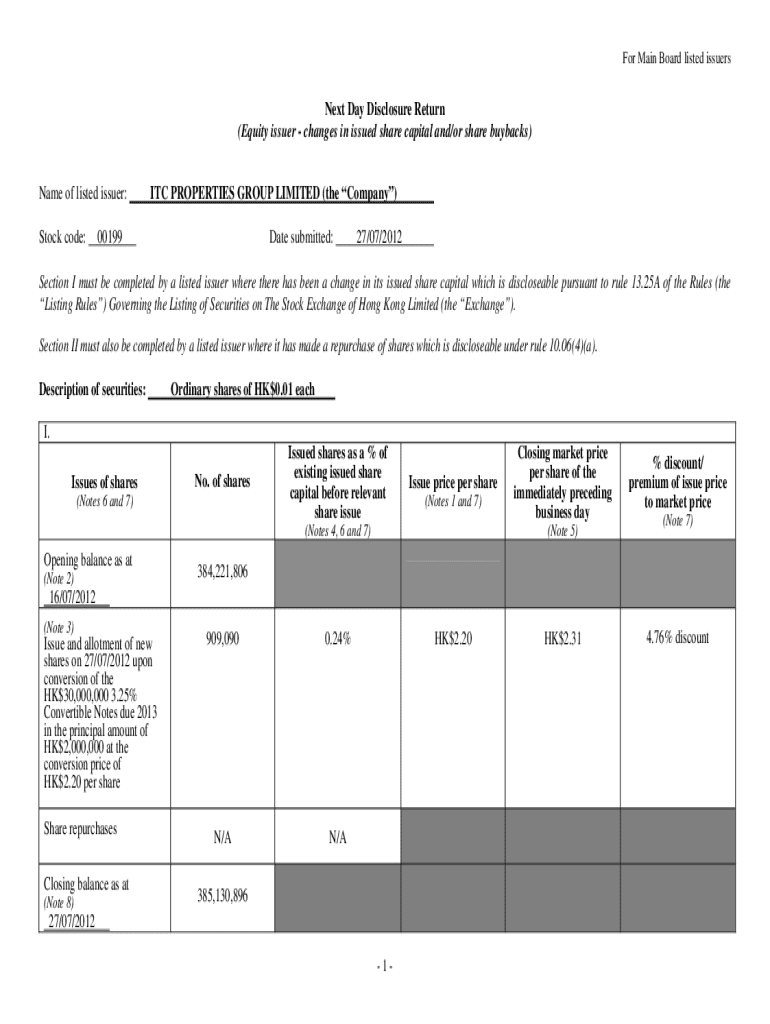

Overview of the Home - ITC Properties Form

The Home - ITC Properties Form is an essential document utilized for property registration and documentation processes. Specifically designed to streamline the transfer of property ownership, its significance cannot be overstated in maintaining accurate and legally binding records. This form helps individuals and teams ensure their property transactions are well-documented, reducing the risk of future disputes or legal issues.

Utilizing a platform like pdfFiller enhances the experience of managing this form. The platform not only simplifies the process of filling out the ITC Properties Form but also offers users various tools that increase efficiency, accuracy, and convenience in property documentation.

Key features of the ITC Properties Form on pdfFiller

pdfFiller provides an array of features specifically designed to facilitate the completion of the ITC Properties Form. One of the primary benefits includes interactive tools that allow users to edit and fill out the form directly within the application. This immediacy significantly reduces the time and effort typically required for paperwork.

Another notable feature is the eSigning capability, which enables users to sign documents electronically. This function not only offers a seamless transition from editing to signing but also ensures that the signed document is legally recognized and secure.

Step-by-step guide to filling out the ITC Properties Form

Filling out the ITC Properties Form is a straightforward process when you follow a step-by-step approach.

Step 1: Accessing the Form

To get started, navigate to pdfFiller's website and locate the ITC Properties Form. You can find it easily using the search bar. Once located, click on the document to open it in the editor.

Step 2: Completing personal information section

This section requires your name, address, and contact information. Ensure that all details are accurate as any discrepancies can result in processing delays. Double-check for typos and incorrect information before moving on.

Step 3: Property details entry

When entering property details, include the address, type of property, and current valuation. Common mistakes include incorrect property descriptions or misentering numerical values. Take your time to ensure all entries reflect accurate and up-to-date information.

Step 4: Reviewing legal and compliance requirements

Before submitting the form, verify that all legal aspects are considered. Familiarize yourself with your local regulations to ensure compliance. This could involve checking necessary permits or certifications required for property transactions in your area.

Step 5: Final review and eSigning the form

Conduct a final review of the completed form to catch any errors. Once satisfied, use the eSigning feature to sign the document electronically. This ensures that your submission is legitimate and legally binding.

Editing and managing the ITC Properties Form

After filling out the ITC Properties Form, you may find the need to edit the document. With pdfFiller, editing is user-friendly; simply open the form in your workspace, and make any necessary adjustments. This flexibility allows you to refine your submissions effectively.

The collaborative features of pdfFiller stand out when dealing with property forms. Share the document with team members for their input or approval prior to finalizing. Saving and sharing your document is a breeze, allowing you to maintain workflow without unnecessary delays.

Troubleshooting common issues

Using the ITC Properties Form can present challenges. Common issues include technical difficulties with form submission, misunderstood sections, or the need for additional information. It is important to be informed about these potential pitfalls.

To address these hurdles, pdfFiller offers a comprehensive FAQ section regarding the ITC Properties Form. Engaging with customer support can also provide personalized assistance, ensuring that all concerns are resolved quickly. Ensure you’ve read through common questions to preemptively tackle issues.

Supporting documentation and additional forms

Alongside the ITC Properties Form, there may be additional documentation required for submission. These can include proof of identity, land surveys, or property titles. Familiarity with these supplementary documents is crucial as they can expedite the approval process.

Consider using linked supplemental forms available on pdfFiller to assemble all necessary documentation with ease. Ensuring you have all related documents can save you significant time and prevent delays in the submission process.

Getting help and support

pdfFiller offers robust customer support for users of the ITC Properties Form. To access help, navigate to their dedicated support center where you can find answers to many common issues. The user community also presents a wealth of knowledge through shared experiences and solutions.

For specific inquiries, pdfFiller provides contact information for direct support teams. Whether you prefer online chats or emails, professional assistance is available at your fingertips.

Real-world applications of the ITC Properties Form

The ITC Properties Form has seen successful use across diverse cases. For instance, a local real estate team recently utilized pdfFiller to streamline their property transactions, resulting in a 30% decrease in processing time. Similarly, individual homeowners have reported smoother transitions when selling their properties using the form.

The benefits observed include reduced paperwork errors, increased efficiency, and a greater level of confidence in their submissions. This form not only serves as a tool for documentation but as a means to foster effective communication between all parties involved.

Conclusion of the ITC Properties Form experience

Using pdfFiller for the ITC Properties Form enhances the experience of property documentation immensely. From interactive editing to efficient eSigning, every feature is geared towards creating a seamless process for users.

As property transactions can be intricate and detail-oriented, leveraging pdfFiller not only simplifies managing your documents but also promotes better organization and compliance. Embrace this technology for a more efficient documentation experience and confidently handle your property registration and transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find home - itc properties?

How can I edit home - itc properties on a smartphone?

How do I complete home - itc properties on an iOS device?

What is home - itc properties?

Who is required to file home - itc properties?

How to fill out home - itc properties?

What is the purpose of home - itc properties?

What information must be reported on home - itc properties?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.