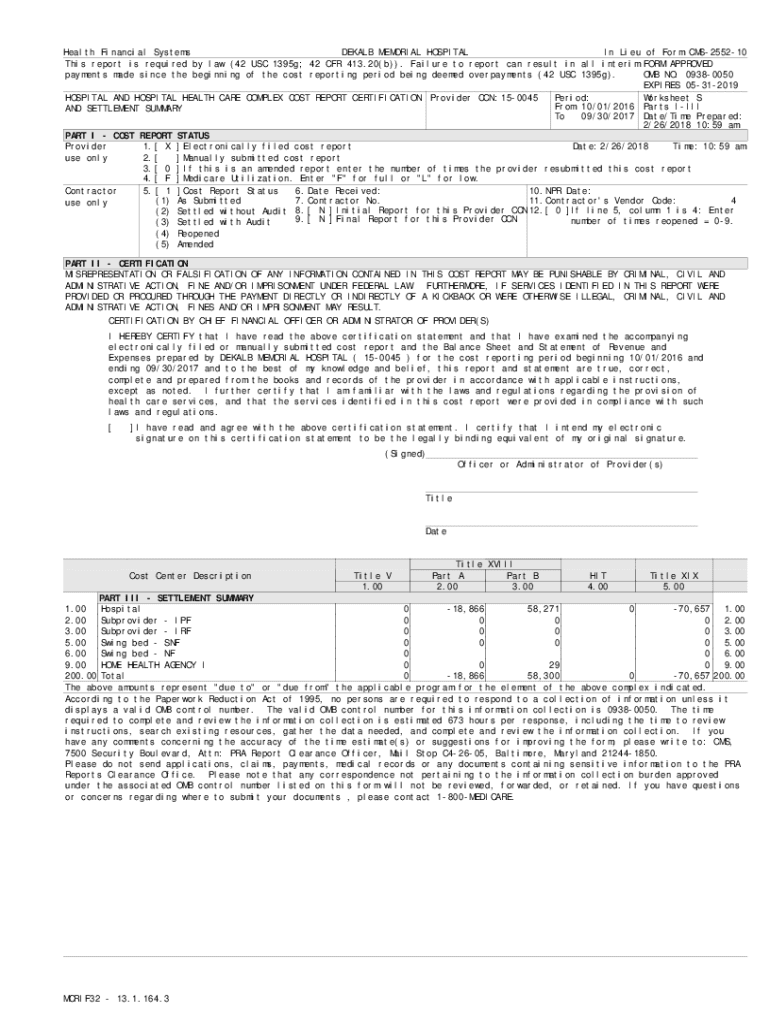

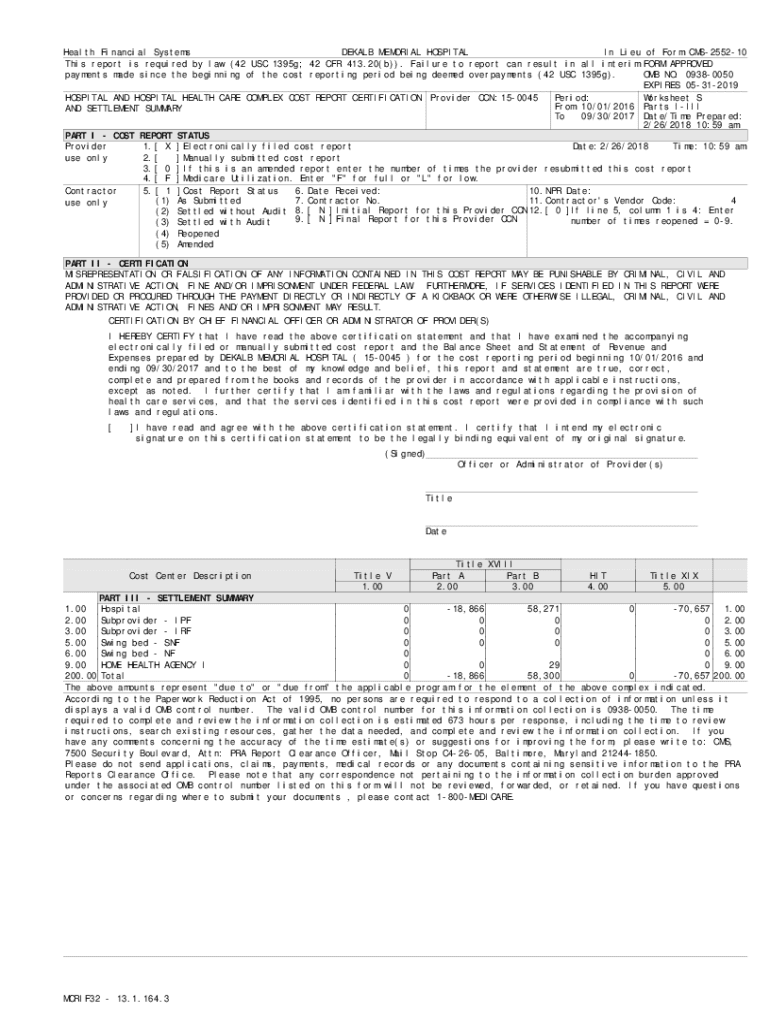

Get the free Expenses prepared by DEKALB MEMORIAL HOSPITAL ( 15-0045 ) for the cost reporting per...

