IRS 6198 2024-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Complete Guide to IRS 6198 Printable Form on pdfFiller

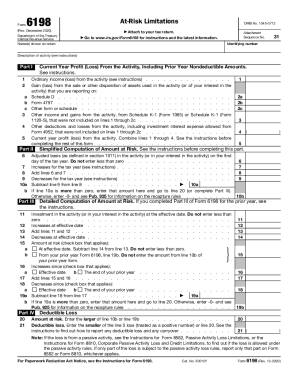

If you need to complete the IRS 6198 form for tax reporting, this guide will take you through all the essential steps. The IRS 6198 printable form for 2 is crucial for reporting at-risk limitations effectively.

What is IRS 6198 and why is it important?

IRS 6198 is the form used by taxpayers to report at-risk limitations, which dictate how much of their investments they can deduct for tax purposes. This form is essential for anyone involved in business activities where losses may exceed investments. Understanding at-risk limitations ensures compliance and can lead to substantial tax savings.

-

It determines the maximum amount of loss a taxpayer can claim based on their at-risk investment.

-

Knowing your at-risk limitations helps in minimizing tax liability while complying with IRS regulations.

-

Keep track of any updates to the form or regulations impacting how at-risk investments are calculated.

How can you find the IRS 6198 form on pdfFiller?

Accessing IRS forms on pdfFiller is straightforward. The platform features a user-friendly interface that simplifies document searches, making it easier for users to locate necessary forms.

-

Use the search bar on the homepage by typing 'IRS 6198' to find the correct form.

-

Once you've located the form, you can choose to view it in PDF format immediately or print it.

-

If you are a first-time user, register for an account to save your progress and access additional features.

How do you fill out the IRS 6198 form?

Filling out the IRS 6198 form requires careful attention to detail to ensure accuracy. The form consists of several sections that need to be completed precisely to avoid penalties.

-

This section asks for details regarding your earnings and losses for the year, which impacts at-risk calculations.

-

Here, taxpayers input straightforward calculations of amounts they have at risk in the business.

-

This part requires a more intricate breakdown of all figures concerning investments, loans, and other pertinent details.

How to edit and eSign your IRS 6198 form using pdfFiller?

pdfFiller offers tools to edit your IRS 6198 form seamlessly. Users can revise text, add notes, and electronically sign the document within the platform.

-

The pdfFiller platform includes various editing features, allowing you to modify your IRS 6198 form as needed.

-

You can quickly insert eSignatures, making the form ready for submission without printing.

-

Ensure you save your work regularly and you can export the completed form to PDF or other formats for submission.

What common mistakes can you avoid when filing IRS 6198?

Many taxpayers experience difficulties when filing IRS 6198, often leading to errors that can affect their refunds or create compliance issues.

-

Ensure all required fields are completed, as missing data can delay processing or result in rejection.

-

Double-check numerical entries to guarantee accuracy, which is crucial for at-risk amount computations.

-

Be aware of filing deadlines to avoid penalties for late filings; mark your calendar accordingly.

How to stay compliant with IRS recommendations for 2?

It is vital to remain compliant with IRS rules and updates regarding at-risk limitations, as this impacts your financial and tax obligations.

-

Regularly review IRS guidelines on at-risk limitations to stay informed of any changes or updates.

-

Employ pdfFiller tools not only for documentation but for ongoing compliance checks and management.

-

Consider consulting tax professionals for in-depth knowledge, especially if your tax situation is complex.

What additional resources can help with IRS 6198?

There are several tools available on pdfFiller and elsewhere that can assist you in understanding and managing your tax obligations.

-

Find various templates and forms available on pdfFiller for tax filings to ensure you have what you need.

-

Leverage additional document management functionalities that pdfFiller provides beyond filling out forms.

-

Seek educational materials that can enhance your understanding of tax obligations and proper filing methods.

Frequently Asked Questions about pdffiller form

What is the filing deadline for IRS 6198?

The filing deadline for IRS 6198 typically aligns with the individual income tax return deadlines, usually April 15. Extensions may be available, but taxpayers must file the form by the deadline to avoid penalties.

Who needs to file IRS 6198?

Taxpayers involved in certain business activities that result in losses must file IRS 6198 to report their at-risk limitations. Individuals, partnerships, and businesses claiming tax deductions for losses must consider submitting this form.

What happens if I don’t file IRS 6198?

Failing to file IRS 6198 when required can lead to penalties, including loss of loss deductions and potential audits. Non-compliance can also increase your tax liabilities, so it is crucial to submit the form accurately.

Can I electronically file IRS 6198?

Yes, taxpayers can electronically file IRS 6198 if they are using the right tax software that supports e-filing. It's essential to check with your software provider to confirm compatibility.

What resources does pdfFiller offer for IRS 6198?

pdfFiller provides user-friendly tools for creating, editing, and eSigning IRS 6198 forms. Additionally, users can access a comprehensive library of tax forms and templates, making management and submission straightforward.

pdfFiller scores top ratings on review platforms