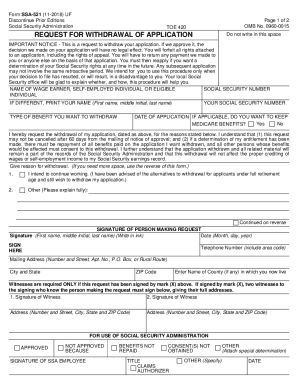

Who needs an SSA-521 form?

This form is completed by the individuals who want to withdraw applications sent to the Social Security Administration. If the request is approved, the applicant will lose all the social security benefits. The individual might want to make such a decision if she wants to return to work or if she wants to receive a larger monthly benefit.

What is the SSA-521 form for?

This form acts as a request for withdrawal of the application for benefits. The requester has the right to send this form only once in a lifetime. The information in the form is used by the SSA to withdraw all the applicant’s benefits and return all the payments made on the basis of that application. Keep in mind that if the request is approved by the SSA, the applicant must return all the benefit payments she received.

What documents must accompany the SSA-521 form?

There is no need to attach other documents to this request.

When is the form due?

The individual is to complete and send the form within 12 months of the original application’s date. The estimated time of filling out the form is 5 minutes. If the SSA approves the request and notifies you about it, you have 60 days to cancel the request.

What information should be provided in the form SSA-521?

The requester has to provide the following information:

- Name of the wage earner, self-employed individual

- SSN

- Type of the benefit for withdrawal

- Date of the application

- Reason for withdrawal (use additional sheets if needed)

- Address, phone number, name of the county

The form must be signed by the requester and by the witnesses (if required). The witnesses also have to type their name and address.

What do I do with the form after its completion?

The completed and signed request is forwarded to the local SSA office.