Get the free 10-K - 02/28/2018 - America First Multifamily Investors, L.P.

Get, Create, Make and Sign 10-k - 02282018

Editing 10-k - 02282018 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10-k - 02282018

How to fill out 10-k - 02282018

Who needs 10-k - 02282018?

10-K - 02282018 Form: A Comprehensive How-to Guide

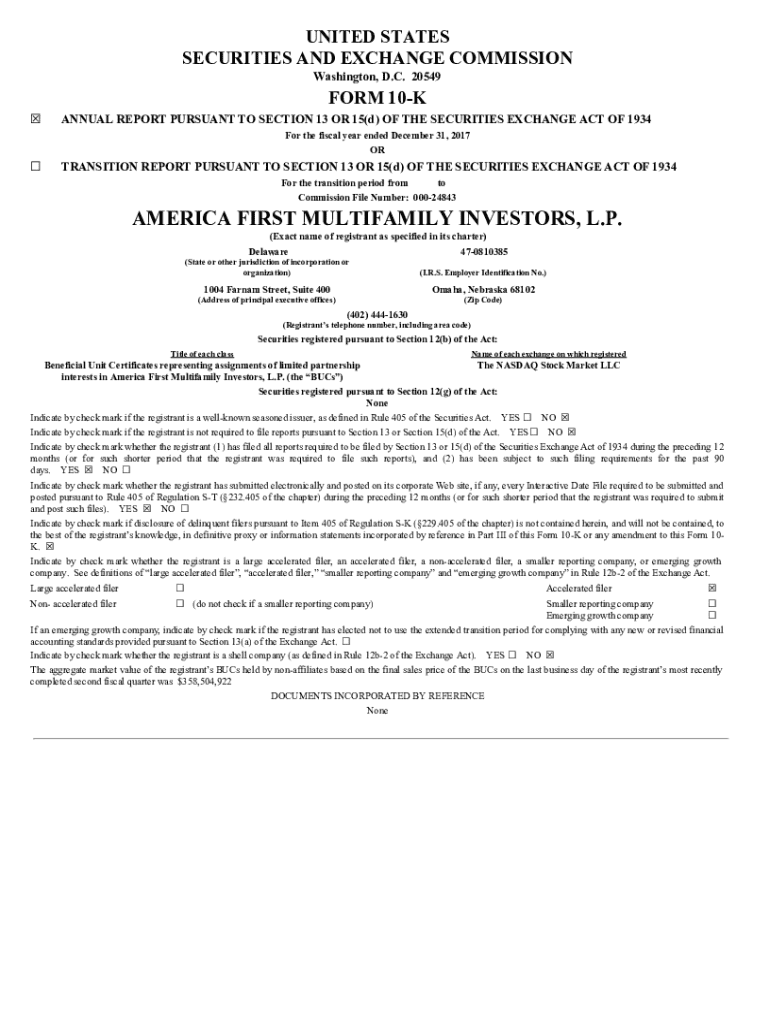

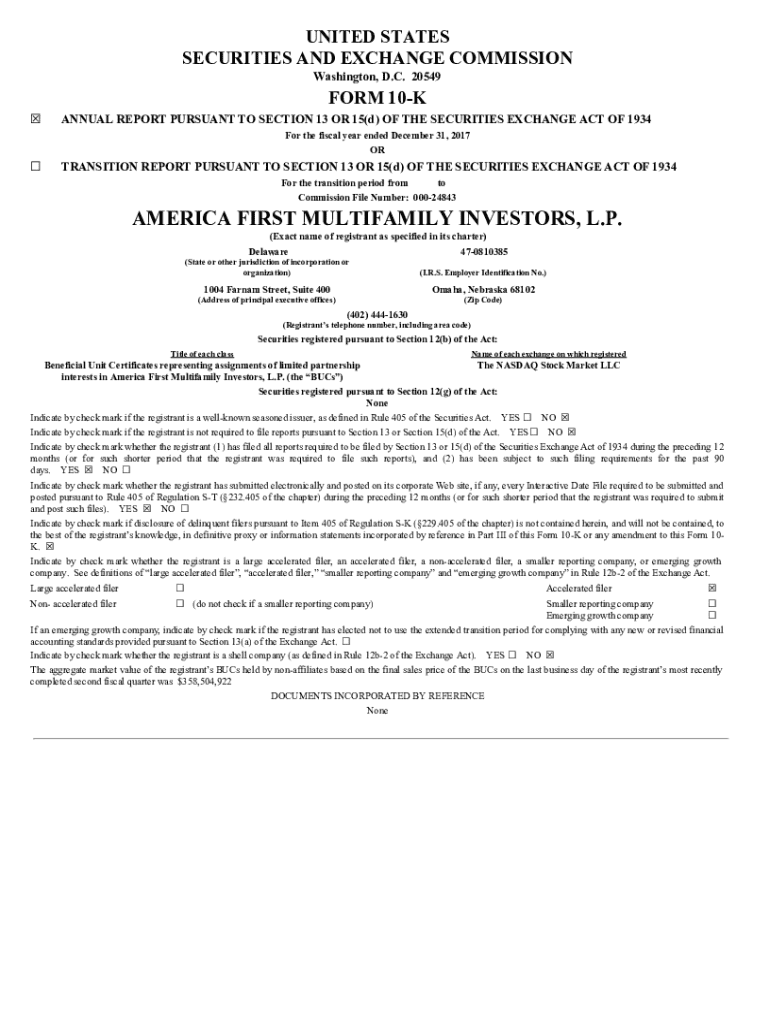

Overview of the 10-K form

The 10-K form is an essential document that publicly traded companies must submit annually to the Securities and Exchange Commission (SEC). It provides a comprehensive overview of a company's financial performance and detailed insights into its operations, management, and future risks. The purpose of filing a 10-K is to inform shareholders and potential investors about the company's financial health, business strategies, and key performance metrics.

The importance of the 10-K in corporate reporting cannot be overstated. It acts not only as a financial report but also as a tool for transparency and compliance with regulatory bodies. The 10-K aids in maintaining investor trust and ensuring informed investment decisions.

Understanding the 02282018 filing

The filing date of February 28, 2018, marks a significant point in the reporting cycle for many companies. This timestamp is critical as it aligns with the end of the fiscal year for various organizations, providing a snapshot of performance and strategic direction.

The highlights of the 10-K filed on this date include trending earnings data, elucidation of strategic goals, and critical risk management practices. Analyzing annual reports over the years reveals comparable fiscal trajectories and shifts in management strategy, especially in response to market dynamics.

Regulatory changes have also shaped the 10-K filing process. The shift towards enhanced transparency and the increased importance placed on risk disclosures have emerged as key focal points, reflecting SEC's commitment to investor protection.

Step-by-step guide to completing the 10-K form

Completing the form requires meticulous attention to detail, reflecting the complex nature of corporate reporting. Below is a structured approach to filling out the 10-K.

To ensure thoroughness and accuracy, follow these tips: thoroughly verify financial data against source documents, engage relevant department heads for input, and ensure compliance with the latest SEC guidelines. One common mistake is underreporting risk factors; thus, all potential risks should be discussed in detail.

Interactive tools for document management

Managing 10-K forms can be streamlined with pdfFiller, which provides an array of features customized for corporate needs. These tools simplify the editing process, ensuring compliance and accuracy in submissions.

