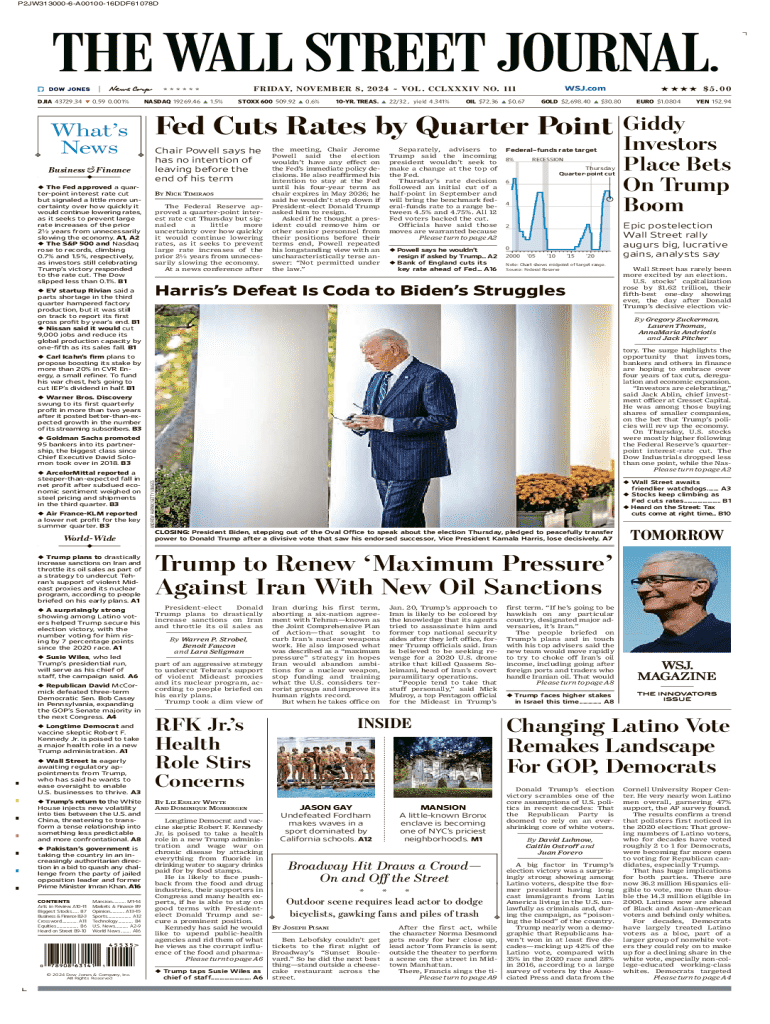

Get the free Fed Cuts Rates by Quarter Point

Get, Create, Make and Sign fed cuts rates by

Editing fed cuts rates by online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fed cuts rates by

How to fill out fed cuts rates by

Who needs fed cuts rates by?

Fed cuts rates by form: A comprehensive guide to understanding and navigating rate cuts

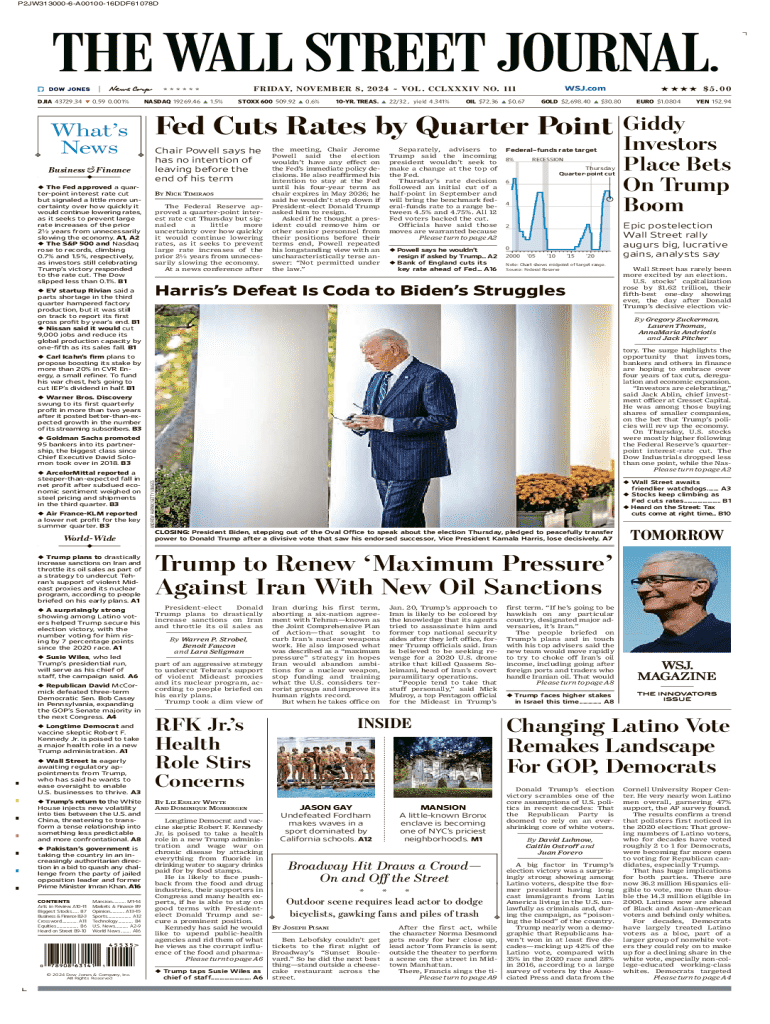

Understanding the Federal Reserve's rate cuts

Monetary policy refers to the actions undertaken by a nation's central bank to control money supply, interest rates, and overall economic stability. It is a critical tool that shapes not only the economy but also the financial decisions of individuals and businesses alike. The Federal Reserve (often referred to as the Fed) plays a pivotal role in this ecosystem, tasked with managing monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates.

