Get the free SEC Rules and Codes

Get, Create, Make and Sign sec rules and codes

How to edit sec rules and codes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec rules and codes

How to fill out sec rules and codes

Who needs sec rules and codes?

Understanding SEC Rules and Codes Form

Understanding SEC rules and codes

The Securities and Exchange Commission (SEC) plays a crucial role in regulating the securities industry in the United States. The SEC rules and codes aim to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. Over time, these regulations have evolved in response to changes in the marketplace, technology advancements, and significant financial crises.

Overview of SEC regulations

The SEC's regulatory framework consists of various rules and codes that dictate how public companies must operate. These regulations are designed to establish transparency and accountability, ensuring companies provide accurate and timely financial information to investors. This framework serves as the backbone of the U.S. financial markets, encouraging investor confidence and integrity.

Types of SEC rules

Navigating SEC rules and codes forms

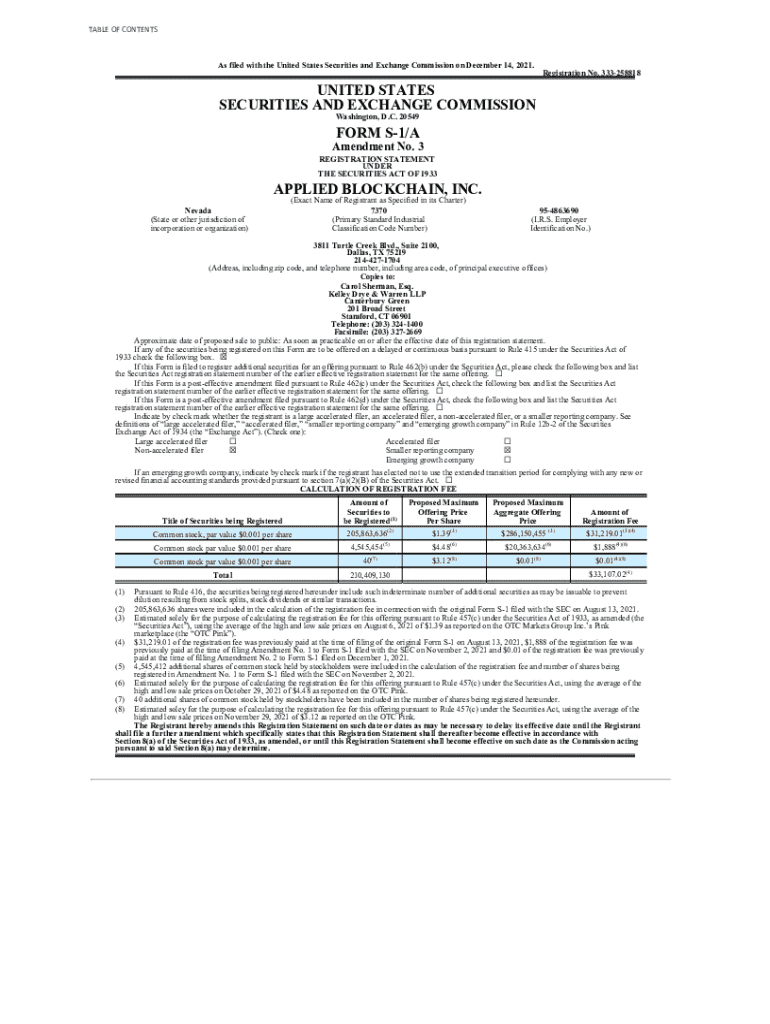

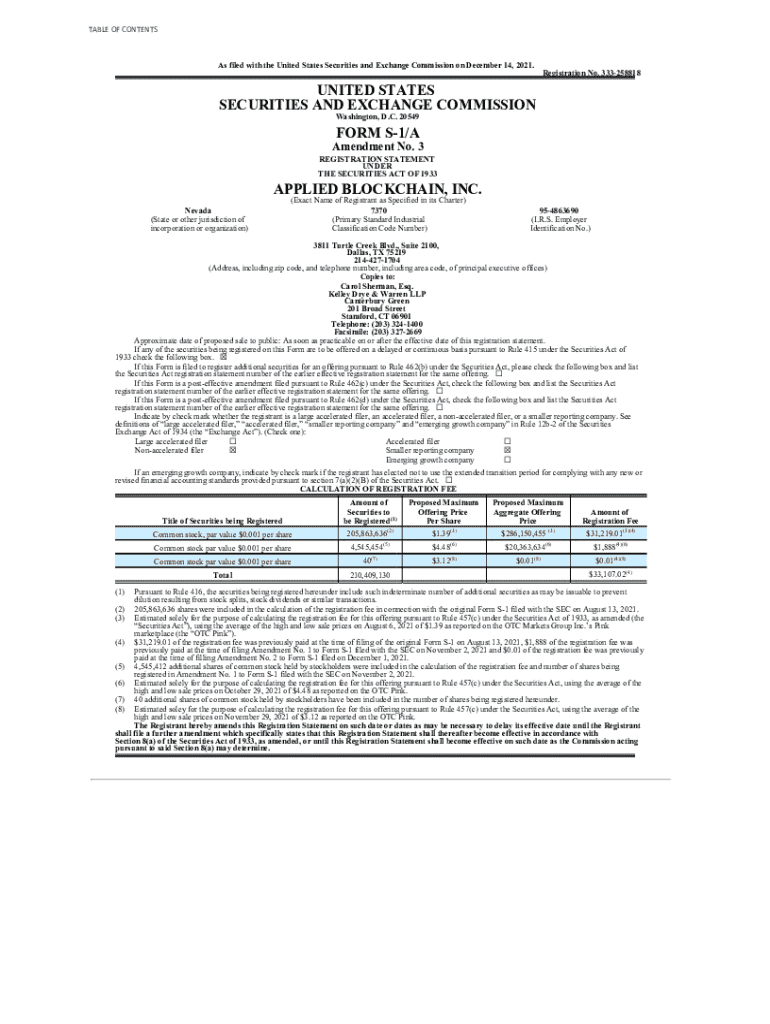

Filing forms with the SEC is a fundamental part of compliance for public companies and issuers of securities. These forms range from annual reports to registration statements and are critical for providing necessary information to investors and the public.

Purpose of SEC forms

SEC forms serve as standardized documents for companies to report information about their financial performance and operational changes. Proper use of these forms ensures compliance with federal securities laws, as well as aids in maintaining market integrity. Accurate and timely filing is essential as it can influence investment decisions and the overall market landscape.

Common SEC forms

Step-by-step guide to filling out SEC forms

Completing SEC forms can be challenging due to the level of detail required. However, understanding the steps involved can simplify the process.

Preparing for form submission

Before submitting an SEC form, companies need to gather important documentation including financial statements, disclosures, and other relevant corporate records. Common challenges in this phase include ensuring all data is accurate and current, assembling the necessary approvals, and understanding the filing deadlines.

Detailed breakdown of form fields

Each SEC form has specific fields that require careful attention. Generally, forms will ask for the company's name, SEC file number, and other essential data. Major forms like Form 10-K and Form S-1 have their distinct sections, which include financial summaries, risk factors, and management’s discussion and analysis (MD&A).

Tips for accurate reporting

To ensure compliance with SEC regulations, firms should implement best practices for data reporting, such as double-checking figures and getting legal or accounting review. Utilizing resources like SEC’s website for guidance or employing document management tools can streamline the filing process.

Editing and managing SEC forms through pdfFiller

The use of technology, such as pdfFiller, can significantly enhance the process of managing SEC forms, providing users with tools for editing, collaboration, and submission.

