CA FTB 3522 2025 free printable template

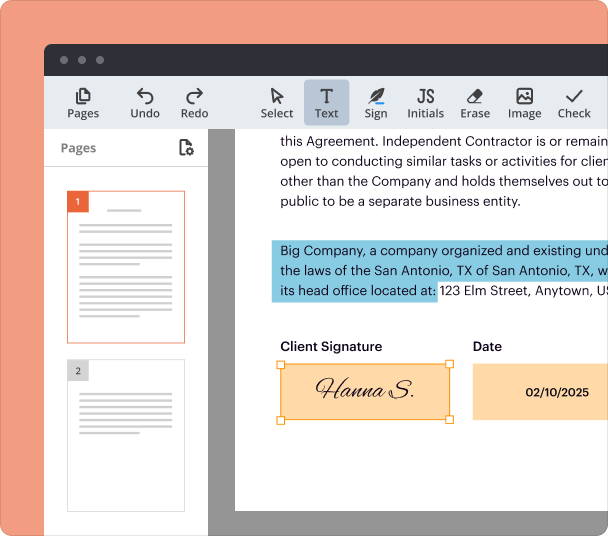

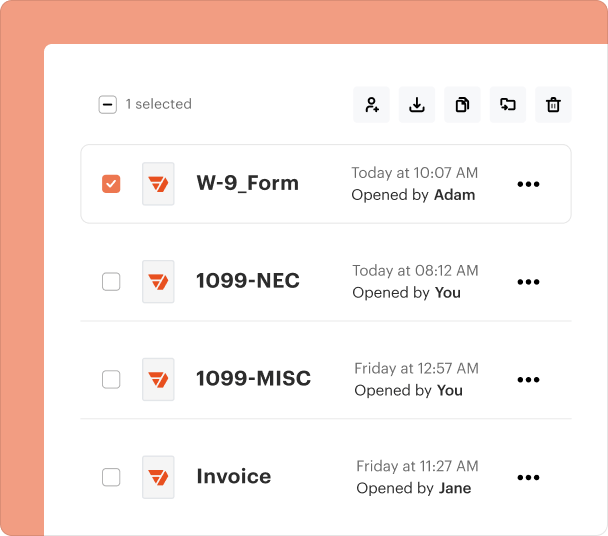

Fill out, sign, and share forms from a single PDF platform

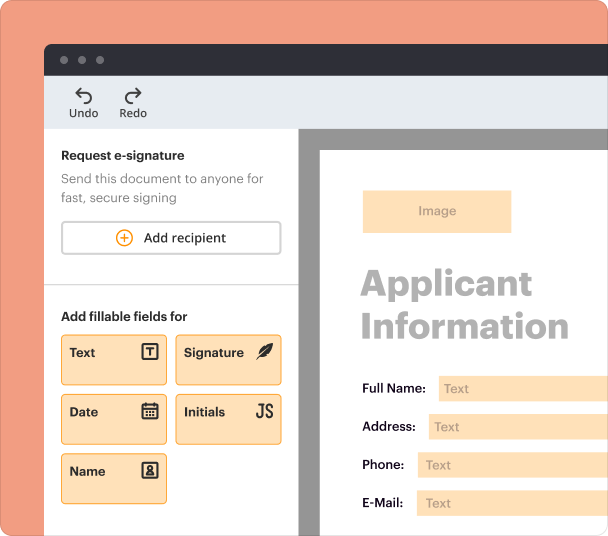

Edit and sign in one place

Create professional forms

Simplify data collection

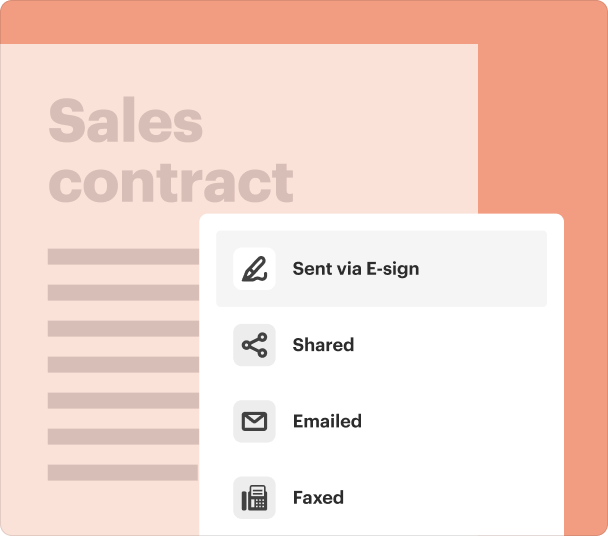

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

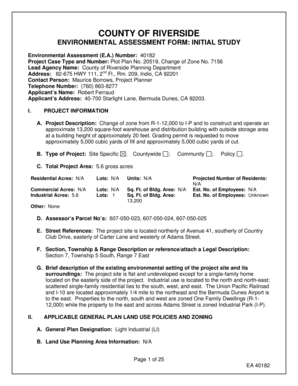

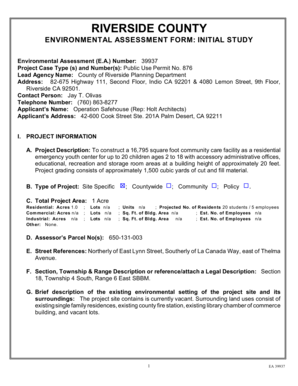

Comprehensive Overview of the CA FTB 3 Form

Overview of the CA FTB 3 Form

The California Form 3522, also known as the LLC Tax Voucher, is utilized by limited liability companies (LLCs) to make their annual tax payments to the California Franchise Tax Board (FTB). This form is essential for compliance with state tax obligations, allowing LLCs to report and pay the required tax based on their income and activities in the state.

