Get the free Tax Maps and Tax Mapping Information

Get, Create, Make and Sign tax maps and tax

Editing tax maps and tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax maps and tax

How to fill out tax maps and tax

Who needs tax maps and tax?

Understanding Tax Maps and Tax Forms: A Comprehensive Guide

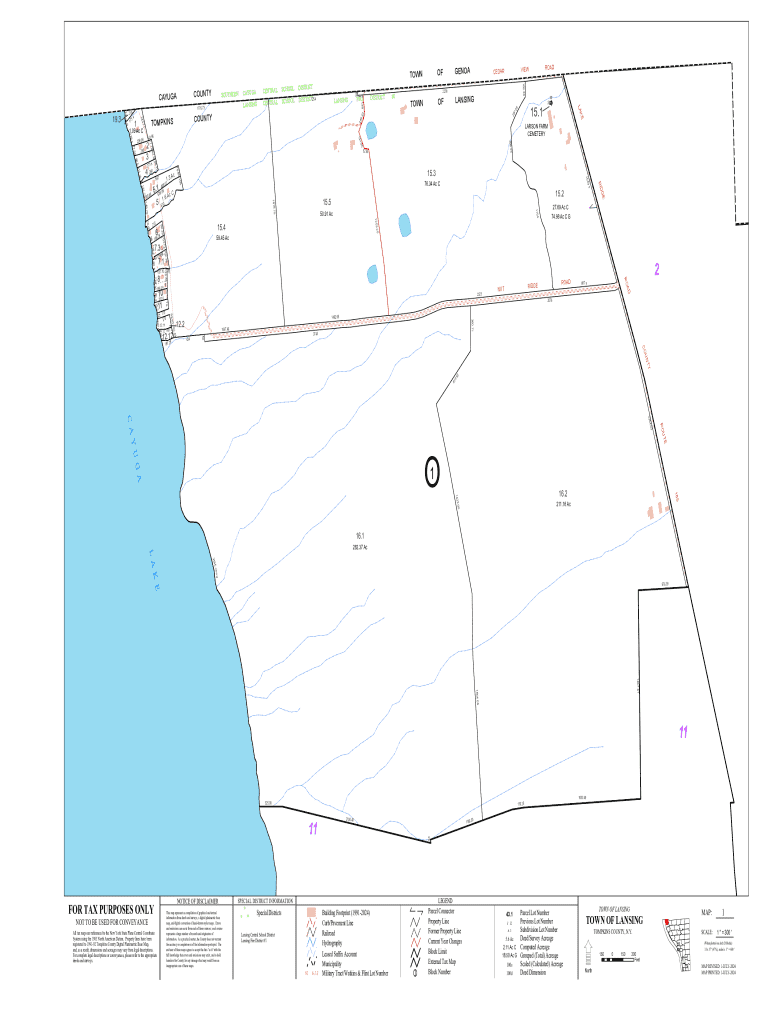

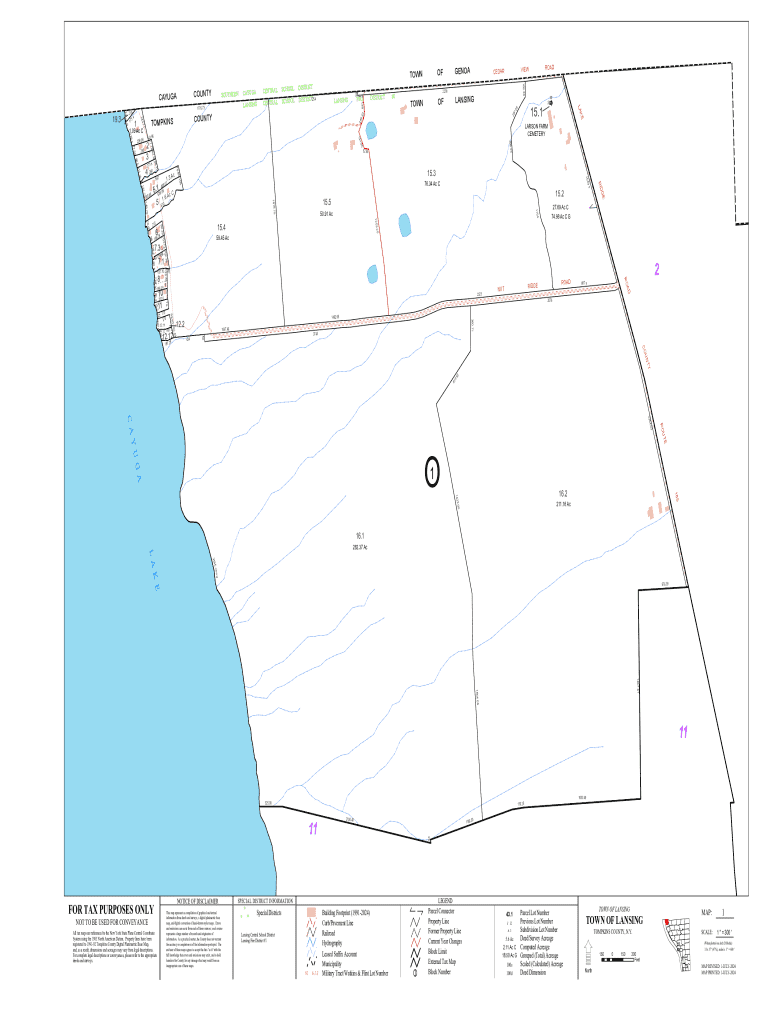

Understanding tax maps

Tax maps are essential tools used by local governments to assess property taxes. These maps visually represent the boundaries and characteristics of properties within a given jurisdiction. They display details such as property lines, zoning classifications, ownership information, and unique parcel identifiers. Understanding tax maps is crucial for property owners, as they not only aid in determining the property tax obligations but also play a critical role in property assessments, zoning, and even development planning.

