CA BOE-230-H-1 2015 free printable template

Show details

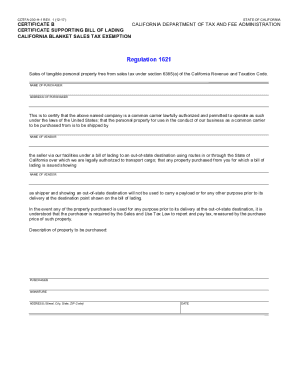

BOE-230-H-1 (5-15) STATE OF CALIFORNIA BOARD OF EQUALIZATION CERTIFICATE B CALIFORNIA BLANKET SALES TAX EXEMPTION CERTIFICATE SUPPORTING BILL OF LADING Regulation 1621 Sales of tangible personal property

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA BOE-230-H-1

Edit your CA BOE-230-H-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA BOE-230-H-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA BOE-230-H-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA BOE-230-H-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA BOE-230-H-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA BOE-230-H-1

How to fill out CA BOE-230-H-1

01

Obtain the CA BOE-230-H-1 form from the California State Board of Equalization website or your local office.

02

Read the instructions carefully before you start filling out the form.

03

Fill in your personal information at the top of the form, including your name, address, and contact information.

04

Provide the specific details requested about your business or property that is being reported.

05

Complete all sections of the form as applicable, making sure to check for accuracy in your entries.

06

If you are claiming any deductions, list them clearly in the appropriate section.

07

Review the entire form to ensure everything is filled out correctly.

08

Sign and date the form at the designated area.

09

Submit the completed form by the specified deadline to the appropriate government office.

Who needs CA BOE-230-H-1?

01

Individuals or businesses that are required to report certain property or business ownership information to the California State Board of Equalization.

02

Taxpayers who are claiming specific deductions or exemptions related to property or business taxes.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for sales tax exemption in California?

In general, businesses which provide a service that does not result in a tangible good are exempt from sales tax, as it only applies to goods. For example a freelance writer or a tradesperson is not required to remit sales tax, although a carpenter making custom furniture is so required.

Who is subject to California withholding?

Payments subject to withholding include: Payments to nonresident independent contractors or consultants who provide services in California. Other non-wage payments of California source income to nonresidents such as leases, rents, royalties, winnings and payouts.

What qualifies for sales tax in California?

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor services and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new tangible personal property.

Is certificate of tax exemption required?

Section 30 corporations who availing of the tax exemption are required to secure a Certificate of Tax Exemption (CTE) or a tax exemption ruling. A CTE shall be valid for three years from the date of its effectivity, unless sooner revoked or canceled. However, it may be renewed or revalidated for another three years.

Who needs CA 590?

Form 590 is certified (completed and signed) by the payee. California residents or entities exempt from the withholding requirement should complete Form 590 and submit it to the withholding agent before payment is made.

What is a tax-exempt certificate California?

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

How do I become tax exempt in California?

There are 2 ways to get tax-exempt status in California: Exemption Application (Form 3500) Download the form. Determine your exemption type , complete, print, and mail your application. Submission of Exemption Request (Form 3500A) If you have a federal determination letter:

Who qualifies for sales tax exemption in California?

Medical devices such as prosthetics are exempted from sales tax. In addition, certain groceries, hot beverages, some types of farm items, and certain alternative-energy device are also considered to be exempt from the California sales tax.

What qualifies a person as tax exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

How do I get a California tax clearance certificate?

To obtain a Certificate of Excise Tax Clearance, you must complete this form (CDTFA-329). Carefully review the form to ensure that all the required information is provided and copies of the requested documentation is attached. Do not send originals.

Who is exempt from California sales tax?

In general, businesses which provide a service that does not result in a tangible good are exempt from sales tax, as it only applies to goods. For example a freelance writer or a tradesperson is not required to remit sales tax, although a carpenter making custom furniture is so required.

Who is exempt from California withholding?

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

What is a California tax exemption certificate?

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the California sales tax. You can download a PDF of the California General Sales Tax Resale Certificate (Form BOE-230) on this page.

Is California a mandatory withholding state?

California's law requires employers to withhold state personal income tax (PIT) from employee wages and remit the amounts withheld to the Employment Development Department. Persons in business for themselves (independent contractors) are not employees and are generally not subject to withholding.

How do I get a California tax exemption certificate?

To apply for California tax exemption status, use form FTB 3500, Exemption Application. This is a long detailed form, much like the IRS form 1023. If you have already received your 501c3 status from the IRS, use form FTB 3500A, Submission of Exemption Request.

What is certificate of tax exemption?

A Certificate to be accomplished and issued by a Payor to recipients of income not subject to withholding tax. This Certificate should be attached to the Annual Income Tax Return - BIR Form 1701 for individuals, or BIR Form 1702 for non-individuals.

How do I get California state tax exemption?

There are 2 ways to get tax-exempt status in California: Exemption Application (Form 3500) Download the form. Determine your exemption type , complete, print, and mail your application. Submission of Exemption Request (Form 3500A) If you have a federal determination letter:

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA BOE-230-H-1 for eSignature?

Once your CA BOE-230-H-1 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the CA BOE-230-H-1 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your CA BOE-230-H-1 and you'll be done in minutes.

How do I edit CA BOE-230-H-1 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share CA BOE-230-H-1 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is CA BOE-230-H-1?

CA BOE-230-H-1 is a form used in California for the reporting of taxable sales to the California State Board of Equalization (BOE).

Who is required to file CA BOE-230-H-1?

Any seller or retailer in California who makes taxable sales of tangible personal property is required to file CA BOE-230-H-1.

How to fill out CA BOE-230-H-1?

To fill out CA BOE-230-H-1, you need to provide information on your business, the period for which you are reporting, total sales, and the specific amount of tax collected.

What is the purpose of CA BOE-230-H-1?

The purpose of CA BOE-230-H-1 is to report sales and use tax collected on sales of tangible personal property to ensure compliance with California tax laws.

What information must be reported on CA BOE-230-H-1?

The information that must be reported includes the seller's information, total gross sales, exempt sales, taxable sales, and the amount of tax collected.

Fill out your CA BOE-230-H-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA BOE-230-H-1 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.