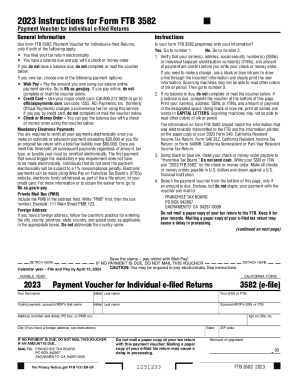

CA FTB 3582 2024-2025 free printable template

Get, Create, Make and Sign 3582 payment voucher form

How to Edit the CA 3582 Form

Uncompromising security for your PDF editing and eSignature needs

CA FTB 3582 Form Versions

How to fill out ftb payment form

How to fill out ca 3582

Who needs ca 3582?

Video instructions and help with filling out and completing ftb 3582

Instructions and Help about form 3582 california

Hello this is Robert I'm a tax attorney here at TRP and were going to be going over how to stop wage garnishments from the California Franchise Tax Board so what is a wage garnishment is pretty much in order to issued by the California Franchise Tax Board to your employer if they see they have a delinquent debt you haven't done nothing about it, and they're just going to take the money and a ftp wage garnishment the FT will give them the right to take a percentage of your income the FT considers balances from taxes penalties fees interest and non tax that's owed to government agencies and courts as basis for the garnishment now were not covering how to release it if it's a child support order or something like that you should call a family law attorney that's going to be a separate process what were covering here is how to get it off when you have tax debt so the f2b sends a request you're employed withhold funds from your paycheck to pay the back taxes that so how much can they take FT can garnish up to 25 percent of your disposable income that's pretty much after your federal income tax Social Security state income tax state disability what you got left they can also calculate the garnishment by the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage so here's an example you get 12 a hours you work 40 hours a week weekly wages 480 after deductions your weekly income is 462 four hundred sixty dollars so and were just guesstimating that and then going with 25 of that for 6100 fifteen fifty that's what they're going to take so 25 of what's left over they're not going to take any more than that they might hate your bank account — and that's a separate issue, but there are cases when the FTV modifies the garnishment amount there's sometimes where the payment can't really always I mean a payment plan won't always release the garnishment if you had payment plans, and they've defaulted before sometimes the best thing you're going to get is modifying the garnishment or doing a hardship or something like that to get the garnishment off which well discuss in a little here so how doesn't have to be garnishment take place they send an order with order to withhold first they must send notice to the employer or business entity and the notice to garnish wages should contain the following information nature of the garnishment the amount and the summary of how it was derived a statement indicating your right to an exemption in certain circumstances and instructions on how to so that when you get the notice there's an opportunity for a hearing — you should get notice about it, you can request a hearing and try to do something however if they're right about the debts it's easier to just try to resolve it right away and that that's generally what well do it's just easier than trying to go through the hearing process, and it's going to be faster a lot of times in any case order withhold was sent to a financial institution...

People Also Ask about california payment individual e

Is there a payment voucher for 540?

What is CA 3893?

Do you have to pay the $800 California Corp fee the first year?

What is a payment voucher for taxes?

Is first year LLC fee waived for California?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the ca 3582 form used for?

Can I fill out the ca 3582 online?

Is there a way to download the ca 3582 PDF?

Are there printable versions of the ca 3582 form?

How can I customize the ca 3582 form?

How secure is my information on the ca 3582 form?

Can multiple users collaborate on the ca 3582 form?

What should I do if I encounter issues while filling out the ca 3582 form?

Is there an option to electronically sign the ca 3582 form?

Can I save my progress when filling out the ca 3582 PDF?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.