IA DoR W-4 2025 free printable template

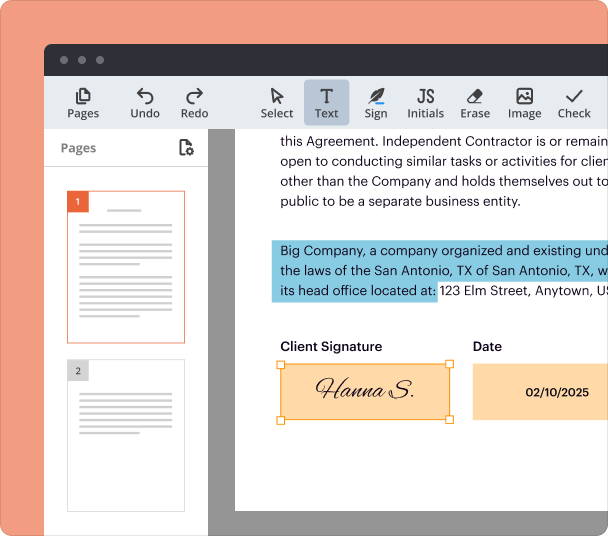

Fill out, sign, and share forms from a single PDF platform

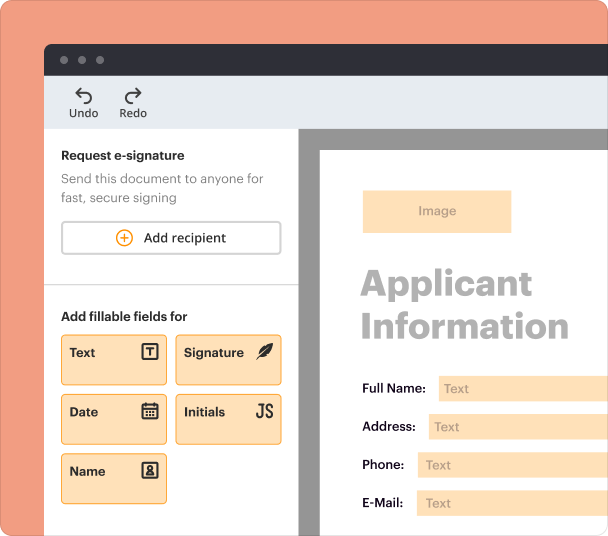

Edit and sign in one place

Create professional forms

Simplify data collection

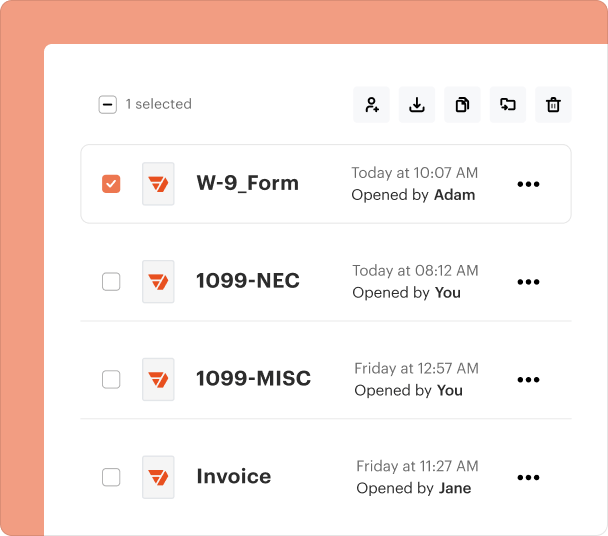

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

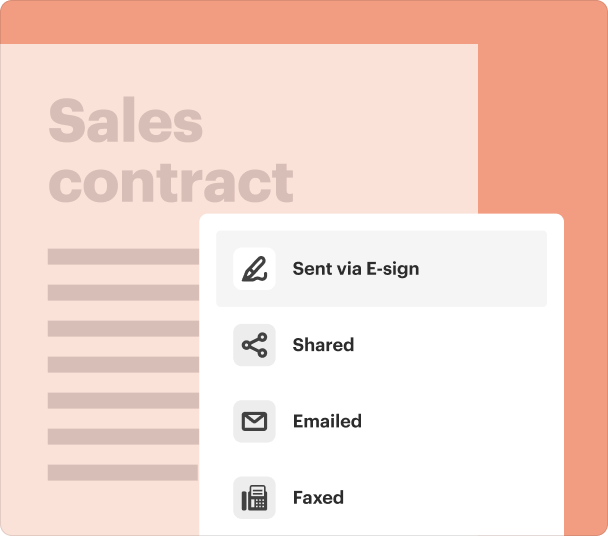

End-to-end document management

Accessible from anywhere

Secure and compliant

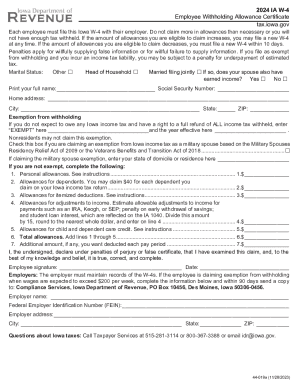

How to fill out the IA W-4 2025 Form: A Comprehensive Guide

TL;DR: How to fill out the IA W-4 2025 form

To fill out the IA W-4 2025 form, start by providing your basic personal information, including your name and Social Security number. Determine your filing status and claim allowances for dependents in accordance with Iowa law. Ensure to review each section for accuracy to avoid penalties.

Understanding the IA W-4 2025 form

The IA W-4 form is crucial for Iowa taxpayers as it determines state income tax withholding, which directly affects your paycheck. For the 2025 filing year, taxpayers can expect updates that may change how you assess your tax liabilities. Understanding this form is essential for financial planning and compliance with state tax regulations.

Who needs to file the IA W-4?

-

Anyone employed in Iowa must fill out the IA W-4 form, regardless of residency.

-

Nonresidents who earn income in Iowa are also required to file the IA W-4 to ensure proper withholding.

-

Certain exemptions apply to active military members and their spouses, which may reduce or eliminate withholding requirements.

Filling out the IA W-4: Step-by-step guide

-

Include your full name and Social Security number to identify your tax record.

-

Choose your status, whether single, married, or head of household, as this impacts your tax rate.

-

You can claim allowances based on your dependents to reduce the amount withheld.

-

Make any additional adjustments or claim exemptions as needed for accurate withholding.

-

Review your form for errors to avoid penalties for false claims or incorrect withholding.

Understanding allowances and exemptions

