IRS 4952 2024-2025 free printable template

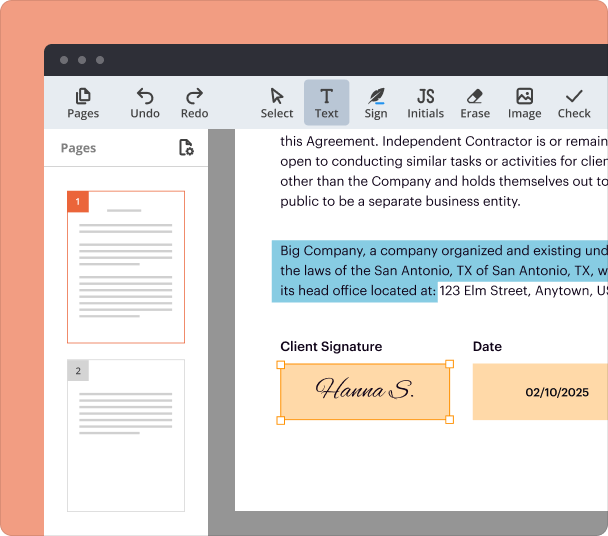

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

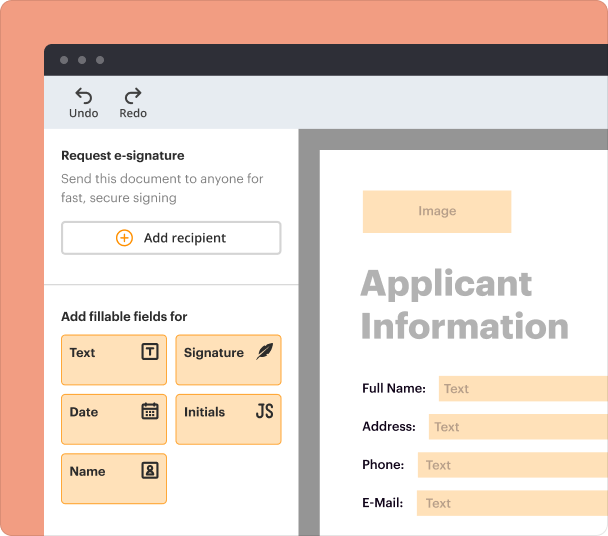

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

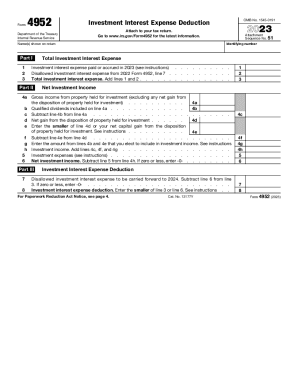

Understanding the IRS 4952 Investment Interest Expense Deduction Form

Overview of the IRS 4952 Form

The IRS 4952 form is utilized by taxpayers to calculate the investment interest expense deduction. This deduction allows individuals to reduce their taxable income by the amount of interest paid or accrued on loans taken out for investment purposes. The form should be attached to your tax return and is crucial for those who wish to report investment interest expenses efficiently.

Key Features of the IRS 4952 Form

The IRS 4952 form includes several important sections. These sections encompass total investment interest expense, net investment income, and the calculation of allowable deductions. Users can easily navigate the form to identify eligible amounts, ensuring accurate reporting on their tax returns.

Essential Documents Needed

To complete the IRS 4952 form accurately, it is important to gather necessary documents. This includes records of all investment income, interest expenses from loans, and any other relevant financial statements. Having this information on hand facilitates a smoother completion process and minimizes the risk of errors.

How to Complete the IRS 4952 Form

Filling out the IRS 4952 form involves several key steps. First, report the total investment interest expense from your records. Next, determine your net investment income by summing all income from investments. Finally, calculate the allowable deduction, ensuring to follow the form instructions closely to avoid common pitfalls.

Benefits of Using the IRS 4952 Form

Using the IRS 4952 form provides significant financial advantages. By accurately reporting investment interest expenses, individuals can lower their taxable income. This form also serves to clarify any questions regarding investment-related expenses, making it easier for taxpayers to comply with IRS requirements while maximizing potential deductions.

Common Mistakes to Avoid

When filling out the IRS 4952 form, several common errors can occur. These include misreporting the amount of investment interest paid, not properly documenting net investment income, and failing to attach the form to the tax return. Carefully reviewing the instructions and verifying all entries can help avoid these pitfalls.

Frequently Asked Questions

Many taxpayers have questions regarding the IRS 4952 form. Common inquiries relate to eligibility for the investment interest deduction, the necessity of documenting all expenses, and strategies for maximizing deductions. Answering these questions accurately can provide clarity and enhance understanding for users navigating their tax obligations.

Frequently Asked Questions about irs form 4952

Who should use Form 4952?

Taxpayers who have paid or accrued interest on loans used for investment purposes should use Form 4952 to claim the investment interest expense deduction.

What constitutes net investment income?

Net investment income is the income generated from investment property, excluding capital gains, and may include interest, dividends, and rental income.

Are there limitations on the investment interest deduction?

Yes, the investment interest deduction is limited to the amount of net investment income you earn, and any disallowed amount can be carried forward to subsequent years.

pdfFiller scores top ratings on review platforms