Get the free Total debt for rated US companies reaches new high

Get, Create, Make and Sign total debt for rated

How to edit total debt for rated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out total debt for rated

How to fill out total debt for rated

Who needs total debt for rated?

Total Debt for Rated Form: Comprehensive Guide to Managing Your Financial Obligations

Overview of total debt

Total debt refers to the sum of all outstanding debts that an organization or individual owes. This includes loans, credit card balances, lines of credit, and any other financial obligations that require repayment. For rated forms, understanding total debt is essential for financial assessments, as it provides a snapshot of an entity's overall borrowings and financial risk profile.

Components of total debt

Identifying the components of total debt is crucial for accurate financial analysis. Total debt primarily includes various forms of borrowing, which may consist of:

It’s essential to differentiate between total debt and total liabilities, whereby total liabilities encompass all debts plus obligations that may not require immediate payment but are still due in the future.

Calculating total debt

Calculating total debt involves a straightforward process that aggregates all forms of outstanding debt. Here’s a step-by-step approach:

For example, if you have $10,000 in credit card debt, $20,000 in a personal loan, and a $150,000 mortgage, your total debt would be $180,000.

Important formulas and ratios

Key formulas and ratios essential in analyzing total debt include:

Understanding the importance of total debt

Total debt serves as a critical measurement of financial health. The higher the total debt relative to assets and income, the greater the risk of financial distress. This balance is vital for evaluating liquidity and long-term sustainability.

Impact on financial health

A company or individual's high total debt levels can restrict operations, increase vulnerability to market changes, and elevate stress linked to fulfilling financial obligations. Conversely, managing total debt effectively can enhance credit ratings and open doors to favorable financing options.

Debt-to-asset ratio explained

The debt-to-asset ratio provides a clear indication of an entity's financial leverage. It is calculated as total debt divided by total assets, and a high ratio may indicate excessive reliance on borrowed funds.

Assessing creditworthiness through total debt

Credit agencies evaluate total debt as part of credit risk assessment models. A lower total debt translates into better credit scores, reinforcing trust among lenders and investors.

Strategic considerations

Effective total debt management is imperative for maintaining financial stability. Here are some strategies for success:

Prioritizing these practices can lead to better financial outcomes.

Total debt management tools

Utilizing tools designed for managing total debt can significantly ease the burden of keeping financial obligations in check. Some valuable resources include:

These tools assist in creating a structured approach to debt management.

Frequently asked questions (FAQs)

What is the total debt formula?

The total debt formula is essentially a summation of all liabilities. It is calculated as Total Debt = Loans + Credit lines + Mortgages + Other Financial Obligations.

How is total debt evaluated by credit agencies?

Credit agencies review total debt alongside other financial indicators to assess risk. A pattern of high total debt, especially in relation to income, can lead to lower credit scores.

What are the consequences of high total debt?

High total debt can lead to reduced credit ratings, limited borrowing capabilities, and increased interest rates on loans due to perceived risk by lenders.

Related topics

These topics expand the understanding of financial stability and insight into effective debt management.

Resources for further learning

These resources emphasize continued education in managing total debt effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find total debt for rated?

How do I edit total debt for rated online?

Can I sign the total debt for rated electronically in Chrome?

What is total debt for rated?

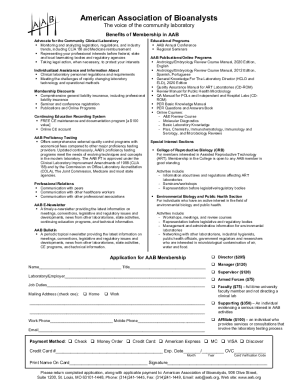

Who is required to file total debt for rated?

How to fill out total debt for rated?

What is the purpose of total debt for rated?

What information must be reported on total debt for rated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.