First B Notice free printable template

Show details

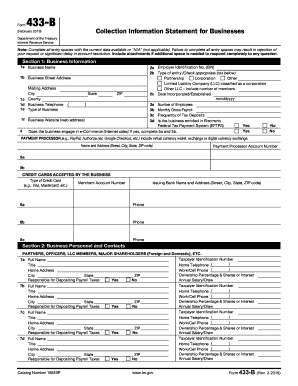

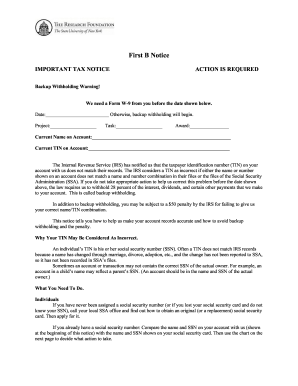

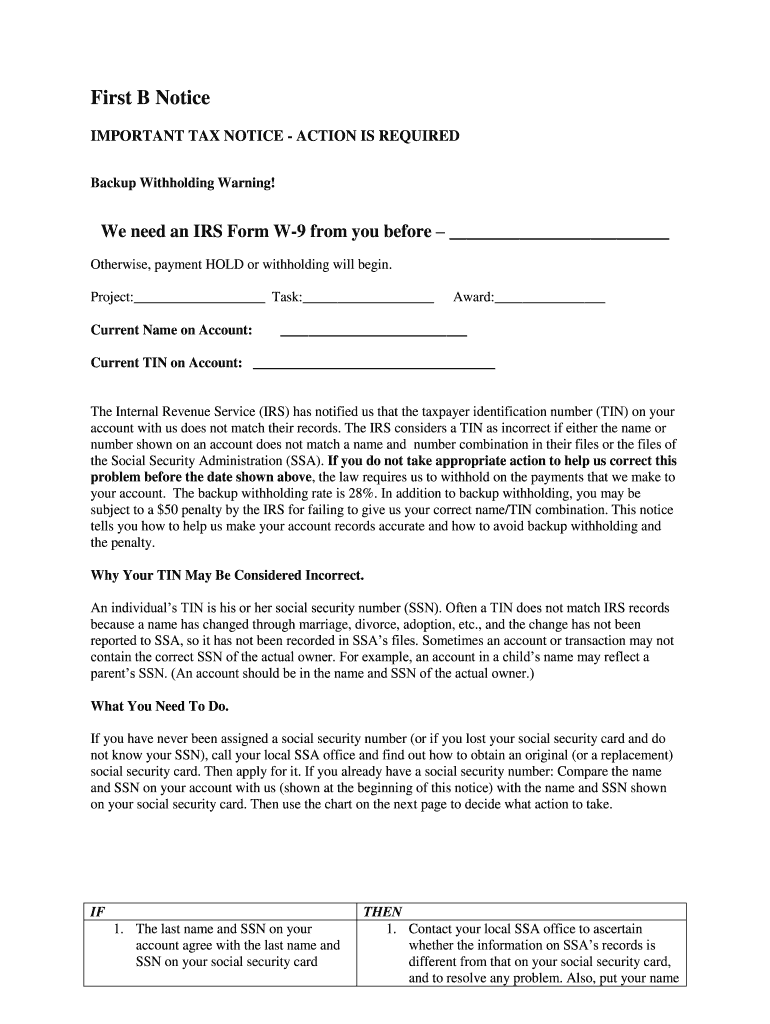

First B Notice IMPORTANT TAX NOTICE ACTION IS REQUIRED Backup Withholding Warning! We need an IRS Form W-9 from you before Otherwise, payment HOLD or withholding will begin. Project: Task: Current

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign irs b notice template form

Edit your b notice template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your b notice form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs b notice form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs b notice form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out b notice form pdf

How to fill out First B Notice

01

Gather the necessary information, including the address of the property and the names of all tenants.

02

Clearly state the nature of the violation or issue that requires the notice.

03

Include a specific date by which the violation must be corrected.

04

Make sure to comply with local laws regarding notice periods and formats.

05

Sign and date the notice before delivering it to the tenant.

06

Deliver the notice in a manner that complies with local regulations (e.g., personal delivery, certified mail).

Who needs First B Notice?

01

Landlords or property owners who have tenants that need to be formally notified of a violation.

02

Property management companies acting on behalf of landlords.

03

Any individual or entity looking to ensure proper communication of lease-related issues to tenants.

Fill

irs first b notice

: Try Risk Free

People Also Ask about b notice

What is the backup withholding B program?

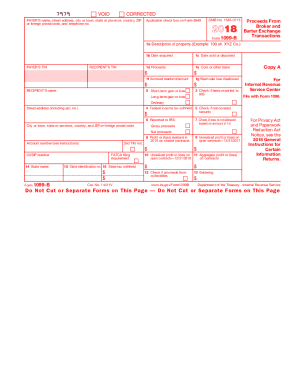

The "B" Backup Withholding Program, under the authority of Treasury Regulation § 31.3406(d)-5 and IRC § 3406(a)(1)(b), provides a CP2100 or CP2100A Notice to payers (a financial institution, business or person) who file certain information returns with incorrect Taxpayer Identification Numbers (TINs) to begin backup

What is the current backup withholding rate?

What is backup withholding? There are situations when the payer is required to withhold at the current rate of 24 percent.

What is the backup withholding rate for B notice?

It includes detailed instructions the payee must follow to satisfy the requirements. Apply a 24% backup withholding to all payments to this payee beginning 30 business days after you sent the second B Notice. Continue to backup withhold until the payee gives you an IRS validation or current social security card.

What is a C notice?

A "C" notice is a backup withholding notice from the IRS stating that the nonemployee has understated interest and dividend income and is subject to backup withholding. When you receive the first "C" notice, you should immediately start withholding taxes at the rate of 24% from that nonemployee's pay.

What is the first B notice from the IRS?

The notice informs you as the payer that you may be responsible to begin backup withholding if you haven't already done so.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit first b notice form template word online?

With pdfFiller, the editing process is straightforward. Open your b notice irs form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in first b notice without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing first b notice template and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the irs first b notice template in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your irs first b notice form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

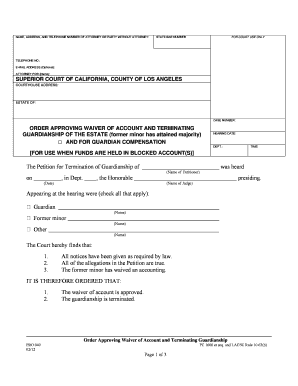

What is First B Notice?

First B Notice is a notification form used in certain jurisdictions to inform a borrower about the initiation of foreclosure proceedings.

Who is required to file First B Notice?

The lender or loan servicer who holds the mortgage and is initiating the foreclosure process is required to file the First B Notice.

How to fill out First B Notice?

To fill out the First B Notice, the lender must provide detailed information about the loan, the borrower, and the property, including the loan amount, default date, and any relevant account numbers.

What is the purpose of First B Notice?

The purpose of the First B Notice is to legally establish communication with the borrower regarding the impending foreclosure and to inform them of their rights and options.

What information must be reported on First B Notice?

The First B Notice must report key information such as the borrower's name and address, property details, account status, date of default, and an outline of the borrower's rights during the foreclosure process.

Fill out your First B Notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

B Notice From The Irs is not the form you're looking for?Search for another form here.

Keywords relevant to irs first b notice form template

Related to b notice irs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.