CT DRS CT-1040ES 2025 free printable template

Fill out, sign, and share forms from a single PDF platform

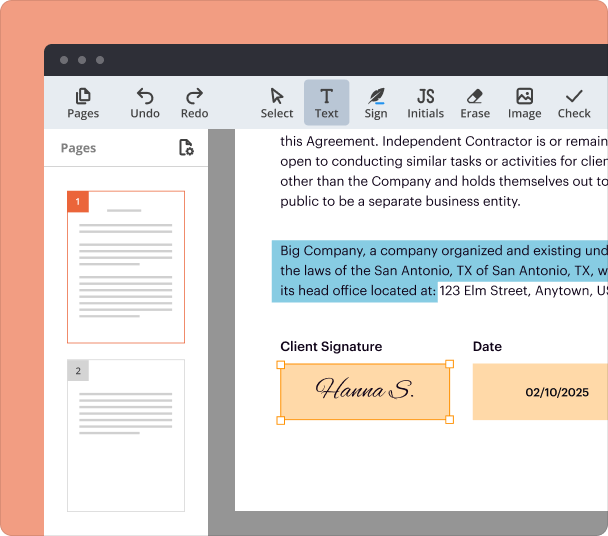

Edit and sign in one place

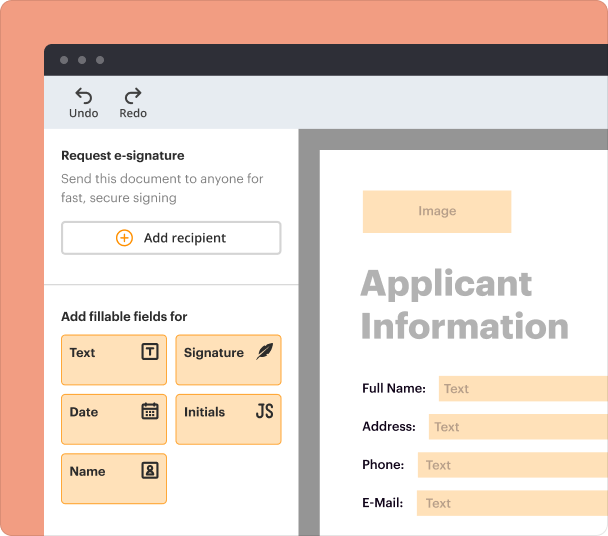

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out the CT DRS CT-1040ES 2025 Form

Understanding the CT DRS CT-1040ES 2025 Form

The CT DRS CT-1040ES form is essential for taxpayers in Connecticut who need to make estimated income tax payments. It helps taxpayers calculate and pay their anticipated tax liabilities to avoid penalties. Understanding this form and its utility is vital to fulfilling tax obligations accurately and on time.

-

This form is used to report and pay estimated income taxes for the state of Connecticut. It is typically required if you expect to owe tax of $1,000 or more when you file your return.

-

Making timely estimated tax payments can prevent expensive penalties and interest that accumulate for late payments. It also helps keep your tax situation manageable throughout the year.

-

Completing the CT-1040ES correctly ensures compliance with Connecticut tax laws and simplifies the year-end tax filing process.

Who Should File the CT-1040ES Form?

Determining whether you need to file the CT-1040ES form primarily depends on your expected income situation. Certain groups of taxpayers are required to file, while others might be exempt based on specific criteria.

-

If your expected tax liability exceeds $1,000 and you're not opting for withholding, you're generally required to file.

-

Individuals who had a tax liability in the previous year or expect to owe less than $1,000 in the current year may not need to file.

-

Failure to file could result in significant penalties and interest on overdue taxes, which can disrupt your financial planning.

Key Components of the CT-1040ES Form

Completing the CT-1040ES form accurately requires an understanding of its key components. This includes identifying required fields and knowing what supporting documents to include.

-

Each form section should be completed with accurate personal and financial information. Missing any field could result in delays.

-

You may need documentation for income sources, deductions, and credits. Prepare these ahead of time to ensure smooth processing.

-

Taxpayers who receive preprinted coupon packages have a more straightforward filing process. Be sure to verify the information accuracy.

Filling Out the CT-1040ES Form: Step-by-Step Guide

Knowing how to fill out the CT-1040ES form is crucial for successful tax compliance. This step-by-step guide will aid taxpayers who are uncertain about the filling process.

-

Follow the guidelines carefully for filling out each part of the CT-1040ES to minimize errors.

-

Double-check calculations and ensure all required fields are filled to avoid common pitfalls.

-

pdfFiller provides user-friendly features for filling and submitting forms, allowing you to edit and eSign your documents seamlessly.

How to Submit Your Completed CT-1040ES Form

Once you have completed the CT-1040ES, it’s essential to know how to submit it correctly to avoid delays or penalties. Multiple options are available, making it easier for taxpayers.

-

You can submit your form via mail or electronically, providing flexibility according to your convenience.

-

For quicker processing, consider using myconneCT, Connecticut's online portal, to file your estimated taxes.

-

Note that estimated taxes are typically due quarterly; therefore, adhering to deadlines is crucial for compliance.

Understanding Tax Payment Requirements for 2025

Knowing who needs to make estimated payments is essential for compliance with Connecticut tax regulations in 2025. There are specific rules regarding different taxpayer statuses.

-

Understand the thresholds that require estimated payments; they're largely determined by your expected tax liability.

-

Nonresidents may have a different set of rules for filing and should review Connecticut's regulations carefully.

-

Employers can play a significant role in your tax situation, especially if you have multiple simply state requirements.

Utilizing pdfFiller for Your Tax Documentation Needs

pdfFiller offers a comprehensive solution for managing your tax documentation. With its cloud-based platform, users can access and edit tax forms from anywhere.

-

Streamlining tax documentation through editing and eSigning helps you submit forms more efficiently.

-

Share and collaborate with team members effortlessly on your tax forms, ensuring all data is accurate.

-

pdfFiller’s centralized platform means all your documents are easily accessible and manageable.

Frequently Asked Questions about ct 1040es form

What happens if I miss a deadline for the CT-1040ES form?

Missing a deadline for submitting the CT-1040ES form can result in penalties and interest on unpaid taxes. It's essential to file as soon as possible to minimize any additional costs.

Can I amend my CT-1040ES form after submission?

Yes, you can amend your CT-1040ES form if there are errors or changes in your financial situation. It is recommended to follow the state's amendment guidelines carefully.

Is the CT-1040ES form different for nonresidents?

Yes, nonresidents have specific filing requirements and rules that differ from those for residents. It's important to review the guidelines pertinent to your residency status.

How do I know if I need to make estimated payments?

You are required to make estimated payments if you expect to owe at least $1,000 in tax after subtracting withholding and credits. A review of your last year's tax return can help you determine your needs.

Where can I find additional resources for filling out the CT-1040ES form?

Additional resources can be found on the Connecticut Department of Revenue Services website, which provides guides and contact information for assistance with the CT-1040ES form.

pdfFiller scores top ratings on review platforms