When the Fed cuts rates, it lowers the interest rates at which banks can borrow money, which can lead to cheaper loans for consumers and businesses. Historically, the Fed has employed rate cuts during periods of economic distress or low consumer spending to stimulate growth. This was evident during the 2008 financial crisis and the COVID-19 pandemic, where rapid rate cuts aimed to encourage borrowing and investment.

Types of rate cuts and their implications

Understanding the various types of rate cuts is essential for navigating their repercussions. Full cuts involve a significant drop in rates across the board, while incremental cuts reflect gradual adjustments. Immediate cuts may lead to quick changes in borrowing costs, while anticipated cuts allow businesses and consumers to prepare ahead of time, smoothing the transition for financial planning.

The effects of these cuts can vary. For consumers, lower rates often mean reduced monthly payments on loans and mortgages, leading to increased disposable income. For businesses, rate cuts can result in lower costs for financing investments and potentially increased hiring. However, the benefits may depend on other economic conditions, like inflation rates and overall confidence in the marketplace.

The rate cut process explained

The decision to cut rates is not arbitrary; it relies heavily on economic indicators that the Fed monitors closely. Key indicators include unemployment rates, inflation statistics, and GDP growth. Economic forecasts play an integral role, as they provide insights into potential future conditions that may warrant a rate adjustment. For instance, if inflation is consistently below a target level, the Fed may opt to cut rates to stimulate spending and investment.

To analyze a Federal Open Market Committee (FOMC) announcement effectively, individuals must pay attention to the accompanying statements and projections. The dot plot, for instance, is a visual representation of where different Fed officials see interest rates heading in the future and can significantly influence market expectations and reactions.

Rate cuts by form

Different forms and applications are affected by rate cuts in distinct ways. For example, mortgage application forms become relevant as lower rates typically lead to an increase in refinancing and new home purchases. Lenders may adjust their underwriting processes based on these new rates, affecting how easy or difficult it is to secure a loan.

Similarly, business loan application processes can undergo changes in response to rate cuts. A lower rate environment makes borrowing more attractive, which can lead to increased investment and expansion by businesses. Understanding these shifts can position borrowers to take advantage of favorable loan terms.

How to prepare financial documents post-rate cut

In the wake of a rate cut, individuals and businesses must be proactive about their financial documentation. With pdfFiller, you can manage this process efficiently. Start by uploading your necessary files to the platform, where you can easily access and edit your documents as needed. Ensuring your financial records are up to date is essential for making informed decisions in a dynamic economic environment.

Utilizing interactive tools provided by pdfFiller streamlines document management. You can edit text, adjust terms, and prepare your forms for submission with ease. Additionally, eSigning your documents ensures quick processing, allowing you to take timely action following a rate cut.

How to navigate forms efficiently with pdfFiller

Document management doesn't have to be a painstaking process. With pdfFiller, uploading and converting documents to PDF can be as simple as a few clicks. Follow these steps: first, select the documents you wish to convert; next, upload them to the platform; and finally, utilize pdfFiller's editing features to make any necessary changes.

When it comes to editing and annotating forms, pdfFiller offers comprehensive tools that enhance your experience. You can highlight important sections, add comments for clarity, or even include images where necessary. Moreover, mastering eSignature capabilities is crucial for facilitating quick approvals and ensuring that your forms are processed without unnecessary delays.

Case studies: Real-life impacts of rate cuts

Analyzing recent Fed rate cuts provides insights into their real-world implications. For example, after the last round of cuts, the housing market experienced a notable uptick in mortgage applications, reflecting the immediate response of consumers to more favorable borrowing costs. Many prospective homebuyers found their purchasing power increased, leading to a surge in demand for homes.

In the business sector, an examination of loan approval trends post-rate cut indicates a parallel increase in financing requests. Companies often see these periods as ideal times to invest in growth opportunities, resulting in an increase in employment and economic activity.

FAQs on Fed rate cuts and form management

Understanding the nuances of Fed rate cuts can lead to valuable financial decisions. Here are some frequently asked questions to help clarify common concerns:

Related topics to explore

Beyond understanding rate cuts, other economic indicators influence their frequency and intensity. Inflation trends, for instance, play a significant role in shaping monetary policy. Additionally, it’s crucial to consider how global markets respond to U.S. rate cuts, as they can have far-reaching effects on international trade and investment.

Furthermore, as individuals and businesses prepare for economic fluctuations, accessing document templates for financial planning can be immensely beneficial. pdfFiller provides various templates tailored to budgeting and financial analysis, aiding users during these transitional times.

User support and additional help

If you face challenges during your document management journey with pdfFiller, help is readily available. You can contact pdfFiller support for any queries related to document handling and get the assistance you need to navigate post-rate cut adjustments seamlessly.

In addition to support, pdfFiller offers a wealth of online tutorials and resources aimed at troubleshooting common issues. These tools ensure that even during complex changes like Fed rate cuts, you can maintain efficiency in your financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fed cuts rates by in Gmail?

How do I fill out fed cuts rates by using my mobile device?

Can I edit fed cuts rates by on an iOS device?

What is fed cuts rates by?

Who is required to file fed cuts rates by?

How to fill out fed cuts rates by?

What is the purpose of fed cuts rates by?

What information must be reported on fed cuts rates by?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.