Get the free 00 US departure tax*)

Show details

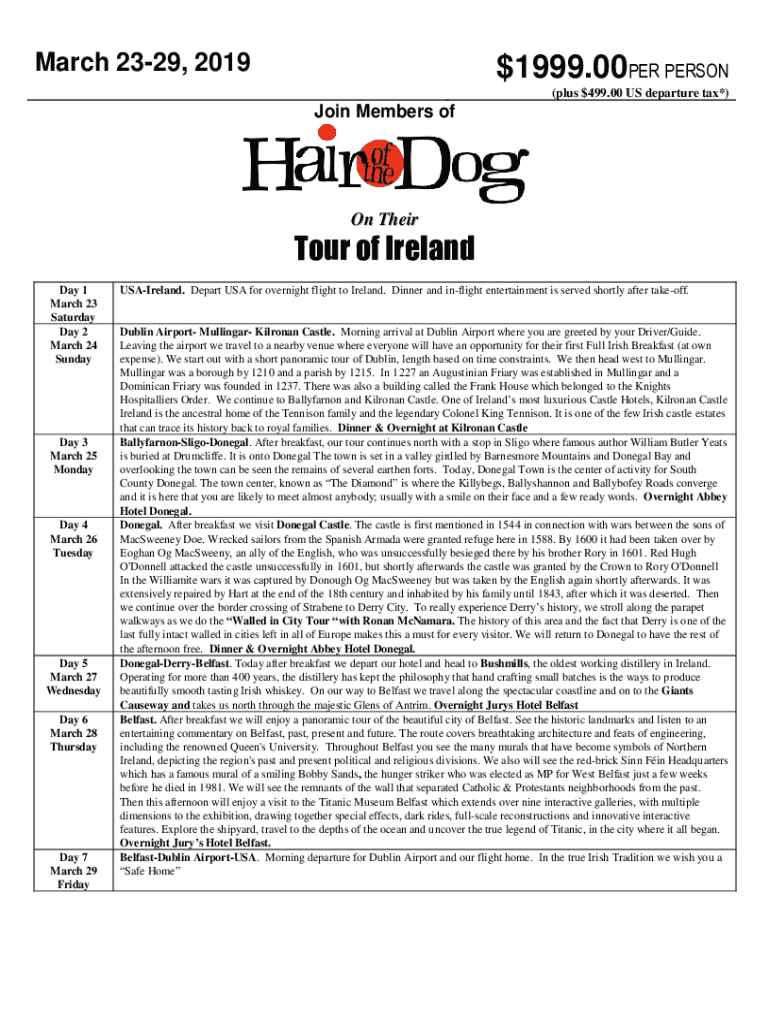

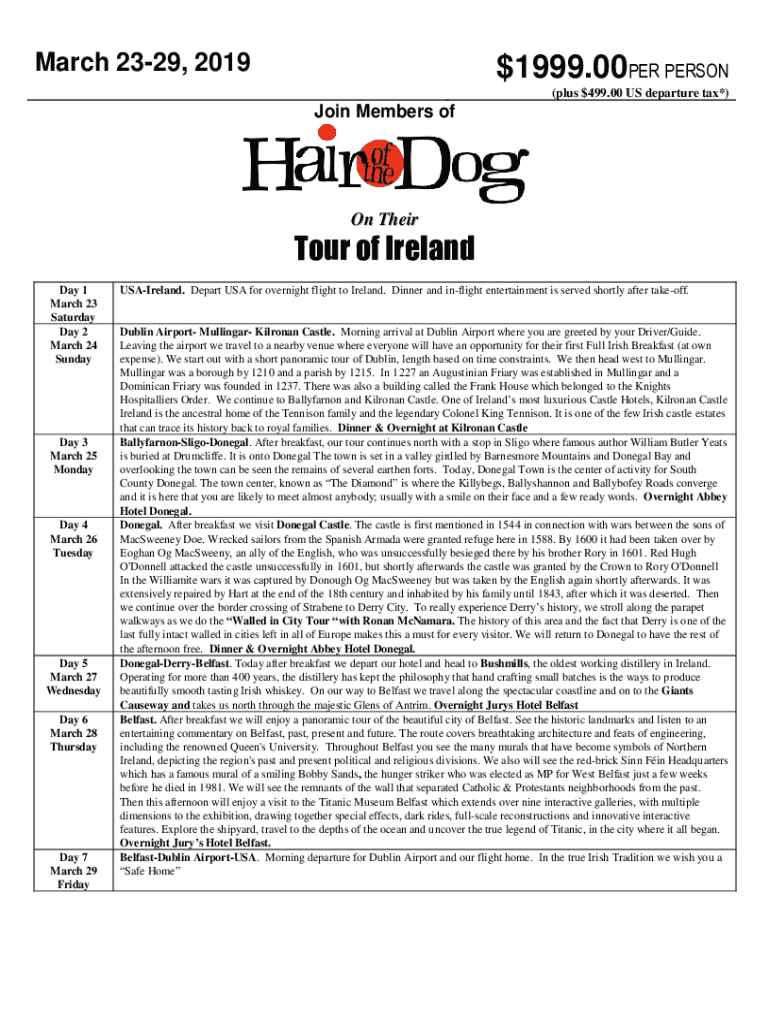

March 2329, 2019$1999.00PER PERSON (plus $499.00 US departure tax*)Join Members ofOn TheirTour of Ireland Day 1 March 23 Saturday Day 2 March 24 SundayDay 3 March 25 MondayDay 4 March 26 TuesdayDay 5 March 27 Wednesday Day 6 March 28 ThursdayDay 7 March 29 FridayUSAIreland. Depart USA for overnight flight to Ireland. Dinner and inflight entertainment is served shortly after takeoff.Dublin Airport Mullingar Kilronan Castle. Morning arrival at Dublin Airport where you are greeted by your...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 00 us departure tax

Edit your 00 us departure tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 00 us departure tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 00 us departure tax online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 00 us departure tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 00 us departure tax

How to fill out 00 us departure tax

01

Obtain the 00 US Departure Tax form from the appropriate government website or office.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your travel details, including your flight number and destination.

04

Indicate the date of your departure from the United States.

05

Calculate the amount of tax based on your total income earned while in the U.S. if required.

06

Review the completed form for accuracy.

07

Submit the form online or in person, along with any required payment.

Who needs 00 us departure tax?

01

Any individual or entity that has been working or earning income while in the United States.

02

Travelers who are expatriates or non-residents leaving the country after a qualifying period.

03

Individuals who have received specific notifications regarding the tax assessment from the IRS.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 00 us departure tax on an iOS device?

Create, edit, and share 00 us departure tax from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete 00 us departure tax on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 00 us departure tax. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit 00 us departure tax on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 00 us departure tax from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is 00 us departure tax?

The 00 US departure tax is a tax imposed on individuals who are leaving the United States. It is typically applied to cover certain services provided by the government related to international departures.

Who is required to file 00 us departure tax?

Individuals who are departing the US and meet certain criteria, such as residency or income thresholds, may be required to file the 00 US departure tax.

How to fill out 00 us departure tax?

To fill out the 00 US departure tax, individuals must complete the appropriate tax form, providing necessary information such as personal details, income, and any applicable exemptions or deductions.

What is the purpose of 00 us departure tax?

The purpose of the 00 US departure tax is to ensure that individuals leaving the country fulfill their tax obligations and contribute to the funding of services that support international travel.

What information must be reported on 00 us departure tax?

Information that must be reported includes personal identification details, residency status, income details, and any deductions or credits that may apply to the tax calculation.

Fill out your 00 us departure tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

00 Us Departure Tax is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.