Get the free Standing Orders of the Board of Governors and its ...

Get, Create, Make and Sign standing orders of form

Editing standing orders of form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standing orders of form

How to fill out standing orders of form

Who needs standing orders of form?

Standing Orders of Form: A Comprehensive How-to Guide

Understanding standing orders

Standing orders are automated instructions set by an individual or organization to their bank, directing it to make regular payments from one account to another. These transactions typically occur at specified intervals and for a defined amount, facilitating consistent and timely payments without additional action required from the payer. The importance of standing orders spans both personal and organizational finance, offering a framework for automated financial management that minimizes missed payments and assists with budgeting.

In personal finance, standing orders are often used for routine bill payments, such as utility bills and subscription services, providing peace of mind that obligations will be met consistently. In a business context, they streamline operations by automating payroll and vendor payments, freeing resources for other critical functions. Understanding how to establish and manage these orders effectively can lead to significant time and cost savings.

Types of standing orders

There are several types of standing orders that cater to various financial needs. Standard standing orders are the most commonly utilized; they involve fixed payment amounts made at regular intervals. For instance, a person might set a standard order to pay a monthly subscription fee for a service like streaming media, ensuring the provider receives their payment on schedule each month.

On the other hand, variable standing orders allow users to adjust the payment amount periodically. This flexibility is useful for bills that change monthly, such as utilities, where the cost can fluctuate based on usage. Users can also opt for automated standing orders where payments are handled through online banking without manual intervention, contrasting with manual standing orders where each payment has to be approved. Each type presents unique pros and cons that users should consider when selecting the best option for their financial management.

How to set up a standing order

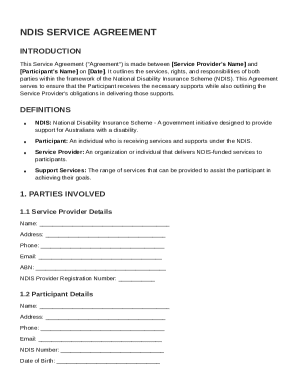

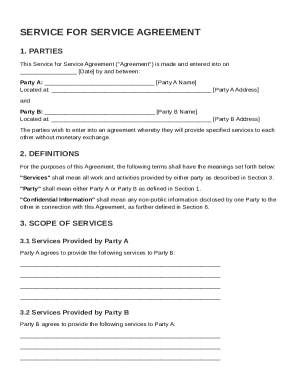

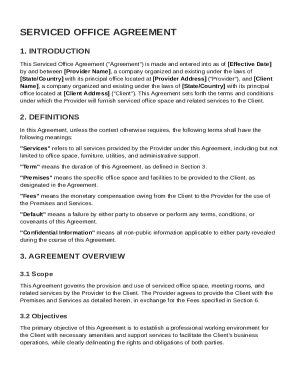

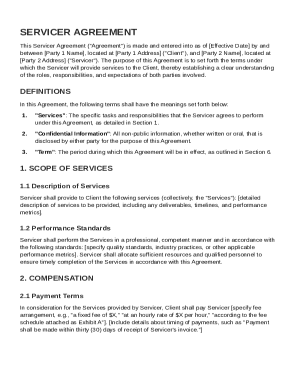

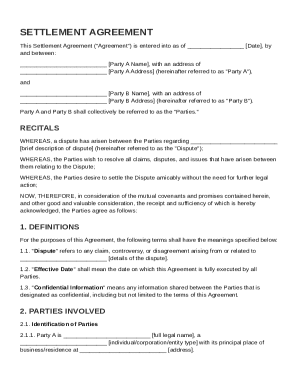

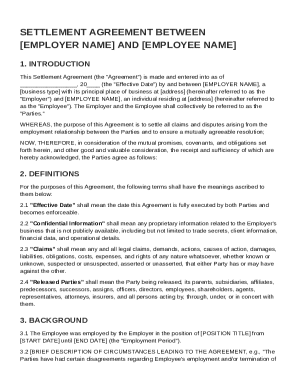

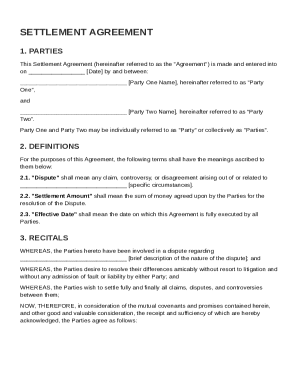

Setting up a standing order begins with gathering necessary information. This includes your bank account details, the recipient’s account information, and the necessary payment amounts. Knowing this data beforehand aids the process, ensuring nothing is overlooked when filling out the standing order form.

