CT CT-W4P 2025 free printable template

Show details

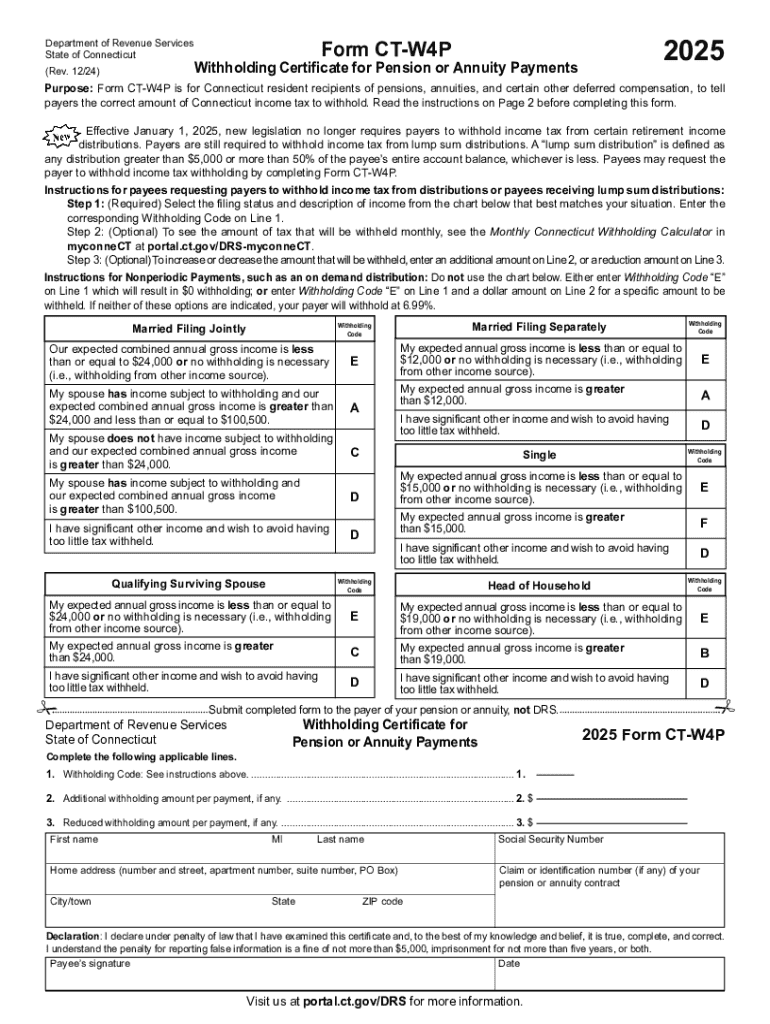

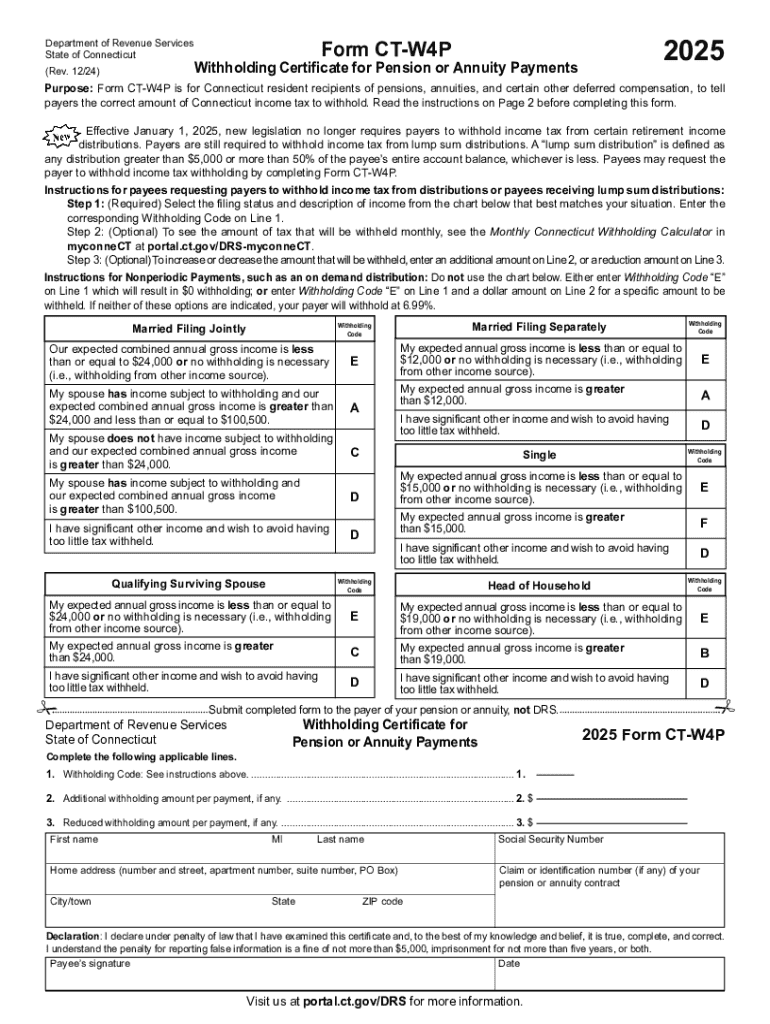

Form CT‑W4P is used by Connecticut residents receiving pensions, annuities, and certain deferred compensation to indicate the appropriate amount of Connecticut income tax to withhold.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ct w4p form

Edit your 2025 connecticut form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ctw4p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct w4p printable online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit connecticut ct w4p form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT CT-W4P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2025 w4p pdf form

How to fill out CT CT-W4P

01

Obtain a copy of the CT CT-W4P form from the Connecticut Department of Revenue Services website or local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box (single, married, etc.).

04

Enter your total expected income for the year in the designated section.

05

Complete the section for deductions and credits if applicable, to calculate your withholding.

06

Specify the amount of Connecticut income tax you want withheld from your payments.

07

Review the completed form for accuracy.

08

Sign and date the form at the bottom.

09

Submit the form to the payer of your income, such as your employer or other paying agency.

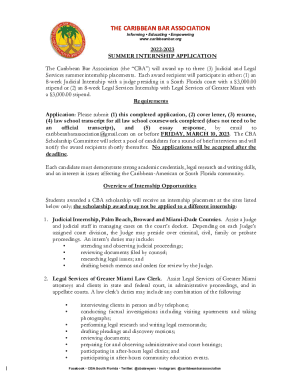

Who needs CT CT-W4P?

01

Employees working in Connecticut who wish to adjust their state tax withholding.

02

Self-employed individuals who receive income subject to Connecticut withholding.

03

Individuals receiving pension or annuity payments that require state tax withholding.

Fill

ct withholding certificate

: Try Risk Free

People Also Ask about form ct w4p

What is the payroll tax withholding in CT?

Connecticut's state income taxes come in the form of a progressive income tax. This progressive income tax ranges from 3% to 6.99%. Connecticut does not have local taxes, so employers will only be responsible for state taxes.

What is CT W4P form?

Form CT‑W4P provides your payer with the necessary information to withhold the correct amount of Connecticut income tax from your pension or annuity payment to ensure that you will not be underwithheld or overwithheld.

What is CT withholding tax?

For any employee who does not complete Form CT-W4, you are required to withhold at the highest marginal rate of 6.99% without allowance for exemption. You are required to keep Form CT-W4 in your files for each employee.

