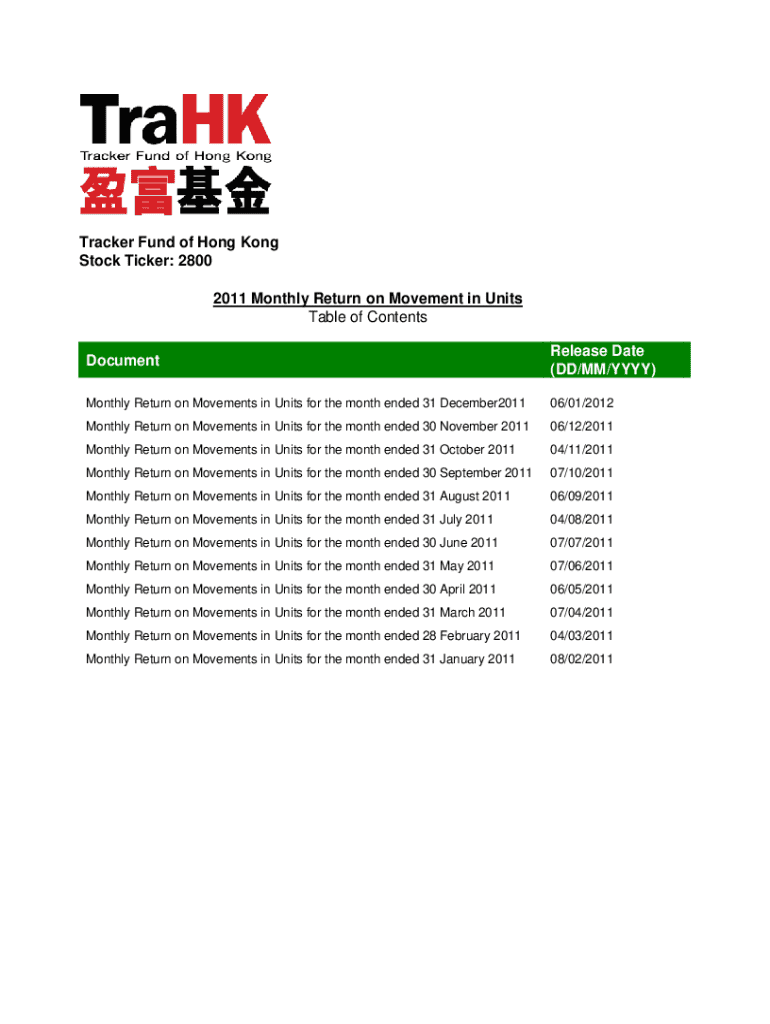

Get the free Tracker Fund Of Hong Kong (2800.HK) Stock Historical Prices ...

Get, Create, Make and Sign tracker fund of hong

How to edit tracker fund of hong online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tracker fund of hong

How to fill out tracker fund of hong

Who needs tracker fund of hong?

Tracker Fund of Hong Form: Your Comprehensive Guide

Understanding tracker funds: A comprehensive overview

Tracker funds, often referred to as index funds, are investment vehicles designed to follow or 'track' the performance of a specific market index. They are crucial for investors seeking diversified exposure to the stock market without the need for extensive research into individual stocks. Essentially, they mirror the components of an index like the Hang Seng Index in Hong Kong, allowing investors to capitalize on overall market movements.

These funds are characterized by their passive management style, meaning that they're not actively traded by fund managers but rather the fund's portfolio replicates the desired index. This approach significantly lowers management fees compared to actively managed funds. Therefore, tracker funds are increasingly popular among both individual and institutional investors.

Investing in tracker funds aligns well with a long-term investment strategy, especially for those who prefer a hands-off approach.

The Hong Form: What you need to know

The Hong Form refers to the documentation required for transactions involving tracker funds in Hong Kong. This form is key in ensuring compliance with securities regulations and facilitates the smooth operation of fund management. It serves both as an application and an authorization to manage the investor's funds according to their selections.

Legal compliance is a significant aspect of utilizing the Hong Form. Regulatory frameworks in Hong Kong require that all investment activities, especially those involving public funds, adhere strictly to prescribed guidelines. This ensures investor protection and market stability.

Understanding the purpose of the Hong Form is crucial for any investor engaging with tracker funds in Hong Kong.

Preparing to fill out the Hong Form

Before filling out the Hong Form, it's essential to gather all necessary documentation and information. This preparation phase helps ensure that your form is completed accurately, reducing the likelihood of delays in processing your application.

Accurate data collection is paramount. Keep your information organized, and consider making a checklist to ensure nothing is overlooked. This will also speed up the application process once you start filling out the form.

Step-by-step guide to completing the Hong Form

Completing the Hong Form can seem daunting, but breaking it down into manageable steps makes the process straightforward. Below is a detailed guide that takes you through each part of the form.

Signing and submitting the Hong Form

Once you've completed the Hong Form, the next step is to sign and submit it. This section outlines your options for signing, which may vary based on your preference for eSignatures or traditional signatures.

Using pdfFiller’s eSignature features can simplify this step.

After submission: What to expect

After you submit the Hong Form, you will receive a confirmation of receipt which is crucial for your records. It usually takes some time for the tracker fund application to process, and understanding these timelines allows you to manage your expectations better.

It's prudent to know how to follow up on your submission. If there are any delays beyond the expected processing time, you can directly contact the fund manager or the submission portal using the provided contact details.

Managing your tracker fund portfolio

Once you're a participant in tracker funds, managing your portfolio requires ongoing attention. Platform accessibility is paramount; pdfFiller offers tools for easy access and management of your account.

Advanced features of pdfFiller for tracker fund management

As you delve into managing your tracker funds, pdfFiller provides advanced features tailored for efficient document management. Team collaboration becomes simpler, especially for those involving multiple stakeholders in financial decision-making.

Case studies: Successful tracker fund utilization

Various individuals and teams have successfully utilized tracker funds to meet their investment goals. A case study of a diversified investment group illustrates how they leveraged multiple tracker fund strategies to minimize risk while maximizing returns over time. Similarly, individual investors have reported positive experiences when sticking with a disciplined investment strategy focused on low-cost tracker funds.

These examples highlight the variability of strategies and the importance of understanding individual risk tolerance levels and market conditions. Engaging actively with available resources significantly contributes to successful fund management.

FAQs about the tracker fund and Hong Form

In the realm of tracker funds and the Hong Form, several common questions arise that necessitate clarification. From the specific information needed on the Hong Form to queries about fund management, addressing these FAQs aids in demystifying the process for first-time investors.

These questions contribute to a clearer understanding of tracker funds and emphasize the importance of preparation in filling out the Hong Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tracker fund of hong?

How do I complete tracker fund of hong online?

Can I edit tracker fund of hong on an Android device?

What is tracker fund of hong?

Who is required to file tracker fund of hong?

How to fill out tracker fund of hong?

What is the purpose of tracker fund of hong?

What information must be reported on tracker fund of hong?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.