The standing order form typically includes sections for your name, account number, and the payee's information. You will also need to determine how much you wish to pay and the frequency of payments—options often include weekly, monthly, or quarterly intervals. After completion, submission can occur through various methods: directly through your online banking system, in-person at a bank branch, or via mail—each with its own associated timelines for processing.

Editing and managing standing orders

Managing your standing orders is crucial to ensure they align with your financial commitments. To modify an existing standing order, you generally need to follow simple steps through your bank or online platform. This process typically involves accessing your account, locating your existing orders, and selecting the option to edit. Amendments can include changing the payment amount or frequency, allowing you to adapt your financial outflows as your situation changes.

Cancelling a standing order should also be approached with care. Reasons for cancellation can vary from changing financial strategies to switching service providers. To cancel effectively, you should access the same management interface used to create the standing order, and follow the prompts to complete the cancellation. However, some common mistakes should be avoided, such as failing to review your account balances regularly or neglecting to confirm that payments are processed successfully prior to a scheduled payment date.

Special considerations for standing orders

When establishing standing orders, understanding the timing of payments is critical. Banks often have cut-off times for processing payments, which can affect when funds are deducted from your account. Missing these deadlines may result in late payments and potential penalties, undermining the advantages of using standing orders.

Moreover, it's essential to be aware of any fees and charges associated with your standing orders, particularly for insufficient funds. Failing to maintain a minimum balance can incur penalties, impacting your overall financial health. Lastly, missed standing order payments can negatively affect your credit score, as consistent payment histories are crucial for maintaining good credit ratings. Therefore, monitoring and managing standing orders are fundamental to avoiding these pitfalls.

Leveraging technology for standing orders

As financial management increasingly shifts towards digitization, leveraging cloud-based platforms, like pdfFiller, can significantly enhance the efficiency of handling standing orders. These platforms provide comprehensive tools for document management, allowing users to edit forms, sign documents electronically, and collaborate effectively. Utilizing technology streamlines the standing order setup process, making it easier to manage payments from anywhere.

Integrating eSignature functionality is especially important for securing financial agreements associated with standing orders. This feature ensures that both parties involved in the transaction maintain a clear, legally binding record, which enhances trust. Moreover, collaborative features built into cloud platforms allow teams to work on standing order forms together, ensuring accuracy and reducing the risk of errors, which is essential for financial transactions.

Frequently asked questions (FAQs)

Several common questions arise regarding standing orders. For instance, what happens if your standing order fails? Typically, your bank will notify you, and you may incur fees if funds were insufficient at the time of withdrawal. Understanding the necessity of having sufficient balance in your account continues to be crucial.

Can you set up a standing order through a mobile app? Many banks now offer mobile banking applications that allow you to create and manage standing orders easily and securely. Lastly, how long does it take for a standing order to take effect? This varies by bank, and it's advisable to check with your provider; however, it's common for payments to take a couple of business days to appear in the payee's account.

Case studies and success stories

Numerous individuals have harnessed the power of standing orders to improve their financial management. For example, a freelance graphic designer set up a standing order to regularly pay for software subscriptions needed for their business. This ensured uninterrupted access to tools crucial for operations while simplifying budgeting, as they could predict monthly expenses accurately.

Equally, businesses benefit from standing orders for payment to vendors. One small manufacturing firm streamlined its operations by automating payroll through standing orders. As a result, employee satisfaction increased due to timely payments, leading to better productivity. These case studies highlight how effectively managing standing orders can facilitate smoother operations and enhance financial stability for both individuals and businesses.

Additional tips for effective use

To make the most of your standing orders, regular monitoring of payments is crucial. Schedule checks to verify that payments are processing correctly each month. By actively managing these orders, you can avoid unexpected overdrafts and ensure bills are paid on time. Keeping a close eye on your bank statements can help identify discrepancies early.

Additionally, creating reminders for payment changes can be invaluable. Utilize digital calendars or reminder apps to notify you of any upcoming adjustments to payment amounts or schedules. This proactive approach enables you to stay ahead of financial shifts, ensuring your standing orders are always aligned with your financial goals.

Contact and support information

If you require assistance with standing orders, various customer support options are accessible through pdfFiller. Their support team can help you navigate any challenges you face during the setup or management process. Engaging with community forums and user groups can also be beneficial, providing individuals and teams with shared insights and experiences regarding best practices in managing standing orders efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find standing orders of form?

Can I create an eSignature for the standing orders of form in Gmail?

How do I fill out the standing orders of form form on my smartphone?

What is standing orders of form?

Who is required to file standing orders of form?

How to fill out standing orders of form?

What is the purpose of standing orders of form?

What information must be reported on standing orders of form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.