Who Should Use the CA FTB 3 Form

Any LLC that operates in California or holds articles of organization accepted by the California Secretary of State must file the CA FTB 3 form. This includes those that may have registered in previous years but are still conducting business or are subject to the annual tax requirements as dictated by California law.

Key Features of the CA FTB 3 Form

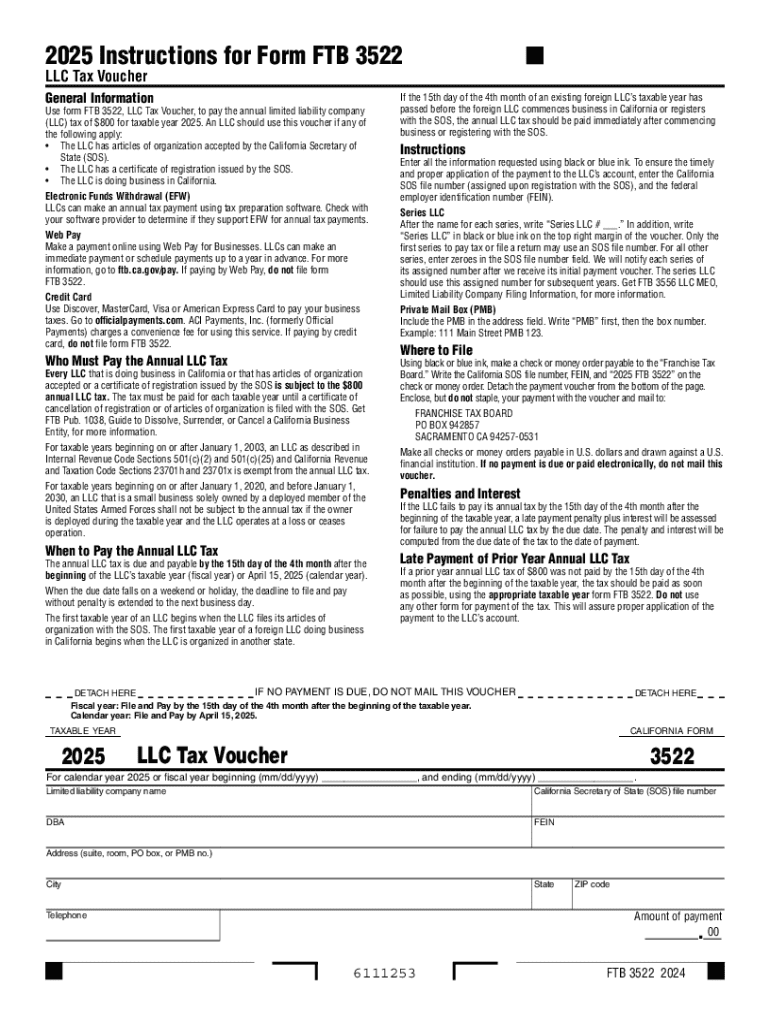

The CA FTB 3522 form includes vital information such as the LLC's unique identification number, total income, and amount of tax owed. This form serves both as a means of payment and a record of compliance with state tax laws. Accurate completion is critical to avoid penalties and ensure timely processing by the FTB.

How to Fill Out the CA FTB 3 Form

Filling out the CA FTB 3522 form requires specific information about the LLC, including its California Secretary of State file number, total income, and tax amount due. Users should meticulously enter all figures and verify the accuracy of their information to ensure compliance. Keeping a copy of the completed form is advisable for record-keeping purposes.

Submission Methods for the CA FTB 3 Form

The CA FTB 3522 form can be submitted through various methods, including electronic submission via the FTB's online system, mail, or in person at designated locations. Each submission method has specific guidelines and deadlines that must be adhered to in order to ensure timely processing of the tax payment.

Common Errors When Completing the CA FTB 3 Form

Common mistakes include incorrect calculations of the total income or tax amount, missing information, or submitting the form after the deadline. Attention to detail is crucial, and reviewing the completed form for accuracy before submission can help prevent these issues. It’s recommended to consult with a tax professional if there are uncertainties about how to fill out the form correctly.

Frequently Asked Questions about llc tax form

What is the purpose of the CA FTB 3 form?

The CA FTB 3522 form is used by LLCs to report and pay their annual tax obligations to the California Franchise Tax Board.

When must the CA FTB 3 form be submitted?

The form must be submitted annually, typically by the due date established by the California Franchise Tax Board for LLCs.

Can the CA FTB 3 form be submitted online?

Yes, the CA FTB 3522 form can be submitted electronically through the California Franchise Tax Board's online portal.

pdfFiller scores top ratings on review platforms