The importance of tax maps extends beyond mere visualization. They serve as official documentation used during property transactions, tax assessments, and legal disputes. By providing a clear layout of properties, these maps help ensure that assessments are fair and based on established boundaries. They also facilitate transparency in local taxation, helping residents understand how their tax dollars are allocated based on their property's location and use.

Types of tax maps

There are various types of tax maps that cater to different assessment needs. Real property tax maps are the most common, detailing residential and commercial properties, including their boundaries and ownership. Special assessment tax maps are focused on areas that require additional assessment or special rates due to infrastructure improvements, such as new roads or sewer lines.

With the advancement of technology, tax maps are now available in both digital and traditional paper formats. Digital tax maps, accessible online, offer interactive features that allow users to zoom in on specific properties and obtain information quickly. In contrast, paper tax maps are still utilized in some jurisdictions, catering to those who prefer physical documentation.

Components of a tax map

Each tax map contains vital components that inform users about the property in question. First, property boundaries and ownership designations provide clear visual references for the extent of ownership. Parcel numbers, unique identifiers assigned to each property, facilitate property identification across tax filings, ensuring accuracy in assessment records. Assessor's maps also play a role by illustrating specific data relevant to the property's valuation.

Furthermore, zoning information appears on tax maps, indicating the property’s designated use—whether residential, commercial, agricultural, or industrial. This zoning information is crucial for property owners considering development projects or changes to property use, as it dictates what modifications are permissible under local regulations.

Accessing tax maps

Finding tax maps is straightforward, as most counties and local governments have made these resources available online. Visiting county or municipal websites often provides direct access to tax maps, allowing users to obtain the information they need without visiting government offices. Many local governments maintain interactive online tax maps that enable users to search for properties by address, parcel number, or owner name.

Utilizing these tools can save time and effort. Additionally, tax map resources often include links to property records and assessment data, giving users comprehensive insights into the properties in their area. Understanding where to find tax maps is crucial for anyone involved in real estate, taxation, or land use planning.

Filling out tax forms related to tax maps

Accurate completion of tax forms is critical for a smooth assessment process. Tax forms, such as property tax assessment applications, appeal forms, and special assessment requests, require detailed information directly correlated to data found on tax maps. A comprehensive understanding of where to locate property details on tax maps facilitates the correct completion of these forms, thereby minimizing errors.

The most commonly used tax forms typically include the property tax assessment form, which reports changes or improvements made to a property, the appeal for tax assessment form, which is submitted to contest a valuation made by the assessor's office, and the special assessment request form, which is needed for properties that benefit from specific improvements. Understanding how to fill out these forms accurately can significantly impact property tax obligations and ensure fair assessments.

Interactive tools for tax management

With the digital age of tax management, tools like pdfFiller have emerged as invaluable resources for simplifying the completion of tax forms. pdfFiller empowers users to access a wide variety of form templates that can be edited and customized to meet specific needs. Users can fill out their forms online from anywhere, making it easier than ever to manage property tax-related documents.

eSigning tax forms is another advantage provided by pdfFiller, allowing users to sign documents electronically without the hassle of printing and scanning. In addition, its collaborative features enable teams to work together on tax matters, ensuring that all necessary information is correctly represented and submitted in a timely manner.

Best practices for managing tax forms and maps

Managing tax documents effectively is essential for both individual property owners and teams handling multiple properties. Keeping tax documents organized for easy access is a fundamental best practice. An organized filing system, whether physical or digital, can ensure that important forms and maps are readily available whenever needed.

Regular updates are also crucial; keeping track of changes in tax maps—such as new property developments or zoning changes—will allow property owners to stay compliant with local tax rules. Staying informed about current regulations and maintaining updated documents will help prevent discrepancies and potential legal issues down the line.

Troubleshooting common tax form issues

Even the most diligent property owners can encounter issues with tax forms. Common errors in tax form submissions often arise from incorrect information such as parcel numbers, property boundaries, or ownership details. Property owners should double-check information against tax maps to ensure accuracy before submission.

If a mistake has been made after submission, it is important to understand the appeals process concerning tax assessments. Most jurisdictions allow taxpayers to appeal assessments within a specified time frame. Familiarizing oneself with this process not only provides a way to rectify mistakes but also empowers property owners to engage proactively with their local tax authority.

Staying informed on local tax regulations

Tax legislation frequently changes, impacting local tax requirements and the way tax maps are maintained. Property owners should stay informed about key changes in tax laws that could affect their assessments or obligations. Participating in local tax workshops or seminars can provide valuable insights and educational opportunities for property owners and teams alike.

Resources like local government websites, professional tax advisors, and community associations can offer ongoing education about local tax regulations and frequent updates to tax maps. By remaining informed, property owners can ensure compliance and better manage their tax obligations.

Engaging with tax professionals

Consulting with a tax advisor can be one of the most beneficial steps property owners take with regard to tax maps and forms. Understanding local tax laws and having experts review documents ensures that submissions are accurate and compliant. Tax professionals can also assist in navigating complex situations, such as disputes over property values or special assessments.

Participating in workshops or seminars focused on tax mapping and form management can also enrich understanding and provide networking opportunities with other property owners. Having a support system of experts can streamline the entire process, making tax season less daunting while promoting better compliance and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tax maps and tax electronically in Chrome?

How do I edit tax maps and tax on an iOS device?

How do I fill out tax maps and tax on an Android device?

What is tax maps and tax?

Who is required to file tax maps and tax?

How to fill out tax maps and tax?

What is the purpose of tax maps and tax?

What information must be reported on tax maps and tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.