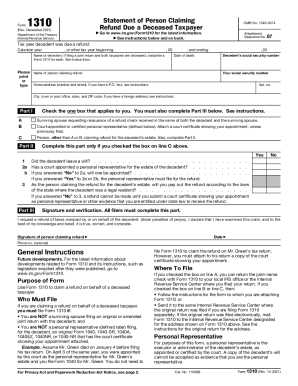

IRS 1310 2024-2025 free printable template

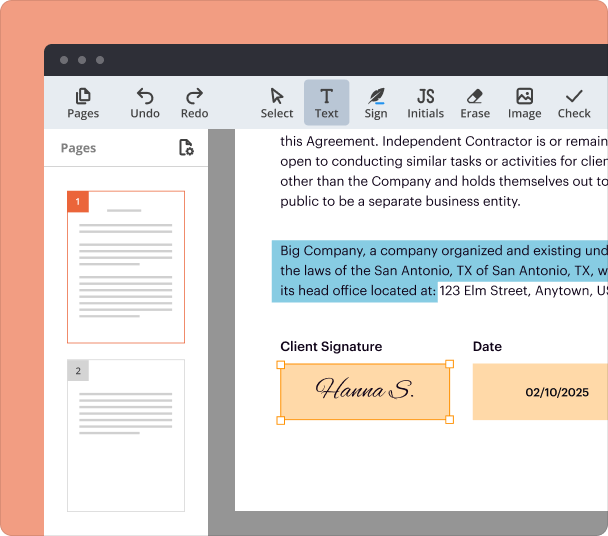

Fill out, sign, and share forms from a single PDF platform

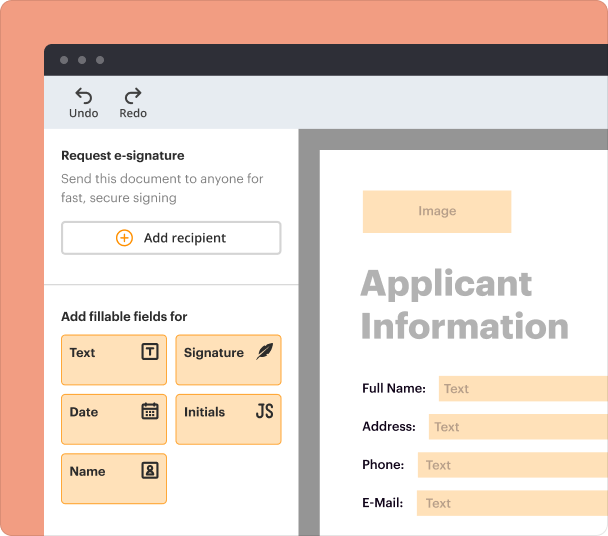

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out an IRS -2025 printable form

Understanding IRS Form 1310: Key Features

IRS Form 1310 is essential for individuals who are claiming a tax refund on behalf of a deceased taxpayer. This form is designed to ensure that refunds are issued to the correct person, particularly in cases where the original taxpayer has passed away between tax years. It plays a crucial role in enabling beneficiaries to receive funds they are rightfully owed after the death of a loved one.

-

IRS Form 1310 is a declaration for refund claims that allows individuals to claim social security tax refunds for deceased taxpayers.

-

This form should be utilized by surviving spouses, heirs, or executors who are managing the deceased taxpayer's financial matters.

-

Without this form, the IRS would not process the refund request, thereby preventing the rightful beneficiaries from receiving their entitled funds.

Detailed Breakdown of IRS Form 1310 Sections

Understanding the sections of IRS Form 1310 is crucial to ensure correct submission and processing. Each part of the form has unique requirements, and accuracy is vital.

-

This number helps in tracking the attachments related to the form. It's typically found in the upper margin of each page.

-

Accurate reporting of the tax year is necessary to ensure the refund is applied correctly to the appropriate tax period.

-

Properly entering the name and Social Security Number (SSN) of the deceased is paramount to avoid any delays or rejections.

Filling Out Form 1310: Step-by-Step Instructions

Filling out IRS Form 1310 involves detailed steps. It’s important to follow the guidelines to ensure the form is completed accurately.

-

In this section, the claimant must indicate their relationship to the deceased and whether they are eligible to claim the refund.

-

This part requires information about the will or estate, determining who has the authority to handle the deceased's financial obligations.

-

Guidance on how to complete this section accurately is crucial for ensuring that all required documentation is submitted with the form.

Special Considerations for Joint Returns

Filing joint returns can complicate IRS Form 1310 submissions. Special protocols exist for these cases.

-

If both taxpayers are deceased, claims should include separate Form 1310 submissions as required.

-

It's critical to ensure that all necessary forms are completed correctly to avoid delays in processing.

-

In the event of more than one deceased individual, submitting multiple forms may be necessary, each with unique details.

Common Mistakes When Using IRS Form 1310

Mistakes in filling out IRS Form 1310 can lead to delays or rejections, making it critical to review the form thoroughly.

-

Common errors include missing fields or incorrect SSNs, which can complicate processing.

-

Submitting court certificates or wills is often required to prove the claimant’s right to file the form.

-

Double-checking all entries and ensuring all documentation is complete can significantly reduce processing time.

Managing Your IRS Form 1310 with pdfFiller

pdfFiller offers robust features for handling IRS Form 1310 effectively, from editing to secure sharing.

-

pdfFiller enables users to manage their tax forms online, providing a flexible and efficient way to handle important documents.

-

Users can easily modify IRS Form 1310, add electronic signatures, and collaborate with team members in real time.

-

pdfFiller provides secure storage options, ensuring that sensitive tax information remains confidential.

Frequently Asked Questions about form 1310

What if the decedent's refund was already sent?

If the refund was already issued to the deceased, claimants should contact the IRS to pursue further steps. Documentation proving the claimant's relationship to the deceased may be required.

How long does it take for the IRS to process Form 1310?

Processing times can vary, but generally, the IRS may take 8-12 weeks. Delays can occur based on the completeness of the submission and current processing loads.

What do I do if additional information is requested?

If the IRS requests additional information, it's important to respond promptly with the required documentation to avoid extended delays. Contact the IRS directly for clarification on what is needed.

Can I file IRS Form 1310 electronically?

As of now, IRS Form 1310 must be filed by mailing a paper form. Electronic filing is not available for this specific form, but accompanying returns can be filed online.

What are the penalties for wrong information on IRS Form 1310?

Providing incorrect information on IRS Form 1310 can result in delays, rejection of the refund claim, and potential penalties. Accuracy is key to ensure timely processing and avoiding legal complications.

pdfFiller scores top ratings on review platforms