Get the free Non-Filer Form 2022-2023

Get, Create, Make and Sign non-filer form 2022-2023

Editing non-filer form 2022-2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-filer form 2022-2023

How to fill out non-filer form 2022-2023

Who needs non-filer form 2022-2023?

A comprehensive guide to the non-filer form 2

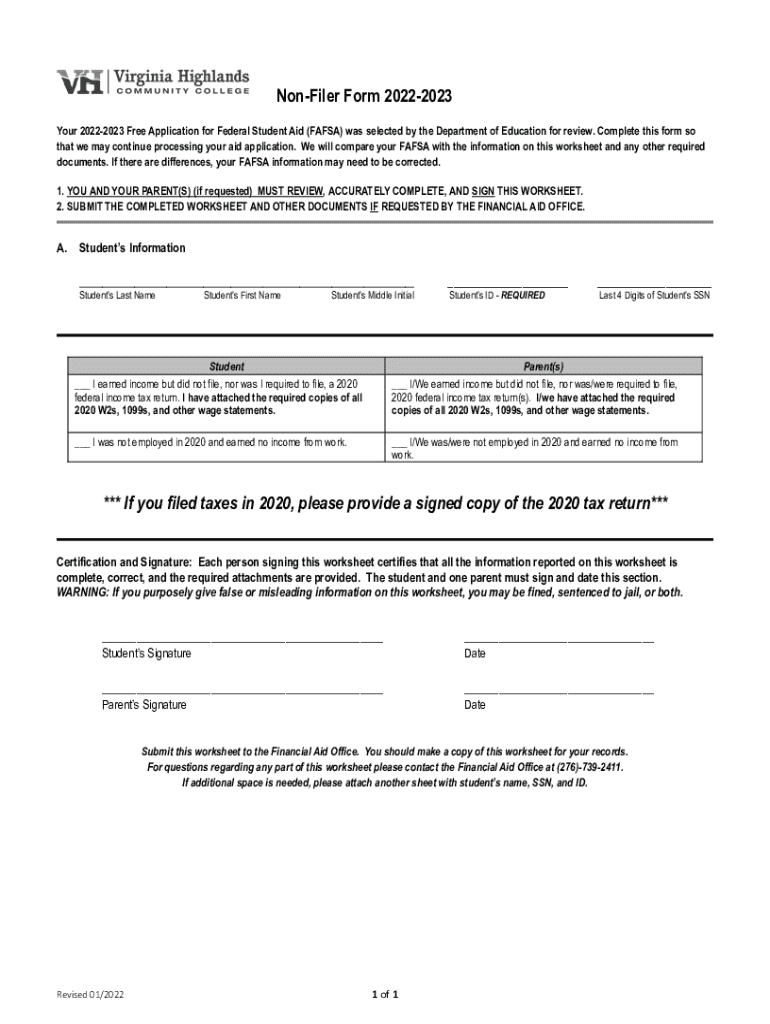

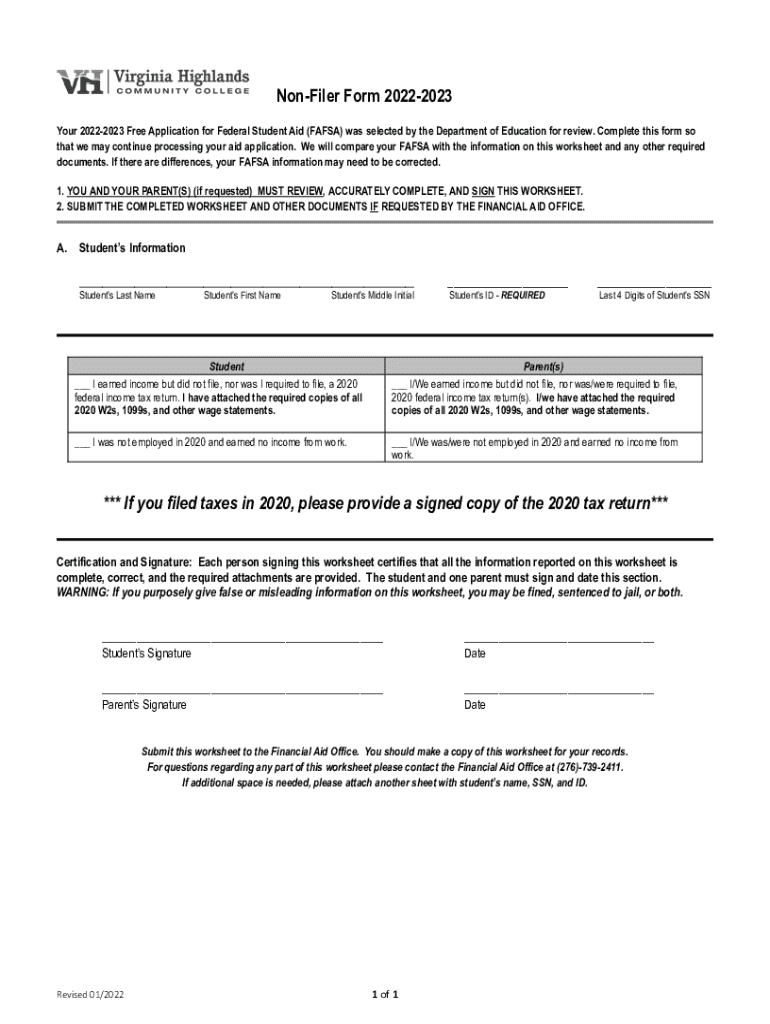

Understanding the non-filer form

The non-filer form for the tax year 2 is a crucial document for individuals who do not meet the income thresholds set by the IRS for mandatory filing. This form allows eligible individuals to report their financial information, ensuring they're accounted for in financial aid processes or other government programs. Understanding this form is vital for those who might otherwise miss out on benefits they are entitled to.

