Get the free () Part I (Employer Information)

Get, Create, Make and Sign part i employer information

Editing part i employer information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out part i employer information

How to fill out part i employer information

Who needs part i employer information?

Understanding the Part Employer Information Form: A Comprehensive Guide

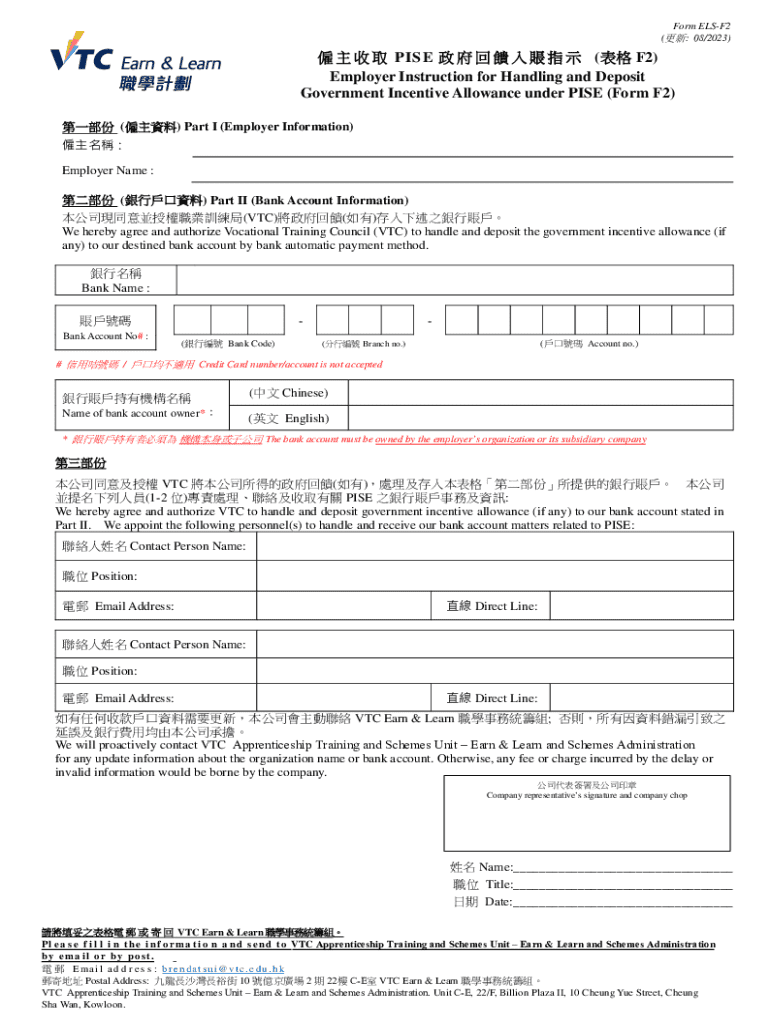

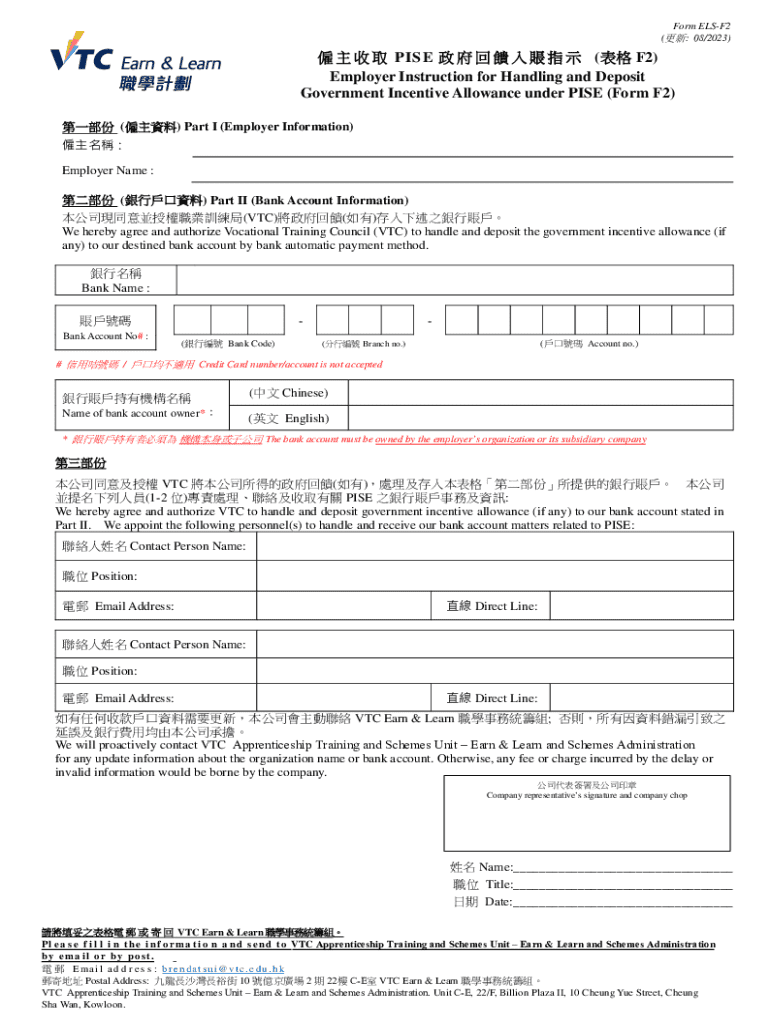

Overview of the Part Employer Information Form

The Part I Employer Information Form is a crucial document used by businesses to provide key identification details to the IRS. Its primary purpose is to ensure that employers accurately report their tax obligations and payroll information. The accuracy of this form is vital for payroll management, as any discrepancies can result in fines or delays in processing tax returns.

This form serves as an official record that facilitates the employer’s compliance with federal tax laws and regulations. Essentially, it acts as an identifier for the employer in the eyes of the IRS and is integral for tax compliance and record-keeping.

Components of the Part Employer Information Form

The Part I Employer Information Form comprises multiple sections, each tailored to gather specific employer data. The first section deals with employer identification information, including the legal name of the business and its Employer Identification Number (EIN). This data is essential for distinguishing one business from another and plays a critical role in tax handling.

Next, the address information section asks for both the mailing address and the physical location of the business. It is important to maintain updated records, as discrepancies can lead to issues with tax authorities or payroll processing. Additionally, the contact details section requires the primary contact person's information for tax-related queries and lists anyone else at the company who may handle such inquiries.

Common mistakes when filling out this form include misinterpreting the requirements of each section and omitting necessary details. It's essential to review the form thoroughly to avoid such pitfalls.

Instructions for filling out the form

Filling out the Part I Employer Information Form should be approached methodically. Begin by gathering all required documents, including your IRS notices and identification numbers. When filling out the sections, ensure that information is accurate. For example, a miswritten EIN could lead to severe complications with the IRS.

To input EIN and other identifiers correctly, it's crucial to follow formatting rules. Be sure to verify that addresses and contact numbers follow standard formats to guarantee clear identification of your business. After you fill out the form, complete a thorough review process to ensure everything is accurate prior to submission.

Employing methods like double-checking for typos and verifying your EIN through IRS resources can help prevent errors that may complicate the filing process.

Editing and managing the form with pdfFiller

