Get the free INVESTING IN FORESTS AND PROTECTED AREAS FOR ...

Get, Create, Make and Sign investing in forests and

Editing investing in forests and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investing in forests and

How to fill out investing in forests and

Who needs investing in forests and?

Investing in forests and form: How-to guide

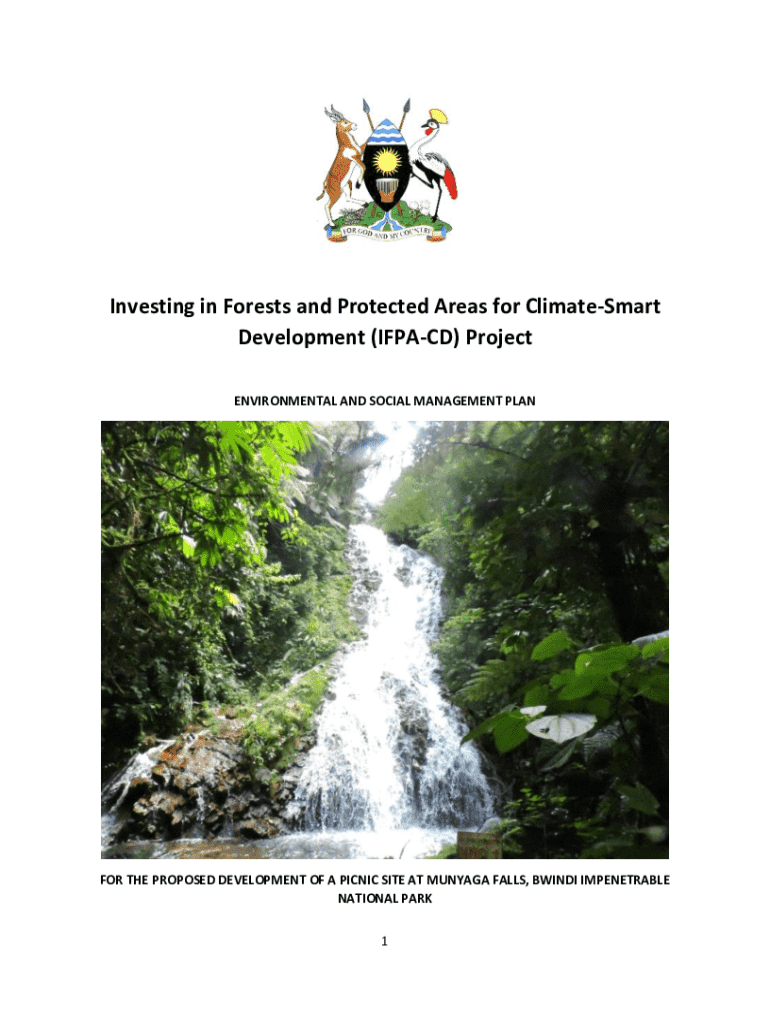

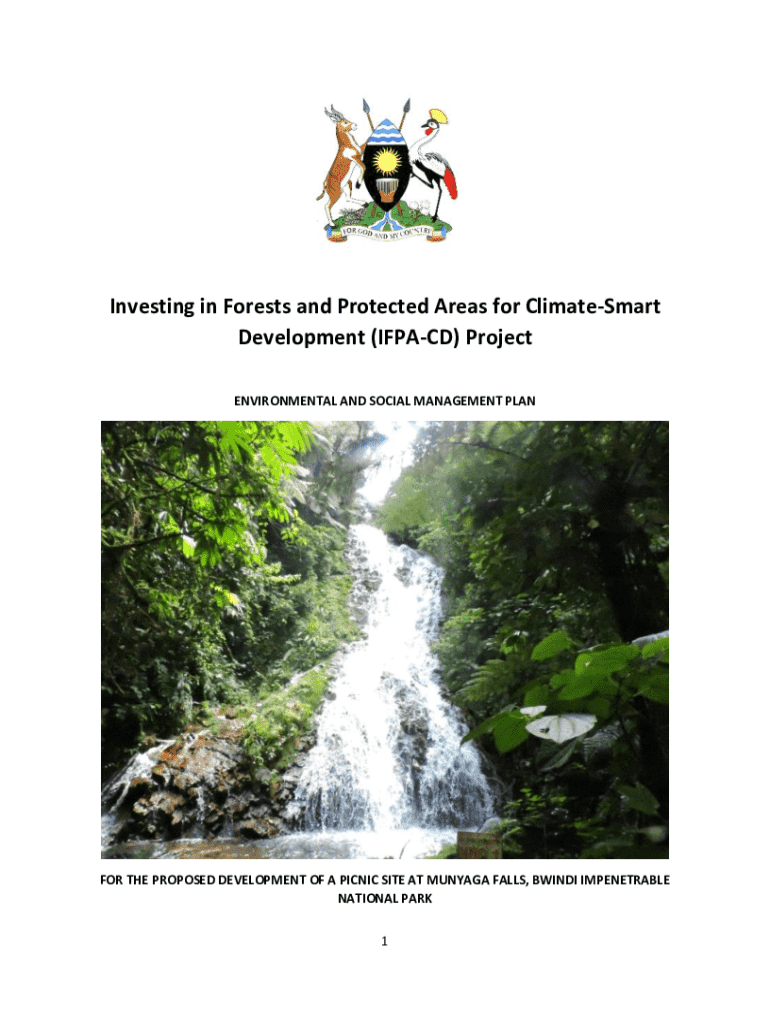

Understanding forest investment

Forest investment refers to the allocation of capital into forestry projects or assets aimed at generating financial returns while promoting sustainable land use practices. The key principles revolve around balance—maximizing profits without undermining the ecological integrity of forest ecosystems. This requires carefully weighted decisions to ensure longevity for both investors and the resources they utilize.

