Get the free 12:00 PM and 7:00 PM

Get, Create, Make and Sign 1200 pm and 700

How to edit 1200 pm and 700 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1200 pm and 700

How to fill out 1200 pm and 700

Who needs 1200 pm and 700?

Understanding the 700 Form and the Importance of Timely Filing at 1200 PM

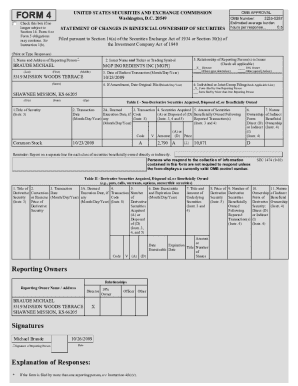

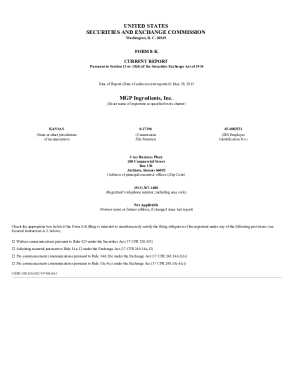

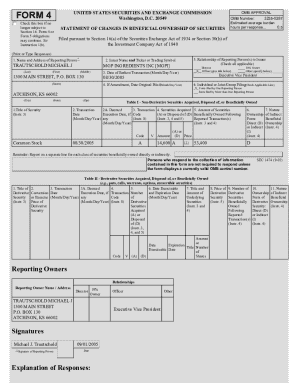

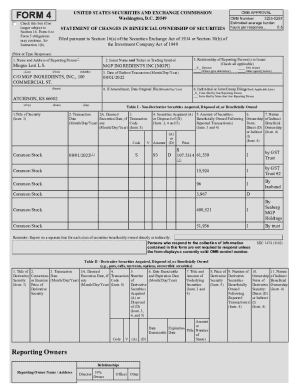

Understanding the 700 form

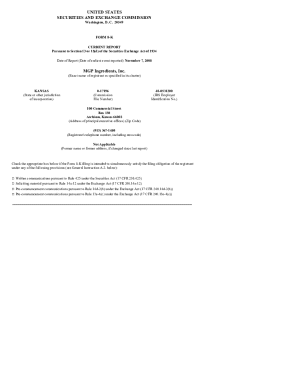

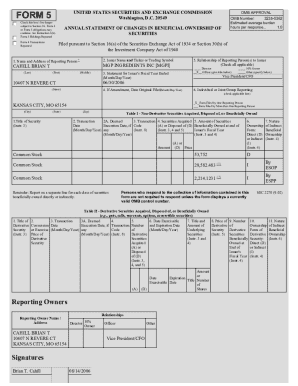

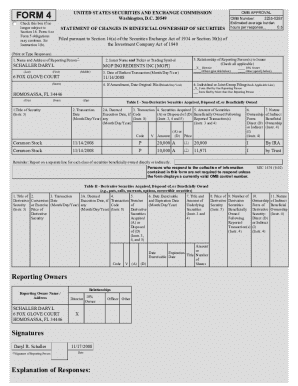

The 700 Form, commonly referred to as the Statement of Economic Interests, is a crucial document that provides transparency regarding the financial interests of individuals in public service. This form is particularly important for public officials, candidates for office, and certain employees who may have influence over the allocation of state resources. It aims to ensure accountability by revealing potential conflicts of interest.

Filing the 700 Form is not just a bureaucratic requirement; it plays an essential role in maintaining public trust in government. By disclosing economic interests, individuals allow for scrutiny that can help prevent corruption and promote ethical decision-making.

Key components of the 700 form

The 700 Form consists of several key sections, each designed to capture critical information about an individual's financial background:

When and why to file the 700 form

The obligation to file the 700 Form hinges on your role within public service. Individuals, such as legislators, appointed officials, and certain employees, are required to submit this form annually. The deadlines for submission vary and are an essential aspect of maintaining compliance to avoid penalties.

Failure to comply with filing deadlines can result in serious consequences, including fines, removal from office, or other legal implications. Thus, understanding the filing requirements is vital for anyone falling under the obligations of the 700 Form.

Detailed instructions for filling out the 700 form

A systematic approach to completing the 700 Form can ease the burden of filing. Here’s a step-by-step guide:

Technologies and resources to aid your filing process

Utilizing technology can greatly simplify the process of completing the 700 Form. Interactive tools, particularly those available on pdfFiller, allow for easy form filling and editing.

Additionally, options for eSignature solutions enable you to sign and submit forms digitally, ensuring a smooth and timely process. Collaboration features also allow teams to work together on form completion, making it easier to share insights and information.

Submitting your 700 form

Submitting the 700 Form can be done either by mail or electronically, depending on your preference and the requirements specified by your governing body. Understanding when to use each method is crucial for timely compliance.

To ensure your submission is received and processed, take the time to track it. Request a confirmation upon submission if mailing, or check online if submitting electronically.

Common FAQs regarding the 700 form

Questions frequently arise around the 700 Form, especially regarding deadlines and what to do if you've missed one.

Understanding filing after 1200 PM

Filing the 700 Form before 1200 PM is critical due to the cut-off time that many jurisdictions set for processing forms on the same day. Late submissions may not only be recorded for the next business day but could also lead to unnecessary complications in meeting compliance.

To ensure timely submission, it’s recommended to plan ahead. Review these strategies to help manage your filing process effectively:

Related forms and resources

Alongside the 700 Form, there are other forms that may be necessary for comprehensive compliance. The Conflict Statement, for instance, might also be required depending on your role and the specifics of your economic interests.

Navigating various forms can be intricate. Keep organized records of your submissions, and use document management solutions available on pdfFiller to simplify every aspect of the filing process.

Connect with experts

For personalized assistance in navigating the complexities of the 700 Form, consider connecting with filing officers who can provide tailored advice.

Additionally, look for upcoming webinars and workshops that focus on effective filing practices for public officials, allowing you to enhance your understanding and practice compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 1200 pm and 700 to be eSigned by others?

How do I edit 1200 pm and 700 online?

How do I fill out the 1200 pm and 700 form on my smartphone?

What is 1200 pm and 700?

Who is required to file 1200 pm and 700?

How to fill out 1200 pm and 700?

What is the purpose of 1200 pm and 700?

What information must be reported on 1200 pm and 700?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.