Using pdfFiller to edit the 10-K form is straightforward. Upload your document, leverage the editing tools, and finalize with secure e-signatures. Furthermore, securely store and share your 10-K form without compromising sensitive information.

Best practices for filing the 10-K

Filing your 10-K on time requires coordinated effort and attention to deadlines. Understanding timelines can often mean the difference between timely compliance and facing penalties.

Securing accurate and timely filings requires concerted efforts across various departments within organizations to ensure compliance and readiness.

Analyzing and interpreting 10-K reports

Once a 10-K is filed, it is integral to understand how to read the financial statements it contains. This comprehension forms the basis for evaluating a company's performance.

Being able to analyze and interpret 10-K reports provides a competitive advantage and fosters informed decision-making in investment or corporate strategies.

Key considerations post-filing

After filing the 10-K, companies must remain vigilant in addressing any comments or requests from the SEC. Maintaining proactive communication channels can mitigate potential misunderstandings.

Utilizing insights from the 10-K filing helps enhance company strategies and stakeholder engagement.

Expert insights on 10-K reporting

Industry experts and financial analysts play a crucial role in assessing the implications of 10-K filings. Diverse perspectives provide insights into what constitutes best practices and what pitfalls to avoid.

Future updates and amendments to the 10-K

Filing an amended 10-K may become necessary due to errors, changes in management direction, or regulatory requirements. Understanding the process is crucial.

Accurate historical records can act as a guide in preparing for future filings and can foster greater compliance overall.

Conclusion: Streamlining your 10-K filing with pdfFiller

Utilizing pdfFiller's expanding range of tools can dramatically enhance the efficiency of your 10-K filing process. From document editing to secure storage, leveraging a holistic, cloud-based document solution enables teams to focus more on crafting comprehensive reports rather than struggling with the technicalities of filing.

Integrating pdfFiller into your document management strategy not only optimizes the filing process but also ensures your 10-K is accurate, timely, and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out 10-k - 02282018 using my mobile device?

Can I edit 10-k - 02282018 on an iOS device?

How do I edit 10-k - 02282018 on an Android device?

What is 10-k - 02282018?

Who is required to file 10-k - 02282018?

How to fill out 10-k - 02282018?

What is the purpose of 10-k - 02282018?

What information must be reported on 10-k - 02282018?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.