Get the free for the fiscal year ended December 31 , 2018

Get, Create, Make and Sign for form fiscal year

Editing for form fiscal year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for form fiscal year

How to fill out for form fiscal year

Who needs for form fiscal year?

Understanding and Managing Your Fiscal Year Form

Understanding the fiscal year form

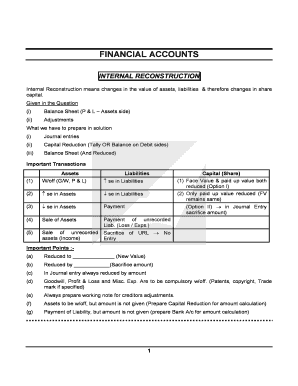

A fiscal year form is a critical document for both individuals and businesses, as it outlines financial performance for a defined period that may not align with the conventional calendar year. Typically, the fiscal year spans 12 months but can be set to end in any month of the year, thus allowing businesses to align their reporting period with their operational cycle. This form is indispensable for accurate financial reporting and fulfilling tax obligations, allowing entities to document revenue, expenditures, and assess their financial health.

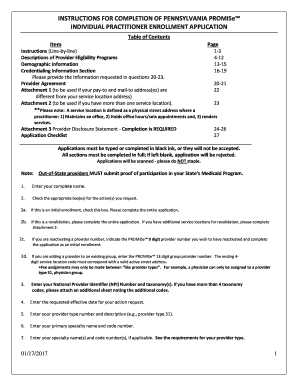

Key components of the fiscal year form

The fiscal year form comprises several essential sections that gather pertinent financial information. Key components typically include details about the filing period, a breakdown of income sources, and information regarding deductions and credits that may be applicable. A thorough understanding of these components is crucial as it helps ensure compliance and minimizes the likelihood of errors that could attract penalties.

In terms of important dates and deadlines, each jurisdiction has specific timelines that must be adhered to. Notably, missing these deadlines can lead to penalties and interest charges, adding unnecessary strain to financial management. Understanding when forms are due, along with the procedures to apply for extensions, is vital for a smooth filing process.

Step-by-step guide to filling out the fiscal year form

Completing the fiscal year form requires careful preparation and gathering of necessary documents. Before starting, ensure that you have all relevant financial records at your fingertips, such as profit and loss statements, expense receipts, and previous tax returns. Familiarizing yourself with applicable tax laws and regulations is also key, as compliance will mitigate the risk of facing penalties.

Once you are prepared, begin filling out the form as follows:

Common pitfalls and how to avoid them

Completing the fiscal year form, when rushed, can lead to a multitude of errors. Common mistakes include misreporting income or deductions, overlooking required signatures, or selecting incorrect submission methods. These errors can delay processing and even lead to audits, highlighting the importance of meticulousness.

To ensure accuracy, here are some tips to follow during the reporting process:

Interactive tools for fiscal year form management

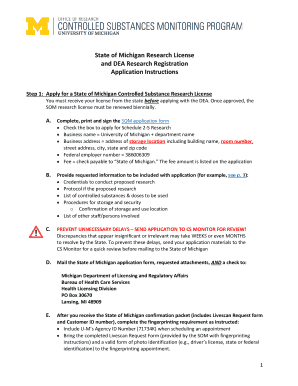

Using pdfFiller's tools enhances your fiscal year form management significantly. The platform provides reliable document editing features, allowing you to modify and update your forms conveniently. You can collaborate with other stakeholders or your tax professional through viewer options that facilitate feedback and revisions.

Additionally, pdfFiller offers online signature capabilities, ensuring that your signature is secure and compliant with legal standards. This streamlines the submission process, allowing users to finalize their documents without the hassle of printing and physically mailing forms.

Post-submission and follow-up

Once your fiscal year form has been submitted, there are several expectations to keep in mind. Generally, processing times can vary, and in some cases, your submission may be flagged for audits. Understanding the typical processing timeline can help in planning subsequent financial actions.

If you realize you made a mistake after submission, it is imperative to know how to amend your fiscal year form. You can file an amended form to correct errors, but ensure this is done promptly to minimize repercussions. There are resources available through government tax websites and services to assist users in correcting their submissions.

Additional considerations

Choosing between a fiscal year and a calendar year can impact your financial reporting. Each option comes with its own set of advantages and disadvantages. A fiscal year may align better with your business cycle, potentially allowing for more accurate financial reporting, while a calendar year is straightforward and more commonly understood.

Tax planning strategies for your fiscal year are also crucial for optimizing financial outcomes. Continuously monitoring and evaluating key financial metrics throughout the fiscal year positions businesses to adjust their strategies as needed, ensuring long-term growth and compliance.

Frequently asked questions (FAQs)

Users often have questions regarding the fiscal year form and its implications. Common queries include what to do if the filing deadline is missed, whether changing your fiscal year is feasible, and where to find help in filling out the form.

User experience and feedback

Users have reported enhanced experience while managing their fiscal year forms with pdfFiller. The platform's intuitive design allows for swift navigation and easy editing. Many users appreciate the collaborative tools that foster teamwork, resulting in fewer errors and more efficient workflows.

Continued feedback from users has inspired improvements and new feature considerations, making pdfFiller a dynamic tool that evolves with user needs. User testimonials reflect satisfaction with its ease of use and efficiency in handling complex document workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit for form fiscal year online?

Can I create an electronic signature for signing my for form fiscal year in Gmail?

How do I edit for form fiscal year straight from my smartphone?

What is for form fiscal year?

Who is required to file for form fiscal year?

How to fill out for form fiscal year?

What is the purpose of for form fiscal year?

What information must be reported on for form fiscal year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.