Get the free Revenue and Expense Budget Summary for Fiscal Years 2022-2023 and 2021-2022 - Genera...

Get, Create, Make and Sign revenue and expense budget

Editing revenue and expense budget online

Uncompromising security for your PDF editing and eSignature needs

How to fill out revenue and expense budget

How to fill out revenue and expense budget

Who needs revenue and expense budget?

Comprehensive Guide to the Revenue and Expense Budget Form

Understanding the revenue and expense budget form

The revenue and expense budget form serves as a crucial tool for individuals and businesses alike in managing their finances. This form not only tracks income and expenses but also provides a structured way to forecast future financial performance. Its significance lies in its ability to help users visualize their financial standing and plan accordingly.

The primary purpose of this budget form is financial planning. Users can identify income sources, categorize expenses, and ascertain potential surplus or deficits. By meticulously filling out this form, individuals and companies can make informed decisions regarding spending and saving.

The benefits of using a revenue and expense budget form

Using a revenue and expense budget form offers significant benefits, starting with enhanced financial clarity and control. By clearly identifying various income sources and categorizing expenses, users gain a comprehensive view of their financial health. This visibility is crucial for managing spending and making adjustments as necessary.

Another key advantage is improved decision-making. When users have a clear understanding of their financial situation, they can make informed choices about investments or expenditures. Additionally, this budgeting form aids in goal setting and monitoring, allowing users to track their yearly or monthly financial objectives effectively.

Key features of pdfFiller’s revenue and expense budget form

pdfFiller offers an innovative approach to managing your revenue and expense budget form. Its interactive document editing allows users to make real-time edits, perfect for collaborative efforts among teams or family members. This feature enhances efficiency and ensures that everyone stays on the same page.

Moreover, the cloud-based accessibility of pdfFiller means that users can access their budget from anywhere, anytime. Whether you are at home, in the office, or on the go, your budget is always at your fingertips. Additionally, with eSigning capabilities, users can easily sign any agreements related to budgeting, facilitating seamless transactions and communications.

Step-by-step guide to filling out the revenue and expense budget form

Filling out the revenue and expense budget form involves a systematic approach, starting with gathering your financial data. Collecting past income and expenses allows you to establish a baseline. Tools such as spreadsheets and financial apps can be beneficial for data collection, ensuring accuracy and comprehensiveness.

Next, input your revenue information. Break down various income streams—such as salaries, investments, or rental income—and use formulas to arrive at accurate totals. Following that, categorize your expenses, distinguishing between fixed expenses like rent and variable expenses like entertainment or groceries. Finally, analyze your budget to identify any surplus or deficit, making adjustments as needed to ensure you remain on track financially.

Best practices for managing your revenue and expense budget

To effectively manage your revenue and expense budget form, regular updates and reviews are essential. Establish a routine for reviewing your budget, whether monthly or quarterly, to ensure accuracy and relevance. This is especially important in a dynamic financial environment where income and expenses may fluctuate.

Utilizing budgeting tools like pdfFiller enhances your budgeting efficiency. With its intuitive interface and powerful features, you can remain on top of your finances. Additionally, incorporating contingencies is vital in budgeting; planning for unexpected expenses—such as medical emergencies or car repairs—can prevent financial strain in the future.

Visualizing income and expenses

Graphs and charts can provide a clearer understanding of your financial situation. By converting numerical data into visual aids, complexities in your budget can become more accessible, highlighting trends, and patterns in income and expenses. This can empower users to make informed decisions based on visual insights.

pdfFiller offers tools for easy visualization of budgets. You can create various types of graphs directly from the budget form data, making it user-friendly for individuals unfamiliar with traditional financial analysis. Additionally, these visuals can enhance presentations if you are sharing your budget with teams or stakeholders.

Common mistakes to avoid while using the revenue and expense budget form

Budgeting accurately can be challenging, and many individuals fall into common pitfalls. One such mistake is underestimating expenses. It’s crucial to account for all costs, including those that may not be monthly, like annual subscriptions or taxes. Failing to do so may lead to budget shortfalls unexpectedly.