Uploading SEC forms to pdfFiller

Users can easily upload their completed SEC forms to pdfFiller’s platform. Supported formats include PDF and various document types compliant with the SEC standards. Knowing the upload requirements and compatible formats helps in seamless integration of documents.

Editing features

Once uploaded, pdfFiller offers editing tools that allow users to modify content directly, making necessary corrections efficiently. Moreover, collaboration features enable teams to work on submissions concurrently, enhancing workflow and accuracy.

eSigning and sealing documents

PdfFiller also facilitates eSignatures, ensuring that documents meet SEC’s compliance requirements related to electronic submissions. The integration of legal eSignature options streamlines the approval process while maintaining legal validity.

Interactive tools for SEC compliance

With pdfFiller, various interactive tools assist organizations in maintaining compliance with SEC regulations.

Using pdfFiller’s templates

pdfFiller provides a selection of pre-filled templates for SEC forms, which can save time and reduce filing errors. These templates accommodate typical filing scenarios, making the submission process more efficient.

Analyzing SEC filings

Within pdfFiller, tools are available to help track and manage filing deadlines. Utilizing analytics capabilities allows firms to ensure compliance and improve reporting strategies by reviewing previous submissions for consistency and accuracy.

Real-world applications of SEC rules and codes

Understanding real-world applications of SEC rules and the importance of accurate filings can provide valuable insights.

Case studies

Illustrations of successful SEC filings using pdfFiller show the practical benefits of the platform. Conversely, examining compliance failures can highlight potential pitfalls and the ramifications of incorrect or late submissions.

Staying updated with SEC regulations

In a constantly evolving regulatory environment, it is vital for companies and compliance professionals to remain informed about SEC changes.

Monitoring changes in SEC rules

Resources such as the SEC official website, news alerts, and compliance-focused bulletins can help professionals stay abreast of new regulations and best practices.

Utilizing pdfFiller’s features for updates

pdfFiller also offers alerts and newsletters that provide updates on regulatory developments. Utilizing these features is crucial for those responsible for compliance, ensuring they have the latest information at their fingertips.

Conclusion

The seamless integration of SEC forms and pdfFiller's platform provides users with an efficient solution for document management. By embracing a proactive approach to compliance through technology, firms can navigate SEC regulations effectively and streamline their reporting processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec rules and codes without leaving Google Drive?

How do I edit sec rules and codes straight from my smartphone?

How do I complete sec rules and codes on an iOS device?

What is sec rules and codes?

Who is required to file sec rules and codes?

How to fill out sec rules and codes?

What is the purpose of sec rules and codes?

What information must be reported on sec rules and codes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.