Sustainability plays a vital role in forestry investments as it addresses the growing concern of deforestation and its impacts on our planet. Investing in forests not only allows for profitable returns but also fosters environmental stewardship, contributing positively to carbon sequestration and biodiversity conservation.

The benefits of investing in forests are multi-faceted, influencing both the environment and the economy positively. This investment avenue promotes biodiversity while offering long-term financial rewards that often outpace more traditional investments.

The fundamentals of sustainable forest investment

Sustainable forest investment encapsulates the principles of financial gain through environmentally-friendly forestry practices. This approach is fundamental to preserving ecosystems while ensuring that investments generate returns. Ethical practices are crucial; investors must consider the long-term impacts of their decisions on forest health and local communities.

Investors should utilize key metrics to evaluate the potential of forest investments. The internal rate of return (IRR) helps to understand profitability, while net asset value can gauge current and future growth potential. Risk assessment also plays a critical role as it informs investors about market volatility and ecological footprint.

Investors must navigate compliance shifts and regulatory frameworks that might affect the returns of forest investments. Regulatory bodies often require proof of sustainable practices to mitigate risks associated with environmental degradation.

Strategies for effective forest investment

Identifying high-value forest investments involves thorough research into market opportunities and trends. Investors need to understand local forestry dynamics, including species demand and climate impact. Data analytics tools can offer insights that help in making informed decisions, allowing investors to capitalize on timing to maximize profitability.

Developing a comprehensive investment plan is vital for success. This entails setting clear goals and objectives, followed by financial modeling to project returns. Engaging stakeholders, from local communities to experts, helps build a network that can support sustainable investment objectives.

Portfolio diversification is essential in forestry investments, as it helps to spread risk across different types of assets, including both timberland and sustainable ventures. Investors can benefit from tracking emerging markets and integrating local projects to align with global sustainability efforts.

Managing your forest investment portfolio

Key management practices are essential for optimizing forest investments. Responsible forest management techniques not only promote ecological health but also enhance asset resilience against market shifts. Regular performance monitoring is crucial, allowing for timely adjustments based on market trends and investor goals.

Leveraging technology for forest management can significantly enhance operational efficiency. Utilizing digital platforms facilitates tracking investments, while innovative tools such as drones and Geographic Information Systems (GIS) enable comprehensive data collection and analysis for better decision-making.

Collaboration with experts in the field is vital. Such partnerships can lead to shared insights about sustainable practices, enhancing both the environmental and financial outcomes of the investment.

Documenting and managing your investment

Proper documentation is fundamental in the realm of forest investments. Types of contracts and other agreements must be meticulously maintained to ensure accountability and traceability. Regular updates and accurate record-keeping are not merely administrative tasks but gateways to successful outcomes.

Tools like pdfFiller enhance document creation and management, providing features that facilitate collaboration, eSigning, and version control. This streamlines the documentation process, allowing for an organized, effective approach to managing all relevant investment paperwork.

Best practices for document safety involve not only secure storage but also regular reviews of compliance with evolving data protection laws. This diligence can safeguard investments and bolster investor confidence.

Case studies and success stories

Successful forest investments often serve as benchmarks for future projects. Highlighting notable investment projects shows what strategies work effectively. Investors can learn from case studies that showcase diverse approaches, resulting in profitable outcomes.

Many investors have testified to the financial advantages of integrating sustainable practices into their frameworks. Projects that prioritize environmental health have proven not only beneficial for the planet but are also lucrative, delivering strong returns on investment.

Analyzing the financial outcomes of these sustainable practices highlights the intersection of profit and environmental responsibility, inspiring more investors to adopt similar philosophies.

FAQs on investing in forests

Investing in forests comes with its own set of challenges. Understanding common concerns such as risks involved in forest investments and the effect of market trends is crucial for any investor. Awareness and preparedness can mitigate these risks and create opportunities.

Future predictions suggest a growing interest in sustainable forestry as climate issues become more pressing. Investors are increasingly prioritizing projects that align with eco-friendly practices and innovative approaches, thus shaping future opportunities.

Staying informed about emerging trends and legislative changes is vital for making savvy investment decisions in the forestry sector.

Engaging with the forest investment community

Networking within the forestry sector is crucial for investors seeking collaboration, knowledge sharing, and support. Conferences, seminars, and workshops offer excellent opportunities to connect with like-minded individuals.

Online communities and forums can also serve as valuable resources, enabling knowledge exchange on forestry trends and investment opportunities. Building this network enhances awareness and offers various perspectives on forestry investments.

By actively engaging with the forest investment community, investors can remain informed about best practices, market changes, and emerging challenges in the sector.

Your path to investing in forests

Starting your journey in forest investment requires thorough research and due diligence. Developing an investment framework that aligns with both personal values and financial goals is essential for success. This framework should encompass objectives, preferred investment types, and sustainability principles.

Utilizing effective document management solutions like pdfFiller can streamline your investment process. By providing tools for creating, editing, and managing essential forms, pdfFiller empowers investors to maintain an organized portfolio.

Emerging successfully in the forestry investment sector is about being informed, careful planning, and utilizing tools that supplement your efforts, ensuring sustainability and profitability converge in your investments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my investing in forests and in Gmail?

How can I modify investing in forests and without leaving Google Drive?

Can I create an electronic signature for signing my investing in forests and in Gmail?

What is investing in forests and?

Who is required to file investing in forests and?

How to fill out investing in forests and?

What is the purpose of investing in forests and?

What information must be reported on investing in forests and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.