Get the free his credit. The album is MGM/Verve's Getz Gilbert, ''

Get, Create, Make and Sign his credit form album

How to edit his credit form album online

Uncompromising security for your PDF editing and eSignature needs

How to fill out his credit form album

How to fill out his credit form album

Who needs his credit form album?

Comprehensive Guide to His Credit Form Album Form

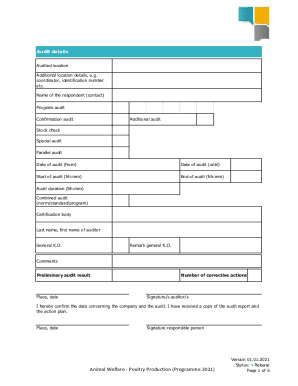

Understanding the 'His Credit Form'

The 'His Credit Form' serves as a crucial document in assessing an individual’s credit profile, compiling essential information that lenders and other parties review to determine creditworthiness. This form is integral to personal finance management, guiding significant financial decisions.

Purpose of His Credit Form

The primary purpose of the 'His Credit Form' is to aid institutions in evaluating an individual's creditworthiness. By detailing financial habits, it enables banks and landlords to make informed decisions regarding loans, leases, and employment.

Step-by-step guide to filling out His Credit Form

Filling out the 'His Credit Form' might seem daunting, but breaking it down into manageable sections can simplify the process.

Tips for accurately completing His Credit Form

Completing the 'His Credit Form' accurately is paramount for a successful review process, and honesty is the golden rule here.

Editing and managing His Credit Form with pdfFiller

pdfFiller elevates the experience of managing the 'His Credit Form' through its robust suite of editing tools, streamlining processes to enhance efficiency.

Ensuring compliance with His Credit Form submission

Legally, there are essential requirements to be aware of when filing the 'His Credit Form', as adherence to regulations protects both you and the evaluating entities.

Common issues and solutions related to His Credit Form

As with many processes, submitting the 'His Credit Form' can lead to challenges if missteps occur or if external factors come into play.

Managing your credit after submitting His Credit Form

After submitting the 'His Credit Form', continual monitoring of your credit status is essential to safeguard financial health and leverage new opportunities.

Frequently asked questions about His Credit Form

Understanding common queries about the 'His Credit Form' can prepare you for a smoother process.

Success stories and testimonials

Real-life examples showcase the advantages gained from effectively utilizing the 'His Credit Form'.

Conclusion and looking ahead

Reflection on past credit applications can greatly inform future submissions. Continuous education and improvement in credit management are pivotal to navigating financial landscapes.

Resources available through pdfFiller can help strengthen your financial literacy and keep you informed about best practices in credit management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get his credit form album?

How can I fill out his credit form album on an iOS device?

How do I edit his credit form album on an Android device?

What is his credit form album?

Who is required to file his credit form album?

How to fill out his credit form album?

What is the purpose of his credit form album?

What information must be reported on his credit form album?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.