What is CT withholding on bonuses?

The percentage method is used if your bonus comes in a separate check from your regular paycheck. Your employer withholds a flat 22% (or 37% if over $1 million). This percentage method is also used for other supplemental income such as severance pay, commissions, overtime, etc.

What is a W4 state and local tax withholding form?

What is a State W-4 Form? A state W-4 Form is a tax document that serves as a guide for employers to withhold a specific amount on each paycheck to go towards state taxes. It works similarly to a federal form W-4 in that it tells your employer about your withholding needs.

What are the CT withholding codes?

Connecticut State Income Tax Withholding Information Filing StatusDescriptionBHead of HouseholdCMarried - Filing Jointly, Spouse Not WorkingDMarried - Filing Jointly, Both Spouses Working (combined income greater than $100,500)FSingle1 more row

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2025 ct w4p?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ct w4p 2025 and other forms. Find the template you need and change it using powerful tools.

How do I make changes in ct w4p form?

The editing procedure is simple with pdfFiller. Open your 2025 pension form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in 2025 ct withholding form without leaving Chrome?

w4p 2025 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is CT CT-W4P?

CT CT-W4P is a form used in Connecticut for employees to indicate their state income tax withholding preferences.

Who is required to file CT CT-W4P?

Employees working in Connecticut who wish to adjust their state income tax withholding are required to file CT CT-W4P.

How to fill out CT CT-W4P?

To fill out CT CT-W4P, employees need to provide their personal information, indicate their filing status, and specify the number of allowances they are claiming.

What is the purpose of CT CT-W4P?

The purpose of CT CT-W4P is to determine the correct amount of state tax withholding from an employee's paycheck.

What information must be reported on CT CT-W4P?

The information that must be reported on CT CT-W4P includes the employee's name, address, social security number, filing status, and number of allowances.

Fill out your CT CT-W4P online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Connecticut Withholding Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to connecticut w4p fillable

Related to 2025 ct w4p form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.