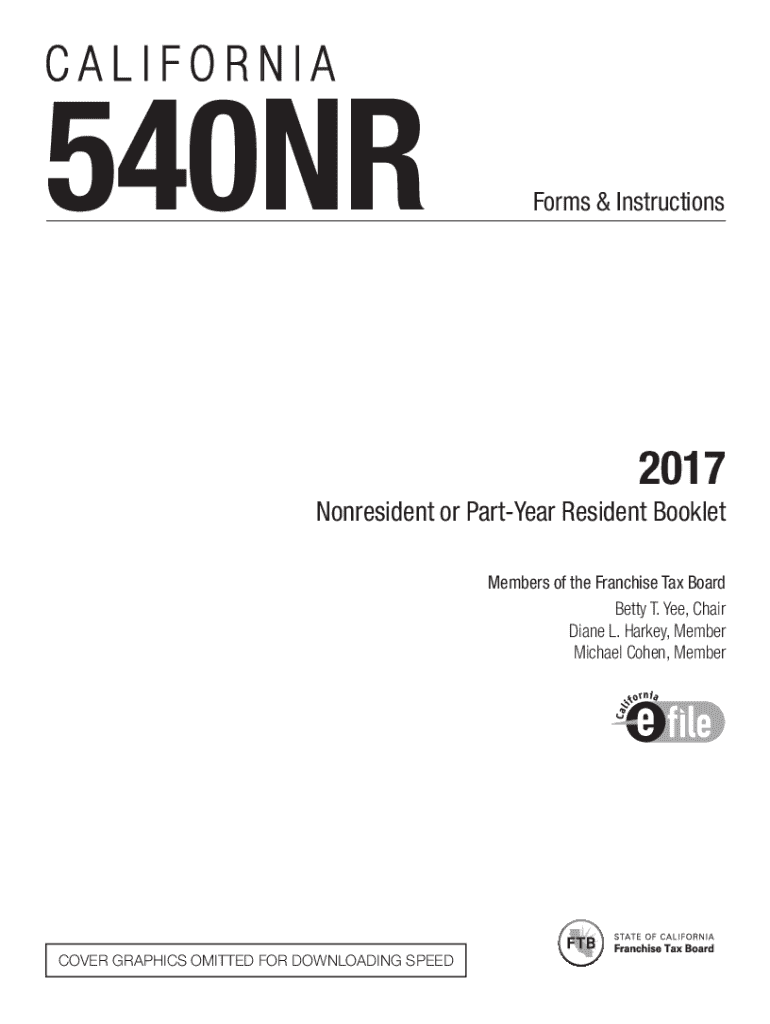

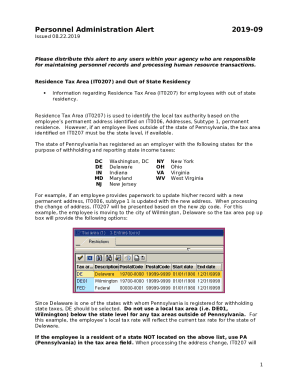

Get the free Short Form 540NR, California Nonresident

Get, Create, Make and Sign short form 540nr california

Editing short form 540nr california online

Uncompromising security for your PDF editing and eSignature needs

How to fill out short form 540nr california

How to fill out short form 540nr california

Who needs short form 540nr california?

A Comprehensive Guide to the Short Form 540NR California Form

Overview of Form 540NR

The Short Form 540NR is an essential tax document for individuals who are either part-year residents or non-residents of California. This form is designed to simplify the tax filing process for those who earned income in California without the complexities included in the full 540NR form. Its primary purpose is to ensure that individuals pay the correct amount of tax on their California-source income while facilitating an easier reporting process.

Key differences between Form 540 and Form 540NR include residency status and the scope of income reported. While Form 540 is used by full-year residents of California, Form 540NR is specifically tailored for those who do not meet the residency requirements but still have California-sourced income.

Who should file Form 540NR?

Filing Form 540NR is necessary for part-year residents and non-residents who earned income that originated from California sources. Eligible individuals typically fall into two categories. First, part-year residents, who may have moved into or out of California during the tax year, need this form to report their income appropriately. Second, non-residents with California source income must file to comply with state tax regulations.

