Get the free County One Cent Sales Tax Now Up To Voters - RICHES

Get, Create, Make and Sign county one cent sales

Editing county one cent sales online

Uncompromising security for your PDF editing and eSignature needs

How to fill out county one cent sales

How to fill out county one cent sales

Who needs county one cent sales?

Your Comprehensive Guide to the County One Cent Sales Form

Understanding the County One Cent Sales Tax

The county one cent sales tax is a specific type of tax levied at the county level, typically adding an extra one percent to the state sales tax. This initiative is designed to generate revenue for local governments, helping support public services such as education, infrastructure, and emergency services. The need for additional funding has made the one cent sales tax crucial in many counties across the United States.

The importance of this tax cannot be overstated. It directly impacts local communities by providing the necessary funds for essential services and projects. For instance, funds from the one cent sales tax can be used for road improvements, public safety enhancements, and park developments, thus directly enhancing the quality of life for residents.

Who needs to use the county one cent sales form?

Not all residents and businesses need to fill out the county one cent sales form, but it's crucial for those affected by the tax. Primarily, any business that sells tangible goods within the county must complete this form to comply with local tax obligations. Additionally, individuals or organizations engaged in activities subject to this sales tax must also be aware of their responsibilities.

Understanding who is subject to the one cent sales tax is critical. Retailers, service providers, and any entities that make sales in the county are typically required to file. However, there are exceptions. Certain non-profits and government agency transactions may be exempt from this tax, which can significantly alter filing responsibilities.

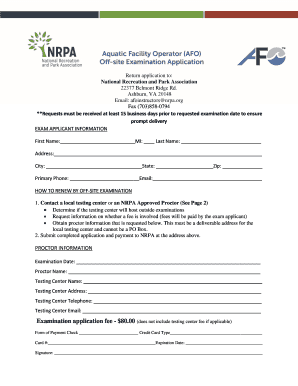

Inputs required for the county one cent sales form

Filing the county one cent sales form requires detailed input to ensure accuracy. You will need basic information that identifies your business, such as the name and address. This information not only confirms your identity but also allows the county to track sales accurately.

Additionally, you must provide sales data for the reporting period. This includes a breakdown of total sales, differentiating between taxable and non-taxable sales. Accurate sales figures are crucial, as they directly affect the amount of tax owed. Furthermore, you may need to attach additional documentation, such as supporting invoices or tax exemption certificates, for any exempt transactions.

Step-by-step guide to filling out the form

Filling out the county one cent sales form can be straightforward if you follow a systematic approach. Start by accessing the form through pdfFiller, which allows for easy editing and digital submission. Make sure you have all necessary information at hand, as this will streamline the entire process.

When filling out the form, pay close attention to each section: Identification of filer, sales figures, and tax computation. Section one should include your basic information, ensuring there are no inaccuracies. In the sales figures section, double-check your computations to correctly report total sales and categories of sales. Finally, in the tax computation section, ensure that your calculations reflect current rates to avoid compliance issues.

Common pitfalls include overlooking the distinction between taxable and non-taxable sales and misreporting figures. Remember, accuracy is essential, as errors can lead to penalties or audits from local tax authorities.

Electronic submission of the county one cent sales form

Once your county one cent sales form is filled out, electronic submission via pdfFiller simplifies the process. The platform allows users to eSign documents, enhancing security and validity. After signing, you will want to verify the submission by checking for a confirmation message from the county government.

Alternative filing options include mailing the completed form or submitting it in person at your local tax office. While electronic submission is quicker and more efficient, it’s essential to know all options available to you in case you encounter technical issues.

Managing income from the one cent sales tax

After successfully filing the county one cent sales form, managing the income generated from this tax is crucial. Local governments impose specific reporting requirements, and businesses must adhere to them to avoid penalties. The frequency of filing can vary; some businesses may need to file monthly, while others could do so quarterly or annually, depending on their sales volume.

It is also important to note how changes in business operations can affect your filing obligations. For instance, if a business expands and begins making sales in new counties, it might need to adjust its filings accordingly or include newer sales data. Keeping accurate records will aid in maintaining compliance and avoiding potential pitfalls.

Local option taxes and their interaction with the one cent sales tax

Understanding local option taxes is crucial for navigating the county one cent sales tax landscape. Local option taxes are often enacted by counties or municipalities to fund specific projects or services. They may exist alongside the one cent sales tax, creating a layered tax structure that can complicate compliance.

The one cent sales tax is typically integrated with these local option surtaxes. This means that businesses operating within the jurisdiction must account for both when calculating taxes owed. Staying aware of how local option taxes are structured will aid in avoiding over-collection or under-collection of sales taxes during the filing process.

Frequently asked questions (FAQs)

Navigating the county one cent sales form can lead to various questions concerning specific situations. One common inquiry is the process for businesses operating online only. These businesses are typically required to collect and remit sales tax when selling to customers within the county, even if they do not have a physical storefront.

Another concern frequently raised is how to handle sales across multiple counties. Each county may have its specific form and tax rates, so it’s essential to keep records organized for accurate reporting in each jurisdiction. Lastly, businesses often ask if discounted items are subject to the one cent sales tax. Generally, sales tax applies to the total sales price, including any discounts offered.

Resources and tools for efficient filing

Utilizing the right resources and tools can significantly ease the filing of the county one cent sales form. Spreadsheets and calculators are available to assist with accurate tax computation. This way, businesses can ensure they are not overestimating or underestimating their taxable income.

Additionally, having direct access to relevant county departments can provide guidance and answer specific questions. Engaging with local tax offices can help clarify any doubts, thus avoiding pitfalls related to compliance. Tools available on pdfFiller for effective document management can streamline the entire documentation process.

Understanding tax compliance and consequences of non-compliance

Tax compliance is a critical aspect that all businesses must adhere to when dealing with the county one cent sales form. Failing to file on time can lead to penalties and interest charges, significantly impacting the overall financial health of the business. It is advised to remain diligent, keeping filing dates and requirements in focus to avoid unnecessary complications.

In addition to penalties, businesses may face audits resulting from non-compliance. The importance of maintaining thorough records cannot be overstated, as accurate documentation can protect against these potential issues. If disputes arise concerning tax obligations or assessments, knowing the procedures for appealing tax decisions becomes essential.

Local government support and outreach

Many local governments recognize the challenges businesses face regarding tax compliance. To support taxpayers, numerous programs are available. These include outreach initiatives designed to educate business owners about taxes, filing processes, and compliance. Attending workshops or webinars can provide invaluable insights that simplify the task of filing the county one cent sales form.

Furthermore, excellent contact resources are often provided by local tax offices. Having a reliable contact for inquiries can ease the often-frustrating process of navigating tax obligations. Make use of these resources to stay informed and ensure compliant practices within your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send county one cent sales to be eSigned by others?

How do I complete county one cent sales online?

How do I edit county one cent sales online?

What is county one cent sales?

Who is required to file county one cent sales?

How to fill out county one cent sales?

What is the purpose of county one cent sales?

What information must be reported on county one cent sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.