Get the free Gift Aid and Tax Efficient Giving - Robinson College

Get, Create, Make and Sign gift aid and tax

Editing gift aid and tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gift aid and tax

How to fill out gift aid and tax

Who needs gift aid and tax?

Gift Aid and Tax Form: Your Comprehensive How-to Guide

Understanding gift aid: A quick overview

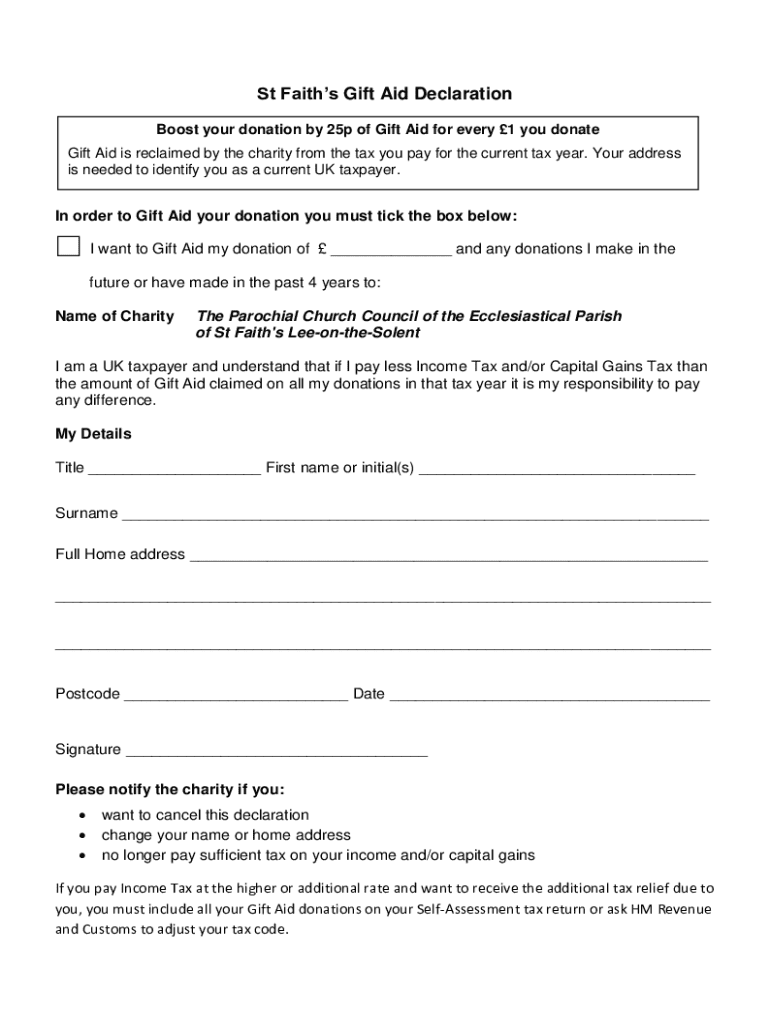

Gift Aid is a UK government scheme that allows charities to reclaim tax on donations made by UK taxpayers. This means that for every £1 a donor gives, charities can claim an extra 25p from the government, boosting the value of donations significantly. Gift Aid is vital as it enhances the financial support that charities receive, allowing for improved services and extended outreach.

To qualify for Gift Aid, donors must be UK taxpayers, and their donations must be voluntary and made without receiving any benefits in return. It’s crucial for donors to understand that they need to pay enough UK income tax or capital gains tax to cover the amount reclaimed by the charity during the tax year.

Preparing to complete your gift aid tax form

Filling out your Gift Aid tax form requires some preparation to ensure you have all the necessary information. Initially, you'll need records of all donations you've made to charities that qualify for Gift Aid. This can include bank statements, receipts, or contribution history provided by the charitable organizations.

In addition to donation records, gather personal tax information, such as your National Insurance number and details of your tax code. It’s essential to pay attention to the details to avoid common mistakes, such as claiming Gift Aid on ineligible donations or entering incorrect personal information.

Key terminology includes understanding donor information, which pertains to your personal details, and knowing the details about the charitable organization you're supporting. These elements are crucial in helping you complete the form accurately.