Claiming allowances on the IA W-4 can significantly impact your net pay. An allowance typically reduces the amount of tax withheld, while exemptions allow certain individuals, including military personnel, to be exempt from withholding altogether. It is vital to understand these aspects to optimize your withholding and avoid owing taxes at the end of the year.

Common mistakes to avoid when filing the IA W-4

-

Claiming too many allowances can lead to under-withholding and unexpected tax bills.

-

Failing to revise your form when personal circumstances change can result in inaccuracies.

-

Being unaware of specific exemptions can lead to unnecessary withholding.

Managing your withholding tax: Best practices

Regularly updating your IA W-4 form is essential whenever there are changes in income or family status. Use tools like pdfFiller to edit and manage your IA W-4 electronically, which simplifies the process and promotes accuracy. Understanding how and when to remit your withholding tax is also crucial for staying compliant with Iowa tax regulations.

Additional resources for Iowa tax filers

-

The Iowa Department of Revenue provides official guidelines and documents regarding the IA W-4.

-

Utilize pdfFiller for seamless document management, including form filling, signing, and collaboration.

-

Professional assistance can be valuable for individuals with unique tax situations.

Frequently Asked Questions about iowa tax form

What is the IA W-4 form?

The IA W-4 form is a withholding certificate for Iowa state income tax, which helps employers determine the amount of tax to withhold from employees' paychecks.

Do non-Iowa residents need to file the IA W-4?

Yes, nonresidents working in Iowa are required to file the IA W-4 to ensure the appropriate amount of state income tax is withheld from their earnings.

How often should I update my IA W-4 form?

It is advisable to update your IA W-4 form regularly, especially after major life events like marriage, having a child, or a significant change in income.

What happens if I make a mistake on my IA W-4?

If you make a mistake on your IA W-4 form, it can lead to incorrect withholding. You can submit a corrected form to your employer to rectify the issue.

Where can I find the IA W-4 form?

The IA W-4 form can be obtained from the Iowa Department of Revenue's website or directly through resources like pdfFiller for easy access and completion.

pdfFiller scores top ratings on review platforms