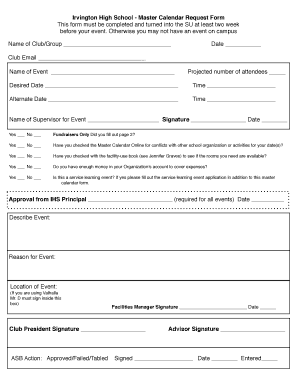

Get the free The Dai M ining Journal

Get, Create, Make and Sign form dai m ining

How to edit form dai m ining online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form dai m ining

How to fill out form dai m ining

Who needs form dai m ining?

How to Mine Dai: A Comprehensive Guide

Overview of Dai

Dai is a decentralized stablecoin that aims to maintain a value of one US dollar. This cryptocurrency is unique in its construction, as it is collateral-backed, giving it stability and reliability when compared to other cryptocurrencies that often experience high volatility. The purpose of Dai is not merely as a medium of exchange but also as a reliable store of value in the increasingly complex landscape of digital finance.

As a part of the Maker Protocol, Dai embodies the principles of decentralization, allowing users to hold and manage their assets without a central authority. This decentralized nature aligns with the broader ethos of the cryptocurrency space, emphasizing trustlessness and financial autonomy. Its model sets it apart from traditional fiat currencies, making it a cornerstone of the decentralized finance (DeFi) ecosystem.

The importance of Dai in the cryptocurrency landscape

Dai plays a critical role in the DeFi ecosystem, acting as a stabilizing force amid the otherwise volatile environments of cryptocurrencies. It serves various functions — from lending and borrowing to facilitating trade, thus broadening its usability.

Understanding the mining process

While Dai is often referred to in the context of mining, it is crucial to clarify what this means. Unlike traditional cryptocurrencies like Bitcoin, which rely on proof-of-work (PoW) mechanisms requiring extensive computational power, Dai's generation process is fundamentally different. 'Mining' Dai involves participating in the Maker Protocol through collateralized debt positions (CDPs), rather than solving complex mathematical problems.

The key distinction here is that Dai is not mined but minted through locking collateral, such as Ethereum. Thus, the term 'mining' in context refers to the minting process which allows users to create Dai while backing it with a stable form of collateral.

Mechanisms behind Dai creation

Dai is created through a system known as collateralized debt positions (CDPs). When users wish to generate Dai, they must first lock a certain amount of collateral, typically Ethereum or other approved assets, into a smart contract within the Maker Protocol. This mechanism ensures that for every Dai that is minted, there is a corresponding value held as collateral, providing stability to the currency.

The mining journey of Dai

Creating Dai requires understanding a structured process. Here is a step-by-step guide to navigating this journey.

Why you can't mine Dai like Bitcoin

The primary reason Dai cannot be mined like Bitcoin is due to its reliance on a collateral-based system rather than a proof-of-work or proof-of-stake model. Bitcoin mining involves substantial energy consumption and computational resources to validate transactions and secure the network. In contrast, Dai's generation through the MakerDAO model is dependent on the locking of collateral, which eliminates the need for extensive mining operations.

This unique feature not only promotes efficiency but also opens up Dai to users who may not have the technological capabilities or resources to engage in traditional mining activities. As a result, Dai offers an approachable method for users to engage with cryptocurrencies.

Advantages of using Dai

Dai provides numerous advantages in personal finance and the business sector. For individuals, Dai's stability, pegged to the USD, allows users to engage in transactions without worrying about the typical volatility associated with cryptocurrencies.

Dai in the business community

Businesses can leverage Dai in innovative ways, such as using it for transactions or to hold treasury reserves. The stable value ensures that they can manage payment processing efficiently without the uncertainty of fluctuating digital currencies. Collaborative DeFi opportunities are also becoming a trend, with various projects enabling companies to lend, stake, or earn yield on their Dai investments.

Challenges and considerations

Minting Dai is not without its challenges. Users must be aware of the potential risks involved in collateralization, including the volatility of the cryptocurrency market, which can lead to a decrease in collateral value.

The future of Dai

Looking forward, Dai's development roadmap indicates ongoing enhancements to the Maker Protocol. These updates promise to streamline the minting process further, expand the collateral options available, and improve access to Dai for more users across different platforms.

Predictions suggest that as DeFi becomes increasingly mainstream, Dai's role as a stablecoin will continue to provide significant utility in both the financial and technological sectors. Collaboration and integration with other blockchain projects may further solidify Dai's position as a leading stablecoin.

Engaging with the Dai community

Being part of the Dai community is an excellent way to stay informed and contribute to its evolution. Numerous online forums, social media groups, and community events focus on Dai and the Maker Protocol, providing avenues for discussions and insights.

Final thoughts on mining Dai

Dai offers a distinct way to engage with stablecoins, providing avenues for flexibility and innovation in personal and business finance. As outlined throughout this article, the mining process, while different from traditional mining methods, still provides a robust and secure framework for users.

By adhering to best practices, being mindful of market conditions, and actively participating in community dialogues, users can maximize their benefits while minimizing risks associated with Dai.

Frequently asked questions (FAQs)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form dai m ining online?

How do I make edits in form dai m ining without leaving Chrome?

How do I fill out form dai m ining using my mobile device?

What is form dai m ining?

Who is required to file form dai m ining?

How to fill out form dai m ining?

What is the purpose of form dai m ining?

What information must be reported on form dai m ining?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.