Another frequent mistake involves neglecting income fluctuations, particularly for those with variable incomes. It’s wise to forecast on both conservative and optimistic bases to prepare for lean periods. Additionally, ignoring the review process can compromise the effectiveness of your budget. Continuous monitoring ensures that users can adapt their strategies as required.

Tailoring the revenue and expense budget form to various needs

The revenue and expense budget form can be tailored to meet individual, family, and business needs. For individuals, a simple yet comprehensive budget may suffice, while families might require more detailed categorizations to account for multiple income sources and expenses, such as childcare or schooling costs.

For businesses, different approaches apply. Small enterprises may focus more heavily on cash flow projections, whereas larger organizations need to incorporate departmental budgets. Additionally, the approach to budgeting may differ significantly depending on whether it’s for short-term operational planning or long-term strategic growth.

Advanced techniques for optimizing your budget

For those looking to dive deeper into managing their finances, advanced techniques like zero-based budgeting can be effective. This approach requires each expense to be justified for each new period, promoting accountability and thorough examination of costs. This method works well for individuals aiming to cut unnecessary expenses.

Rolling budgeting techniques are also worth considering. By continuously updating the budget, it allows for real-time adjustments and reflections upon spending patterns as they develop throughout the year. These strategies can be invaluable in maintaining both flexibility and control over your finances.

Frequently asked questions about the revenue and expense budget form

Budgeting can generate numerous questions. For instance, users often wonder, 'What if my income changes mid-year?' It’s advisable to revisit your budget regularly and adjust figures accordingly, ensuring that payments and expenses reflect your new financial reality.

Another common question concerns the level of detail required for categories. It’s recommended to strike a balance; ensure you’re detailed enough to monitor expenses without overcomplicating your budget. Lastly, many want to know if they can share their budget form with others, and the answer is yes. pdfFiller's collaborative features allow you to share your budget seamlessly with family members or colleagues.

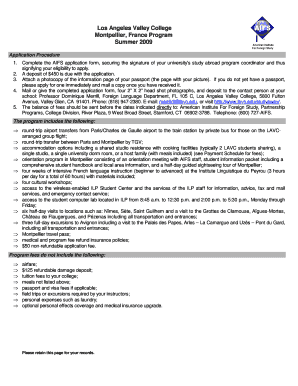

Getting started with your revenue and expense budget form on pdfFiller

Creating a revenue and expense budget form on pdfFiller is a straightforward process. Start by creating your account, which is quick and user-friendly. Once you have access, familiarize yourself with the platform, exploring its myriad features designed to enhance document management.

Begin by uploading your existing budget form or starting from scratch with templates provided by pdfFiller. With its intuitive editing tools, you can easily customize the form to your needs, ensuring it meets your financial management requirements effortlessly.

Success stories and real-life applications

People across various backgrounds have successfully utilized the revenue and expense budget form to improve their financial outcomes. For instance, an individual managed to pay off personal debt in record time by following a strict budgeting regimen, utilizing the insights gained from their budget to cut unnecessary expenses and allocate funds more effectively.

Businesses have also reaped the rewards. A small business implemented strategic budgeting, which allowed them to identify wasteful spending, optimize their resource allocation, and ultimately increase profitability. These case studies highlight the power of effective budgeting in achieving financial goals.

Related document templates for comprehensive financial management

To further assist users in managing their finances, pdfFiller offers a range of related document templates. For tracking daily expenditures, an expense tracker template can provide clarity on spending habits. Additionally, a monthly budget template helps individuals and families manage their finances effectively, while a business department budget template is designed for corporate settings, streamlining the budgeting process for various departments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

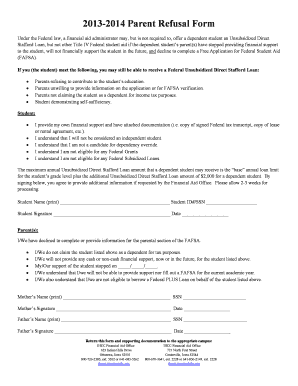

How can I send revenue and expense budget to be eSigned by others?

How do I execute revenue and expense budget online?

How do I fill out revenue and expense budget using my mobile device?

What is revenue and expense budget?

Who is required to file revenue and expense budget?

How to fill out revenue and expense budget?

What is the purpose of revenue and expense budget?

What information must be reported on revenue and expense budget?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.