Get, Create, Make and Sign expenses prepared by dekalb

Editing expenses prepared by dekalb online

Uncompromising security for your PDF editing and eSignature needs

How to fill out expenses prepared by dekalb

How to fill out expenses prepared by dekalb

Who needs expenses prepared by dekalb?

Expenses Prepared by Dekalb Form: A Comprehensive Guide

Understanding the Dekalb form for expenses

The Dekalb Form for Expenses serves as a vital document for accurate and structured expense reporting for individuals and teams. This form is designed to capture all necessary financial transactions related to business activities, ensuring compliance and facilitating effective reimbursement processes.

The importance of accurate expense reporting cannot be overstated. Correctly prepared expense reports not only enhance transparency but also provide financial insights that are critical for budgeting and forecasting. Organizations benefit from reduced audit risks while individuals enjoy quicker reimbursement.

However, submitting inaccurate expense reports can lead to financial discrepancies, delays in reimbursements, and potential legal issues. Therefore, understanding the Dekalb Form thoroughly ensures that all necessary elements are accurately reported.

The validity and acceptance of the Dekalb Form hinges on its compliance with organizational policies and financial regulations. Proper usage fosters trust among stakeholders and promotes a culture of financial integrity.

Preparing your documents

Before diving into the actual filling out of the Dekalb Form, it’s crucial to have all necessary documents prepared. This preparation minimizes errors and speeds up the submission process.

Organizing your information is equally important. Categorizing your expenses based on their nature—such as travel, meals, and supplies—helps in creating a coherent expense report. Maintain comprehensive records of receipts by using labeled folders, either physical or digital, to easily retrieve information when needed.

Step-by-step guide to completing the Dekalb form

Accessing the Dekalb Expense Form is user-friendly. You can fill it out online or download it through platforms like pdfFiller, which simplifies the process significantly.

When you begin filling out the form, pay special attention to each section. Start with your personal information, ensuring all fields are accurately filled out. Next, categorize your expenses by entering details relating to the nature of the expenses incurred.

To ensure accuracy in entries, avoid rushing through the process. Cross-verify your entries against your receipts and invoices. Review your completed form diligently to catch any mistakes, remembering that common pitfalls include omitted receipts or misdated transactions.

Editing and customizing your Dekalb form

Using pdfFiller for editing enhances the efficiency of customizing your Dekalb Form. The platform offers interactive tools that allow for real-time edits, which facilitates a seamless editing experience.

In addition to filling out expense amounts, you can add notes and annotations that specify details or clarifications. This feature is particularly useful for complex expense reports that require additional context for reviewers.

Signing and submitting your Dekalb form

Once your Dekalb Form is filled and reviewed, the next step is signing it. Using pdfFiller, you have multiple options for signing the form. Implementing eSignature technology ensures a quick and legally recognized way of signing documents electronically.

After signing, focus on the submission process. It is crucial to know where to send your completed form—whether to your supervisor or the finance department. Additionally, verify that you receive confirmation of a successful submission to avoid any issues later.

Managing your expense reports

After submitting your Dekalb Form, managing your expense reports is crucial to ensure that all submissions are tracked and organized. Utilize the document management features available on pdfFiller to keep your records in one place.

Setting reminders for follow-ups or revisions helps enhance accountability and keeps your expense reporting on track. Moreover, regularly analyzing your expenses can also reveal spending trends that will be beneficial for future budgeting.

Troubleshooting common issues

Despite the best efforts, users can encounter problems with the Dekalb Form. Some of the frequently encountered issues include missing information or misplaced receipts, which can hinder timely processing and reimbursement.

To get support, pdfFiller provides various support resources to help streamline the process. Additionally, directly contacting the Dekalb office can clarify any uncertainties regarding the form requirements.

Best practices for expense management

Implementing best practices for expense management ensures not only efficiency but accuracy in handling financial matters. Regular updates to your expense log are crucial, as this habit diminishes the burden of backlog entries and simplifies reporting.

Collaboration is equally important for teams when filling out the Dekalb Form. Utilizing shared folders or collaborative tools on pdfFiller can streamline the process for multiple team members, fostering a clear communication pipeline.

Additional tools and templates

Beyond the Dekalb Form, pdfFiller offers a variety of other templates for different documentation needs. These forms can integrate with financial software, providing enhanced tracking and analysis capabilities that cater to a user's specific financial management strategies.

Creating synergy between various tools enhances the overall efficiency of expense reporting. Look for templates that suit your personal or business needs, whether for expense tracking, budget planning, or reporting.

User testimonials and case studies

Users of the Dekalb Form have shared successful stories of how efficiently they managed their expenses. Many have found that implementing the form through pdfFiller streamlined their workflows significantly, reducing the time spent on reporting and increasing accuracy.

Feedback mostly highlights the ease of use and capabilities that pdfFiller integrates within document management. Case studies reveal how businesses experienced improved accountability among participants, leading to better financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit expenses prepared by dekalb from Google Drive?

How do I execute expenses prepared by dekalb online?

Can I edit expenses prepared by dekalb on an Android device?

What is expenses prepared by dekalb?

Who is required to file expenses prepared by dekalb?

How to fill out expenses prepared by dekalb?

What is the purpose of expenses prepared by dekalb?

What information must be reported on expenses prepared by dekalb?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.