Get the free An Alternative Payment Method to Contain Healthcare ...

Get, Create, Make and Sign an alternative payment method

How to edit an alternative payment method online

Uncompromising security for your PDF editing and eSignature needs

How to fill out an alternative payment method

How to fill out an alternative payment method

Who needs an alternative payment method?

An Alternative Payment Method Form: Streamlining Transactions for Modern Business

Understanding alternative payment methods

Alternative Payment Methods (APMs) are innovative solutions that enable consumers and businesses to conduct transactions outside of traditional banking systems. These methods include digital wallets, mobile payments, cryptocurrencies, and more. The adoption of APMs has surged in recent years, reshaping how payments are processed and expanding options for both consumers and merchants.

Key benefits of APMs include enhanced convenience, increased security, and access to users who prefer to avoid credit card debt or don't have traditional banking relationships. However, challenges exist, such as variable acceptance rates and the potential for cybersecurity risks. The shift towards APMs reflects changing consumer preferences and market trends.

The importance of alternative payment method forms

Alternative payment method forms play a critical role in streamlining payment processes by providing an organized way for users to input their information and select their preferred method of payment. These forms ensure that both businesses and customers can process payments efficiently and securely, reducing the likelihood of errors.

Security considerations are paramount with APM forms, especially when handling sensitive financial information. Businesses must adhere to compliance and regulatory requirements to safeguard users’ data and protect against fraud. This highlights the need for secure form designs that include encryption and secure data handling practices.

Types of alternative payment methods

The landscape of alternative payment methods is diverse, with various options tailored to different customer needs. Here are some of the most notable forms:

Creating an effective alternative payment method form

To create an effective alternative payment method form, a few essential components must be included. These forms should encompass fields for user information, including name, address, and contact details. A payment details section should capture specifics regarding the selected payment method—whether it be a credit card number or a digital wallet ID. Furthermore, users should have the option to select their preferred payment method from a clearly marked section.

It is also critical to incorporate an authorization and consent section, ensuring users acknowledge and agree to the terms and conditions associated with the payment. Best practices for form design should emphasize a user-friendly layout that guides users through the process, mobile optimization to ensure accessibility on smartphones, and considerations for users with disabilities to enhance overall usability.

Interactive tools for managing alternative payment method forms

Managing alternative payment method forms can be streamlined using interactive tools like pdfFiller. This platform offers built-in tools for signing and editing forms seamlessly, allowing users to make necessary adjustments on-the-go. Collaboration features enhance team efforts by allowing members to share, comment, and edit documents in real-time, making it easy to keep track of changes.

Integrating these forms with payment gateways and financial platforms is crucial for businesses, enabling smooth transactions and record-keeping. By utilizing pdfFiller, businesses can improve their payment processing efficiency and enhance user experience.

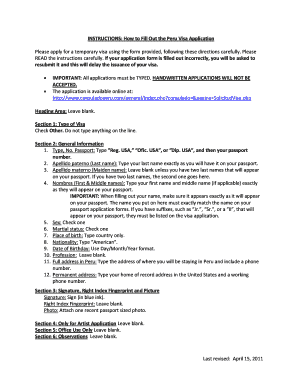

Filling out an alternative payment method form

Filling out an alternative payment method form can be straightforward if you follow a few essential steps. First, users must access the appropriate form, usually provided on a website or through an application. Next, users should carefully fill in their personal and financial information accurately to avoid delays.

Selecting the preferred payment method is the next step, where users may choose from multiple options, depending on what’s offered. Finally, it is crucial to review all entered information for accuracy before submitting the form. Common pitfalls to avoid include neglecting to read terms and conditions, overlooking mandatory fields, and not ensuring data is secure before sharing.

Tracking and managing payment transactions

Utilizing tools like pdfFiller can simplify tracking submissions and ensure compliance regarding alternative payment method forms. Businesses can easily manage payment confirmations and receipts, ensuring that all transactions are documented appropriately for accounting purposes.

Moreover, understanding how to handle disputes and refunds is essential for both consumers and businesses. Established protocols for managing payment-related issues not only build trust but also foster long-term customer relationships.

The future of alternative payment methods

The future of alternative payment methods looks promising, shaped by evolving trends and consumer behaviors. Advances in security features, such as biometric authentication and blockchain technology, are expected to further enhance trust in digital transactions.

As more consumers become open to digital currencies like Bitcoin, the market for cryptocurrencies as a viable payment option will likely expand. Understanding these trends will allow businesses to adapt their strategies, ensuring they meet consumer expectations and enhance user satisfaction.

FAQs about alternative payment method forms

Leveraging pdfFiller for alternative payment method forms

pdfFiller provides several features to enhance document handling for alternative payment method forms. Being cloud-based, users can access forms from anywhere—perfect for teams on the go. Real-time collaboration tools allow multiple team members to work on a document simultaneously, ensuring everyone stays in the loop.

Additionally, with built-in templates for various payment methodologies, creating compliant and user-friendly forms becomes less daunting. Success stories from businesses using pdfFiller demonstrate the positive impact of efficient form management on overall operational success.

Exploring related articles and resources

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get an alternative payment method?

How do I execute an alternative payment method online?

How do I edit an alternative payment method on an Android device?

What is an alternative payment method?

Who is required to file an alternative payment method?

How to fill out an alternative payment method?

What is the purpose of an alternative payment method?

What information must be reported on an alternative payment method?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.