Understanding your residency status is crucial in determining your filing requirements. For tax purposes, a resident is typically defined as anyone who is in California for other than a temporary or transitory purpose. Common scenarios that trigger the need to file Form 540NR include working in California while residing in another state or moving to California within the tax year and earning income from both states.

Important dates and deadlines

The typical filing deadline for Form 540NR coincides with the federal tax deadline, which is usually April 15. However, if you need additional time, you can apply for a six-month extension, giving you until October 15 to submit your form. It's vital to be aware that the extension applies only to the filing of the form, not to any tax payments due. Late filing can result in penalties and interest, significantly increasing the amount you owe.

To avoid these consequences, it is advisable to file your form as early as possible, ideally by the original deadline. After submission, ensure you keep track of any correspondence from the California Franchise Tax Board (FTB) regarding your form status.

Gathering necessary information

To successfully complete Form 540NR, you need to gather relevant documents and information. This includes income statements such as W-2 and 1099 forms that report your earnings. Understanding deductions and credits available to you can also play a significant role in your final tax bill or refund.

Here is a checklist of items you should collect prior to starting your form:

Organizing these documents ahead of time will not only streamline the process but also help minimize the likelihood of errors.

Step-by-step instructions for completing Form 540NR

Completing Form 540NR requires attention to detail. Follow these steps for an efficient filing process: First, begin with your personal details, including your name and address. Next, accurately report your income, differentiating California-sourced income from income earned outside of California. Be diligent about identifying any income exclusions available to you.

After income reporting, focus on claiming deductions. California offers various deductions to help reduce your taxable income. Be sure to check eligibility for standard deductions or any specific credits to which you may be entitled.

Here are common pitfalls to avoid when filling out the form:

Lastly, consider consulting resources to maximize your potential refund or minimize taxes owed.

eFiling vs. paper filing

When deciding how to file your Short Form 540NR, eFiling has notable advantages. The digital process is faster, more efficient, and offers immediate confirmation upon submission. Additionally, eFiling platforms often have error-checking tools that minimize filing mistakes, which can prevent complications down the road.

To eFile, select a reputable online tax filing solution, fill in the necessary information, and follow the prompts to submit your form electronically. Conversely, if you opt for paper filing, print the completed form, sign it, and ensure it is mailed to the appropriate California tax offices. Be mindful of postal timelines to avoid late submissions.

Understanding the California tax code related to Form 540NR

California tax laws encompass pertinent regulations that influence how non-residents should file their taxes. Familiarizing yourself with these laws can aid in navigating complexities and ensuring compliance. Filing inaccuracies can lead to significant penalties and interest, raising the overall tax burden.

If you encounter issues or disputes, it's crucial to engage directly with the California Franchise Tax Board (FTB). They provide resources and assistance for resolving discrepancies and clarifying complex tax situations.

Additional resources and tools for Form 540NR

To enhance your tax filing experience for Form 540NR, various interactive tools can calculate taxes owed or available refunds. Accessing sample completed forms can provide valuable context and understanding of how to accurately fill out your own form.

Key resources include:

Frequently asked questions (FAQs) about Form 540NR

Individuals often have questions specific to the filing of Form 540NR. Some common queries include how to determine residency status, which types of income are considered California-sourced, and the deductions and credits available to non-residents. Clarification on these topics is crucial for ensuring proper compliance with California tax laws.

Final steps after filing your 540NR

After you have submitted Form 540NR, monitoring the status of your filing is crucial. You can use the California Franchise Tax Board's online services to track your return and ensure it has been processed. If you owe taxes, stay proactive by arranging payments promptly to avoid accumulating needless interest and penalties.

Refund timelines can vary, but knowing the typical turnaround can help you plan for your finances. Generally, expect refunds to take a few weeks from the date of acceptance.

Contacting support for help with Form 540NR

For any challenges encountered while filing Form 540NR or clarifications needed, it is beneficial to reach out to the California Franchise Tax Board directly. They offer live assistance to help address your specific queries.

If you prefer personalized assistance, consider hiring a tax professional familiar with California tax laws. Lastly, pdfFiller’s customer support offers resources and FAQs tailored to assist users, enhancing your overall filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete short form 540nr california online?

How do I make changes in short form 540nr california?

How do I edit short form 540nr california on an Android device?

What is short form 540nr california?

Who is required to file short form 540nr california?

How to fill out short form 540nr california?

What is the purpose of short form 540nr california?

What information must be reported on short form 540nr california?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.