pdfFiller offers a streamlined process for managing your Part I Employer Information Form. Users can easily upload the form to the platform, allowing for seamless editing. This includes adding or removing information as necessary, which can be done via intuitive editing tools.

One of the standout features of pdfFiller is its electronic signing capability. This not only ensures that the document remains secure but also facilitates collaboration among team members, allowing them to review and sign off on the form before final submission. The cloud storage feature guarantees that all information is easily accessible, and the version control helps keep track of any changes made.

Submitting the Part Employer Information Form

Once your Part I Employer Information Form has been filled out and reviewed, the next step is submission. Employers have the option to submit the form electronically or by mail. Understanding the critical deadlines associated with these submissions is essential for compliance. Missing deadlines can lead to penalties or delays in processing.

After submitting the form, you should expect to receive a confirmation of receipt from the IRS. If there are any errors regarding the submission, the IRS will usually send a notice outlining the issues that need to be addressed.

Common challenges and solutions

Navigating the Part I Employer Information Form can sometimes be faced with technical challenges, especially when using online platforms like pdfFiller. Issues may arise from internet connectivity or file compatibility. Troubleshooting common errors can often resolve these issues quickly, ensuring a smooth filing experience.

Submitting the form can also lead to rejections if there are discrepancies in the information provided. Common reasons for form rejections include incorrect EIN numbers or mismatched addresses. However, there are clear steps that can be taken to remedy such issues, allowing you to resubmit the form without hassle.

Frequently asked questions (FAQs)

Several common inquiries arise regarding the Part I Employer Information Form. For instance, what should be done if the form is lost or misplaced? The best course of action includes contacting the appropriate tax office for guidance on submitting a duplicate request.

Updating previously submitted forms requires following a specific procedure, which often involves submitting a correction form. Clarifying terms used within the form, such as EIN or 'business entity,' can also be necessary. Understanding these points can significantly ease the overall experience of managing this document.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get part i employer information?

Can I create an electronic signature for signing my part i employer information in Gmail?

How do I edit part i employer information on an iOS device?

What is part i employer information?

Who is required to file part i employer information?

How to fill out part i employer information?

What is the purpose of part i employer information?

What information must be reported on part i employer information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.