Despite its importance, there are several misconceptions surrounding the need for non-filing. Some individuals believe that if they earn any income, they must file, or that completing this form is unnecessary and overly complicated when they do not owe any taxes. In reality, using the non-filer form can simplify processes for accessing financial assistance and understanding one's tax status.

Who needs to use the non-filer form?

Identifying who qualifies to use the non-filer form is essential. Primarily, the non-filer form is designed for students, particularly those enrolled in higher education. Students often earn income during seasonal jobs or internships that do not reach the taxable threshold but still require reporting for financial aid purposes.

In addition, low-income individuals without taxable income or those in precarious financial situations should also consider completing this form. Completing the non-filer form can open up avenues for assistance, scholarships, or benefits, thus providing financial relief and support.

Key components of the non-filer form

The non-filer form consists of several key components. Firstly, users must provide personal identification details including names, addresses, and Social Security numbers. Next, individuals need to report any income details, even if below the taxation threshold. This inclusion is vital for establishing eligibility for various financial aid programs.

Moreover, the breakdown of sections goes deep into requirements such as student and parent information. Students must input their complete names, dates of birth, and details about the schools they attend. For parents, it’s essential to provide their names, Social Security numbers, and tax filing status for verification purposes. If parents did not file a tax return, they should provide alternative documentation to prove income.

Step-by-step instructions for completing the non-filer form

Filling out the non-filer form requires preparation. Start by gathering required documents like your Social Security card, proof of income, and educational enrollment verification. Understanding e-signature requirements is vital, as electronic signatures can expedite the submission process.

Each section of the form should be completed with care. When entering student information, ensure accuracy in your name and school details to avoid delays in processing. For parent information, input all required fields, and if there’s no tax return from the previous year, include other corroborating documents as specified.

Submitting the non-filer form

After filling out the non-filer form, you’ll need to submit it. There are two primary methods for submission—online and by paper. For those choosing the online route, the IRS website provides a user-friendly platform for direct submission. Alternatively, paper submissions can be mailed, but be sure to use certified mail to track the delivery.

Processing times can vary depending on the method chosen. Online submissions might receive quicker confirmations than paper ones. If you experience delays, it’s advisable to contact the IRS for updates on your submission’s status.

Frequently asked questions (FAQs)

One common question about the non-filer form is: What if I made a mistake? If you realize you’ve made an error on your submitted form, it’s crucial to correct it. You can file an amended form with the IRS, ensuring the changes are accurate.

Another prevalent query revolves around checking the status of your non-filer form submission. You can do this on the IRS website or by contacting their customer service. Understanding the consequences of not filing is also paramount, including potential ineligibility for financial aid or future tax benefits.

Using pdfFiller for your non-filer form

Utilizing pdfFiller for completing your non-filer form offers several advantages. The platform provides easy access to templates for various forms including the non-filer form, along with customizable editing tools. This convenience is particularly beneficial for individuals and teams requiring a seamless document creation solution.

Moreover, pdfFiller ensures secure e-signing capabilities, safeguarding your personal information while allowing you to sign documents electronically. This feature is particularly useful for those who may need to have parental approvals without delays, facilitating smooth submission.

Tools and resources within pdfFiller

pdfFiller provides a myriad of interactive tools that enhance the document completion process. Features for document storage and retrieval ensure that your completed non-filer forms are never more than a few clicks away, streamlining future access when needed.

In addition, pdfFiller's customer support is readily available to assist users in navigating issues or questions regarding the non-filer form. This layer of support can be invaluable, especially for first-time filers unfamiliar with the process.

Success stories

Real-life examples highlight the value of completing the non-filer form. Many students and low-income individuals have successfully received financial aid after utilizing the non-filer form to report their income accurately. These success stories anchor the importance of the non-filer form in unlocking educational opportunities and essential government benefits.

Testimonials from users of pdfFiller further accentuate its effectiveness, with many praising the platform for its user-friendly approach and efficient document management capabilities. Emphasizing personal experiences often helps others see the natural benefits of completing their non-filer forms accurately and timely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find non-filer form 2022-2023?

How do I complete non-filer form 2022-2023 online?

How do I edit non-filer form 2022-2023 online?

What is non-filer form 2022-2023?

Who is required to file non-filer form 2022-2023?

How to fill out non-filer form 2022-2023?

What is the purpose of non-filer form 2022-2023?

What information must be reported on non-filer form 2022-2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.