Step-by-step guide to filling out the gift aid tax form

Completing the Gift Aid tax form isn't as daunting as it may seem. Follow these detailed steps to ensure you correctly submit your claim.

Step 1: Gather donor information

Begin by providing your basic personal details, including your name, address, and National Insurance number. Ensure the information is accurate as inaccuracies could result in delays in processing your claim.

Step 2: Acknowledging the charity

Next, verify the charity’s status. This can typically be done on the Charity Commission website or directly via their office. You’ll want to note the charity’s name and registration number, as these details are necessary on the form.

Step 3: Recording your donations

Compile a list of your eligible donations, being careful to include accurate amounts. Double-check against your donation records to avoid discrepancies. Ensure that each donation qualifies under the Gift Aid scheme.

Step 4: Registering for charities online

If you haven't already, consider using the HMRC's online registration process for charities. This not only streamlines your interactions but also speeds up your claims. The online system often provides faster processing times and an easy tracking method for your contributions.

Step 5: Completing the gift aid tax form

When filling out the form, take it section-by-section. Make sure you accurately complete every field according to the instructions provided. Pay special attention to the amount of donation figures and the charity details entered in the system.

Step 6: Checking your submission

Before finalizing your submission, conduct a thorough review of the form. Common mistakes include entering incorrect charity information or missing signatures. Ensure your details align exactly with your records.

Step 7: Submitting the form

Finally, submit your Gift Aid claim. Depending on your preference, submissions can typically be done online or by post. Be mindful of submission deadlines to maximize the tax benefits for the year.

Interactive tools and resources

To facilitate your Gift Aid claims, several online tools can assist you. A Gift Aid eligibility checker is an excellent resource to ensure your donations qualify. Furthermore, consider utilizing an online form assistance tool that guides you through the tax form process.

It's helpful to have access to a detailed FAQs section, as many donors have similar questions regarding Gift Aid. For immediate assistance, live chat support is invaluable for resolving issues as they arise.

Post-submission: What to expect

Once your Gift Aid claim has been submitted, allow some time for processing. Typically, claims are processed within a few weeks, but it can vary depending on the waiting times at HMRC. Tracking your application is vital, and you should receive confirmation once your claim is successful.

Understanding your entitlements stemming from the Gift Aid claim can result in potential refunds, especially if you have made payments exceeding your eligible donations within the tax year. Stay informed about how to manage these refunds for maximum benefits.

Advanced tips for maximizing your gift aid claims

To further enhance your Gift Aid endeavors, collaborating with teams and organizations is beneficial. For instance, consider organizing group donations, which cumulatively meet the tax threshold. Ensure collective understanding of eligibility and proper documentation.

Common pitfalls include neglecting to track the donation history and failing to notify the charity of any changes in donor circumstances. To future-proof your submittals, keep a record of all receipts and document of ongoing contributions annually.

Navigating changes in legislation

Staying updated on changes to Gift Aid rules is crucial for both donors and charities. Recent adjustments may affect how claims are made or how eligibility is determined. Regularly consult HMRC resources or updates to keep abreast of legislative shifts.

Being informed affects how much tax relief charities can claim, which ultimately impacts their funding models. Adaptability in responses ensures optimal utilization of the Gift Aid scheme.

Case studies: Successful gift aid claims

Analysing successful Gift Aid claims helps in understanding best practices. For instance, a charity focused on youth programs successfully optimized their Gift Aid by implementing structured record-keeping and ensuring all volunteers were trained on the significance of claiming Gift Aid.

Feedback from users indicates that clarity in form-filling and commitment to documentation significantly enhances the outcome of claims. Such case studies offer valuable lessons for prospective donors.

Accessing help and support

For further guidance, accessing official HMRC resources is a vital step. Users should also leverage document management platforms like pdfFiller that enhance document handling and streamline the Gift Aid form filling process.

Utilizing pdfFiller’s features not only simplifies document management but also enhances team collaboration when submitting and tracking Gift Aid claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit gift aid and tax online?

Can I create an electronic signature for signing my gift aid and tax in Gmail?

How can I fill out gift aid and tax on an iOS device?

What is gift aid and tax?

Who is required to file gift aid and tax?

How to fill out gift aid and tax?

What is the purpose of gift aid and tax?

What information must be reported on gift aid and tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.