Get the free Individual Income Tax Instructions Packet 2024 - tax idaho

Get, Create, Make and Sign individual income tax instructions

How to edit individual income tax instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out individual income tax instructions

How to fill out individual income tax instructions

Who needs individual income tax instructions?

Your Complete Guide to the Individual Income Tax Instructions Form

Understanding the individual income tax instructions form

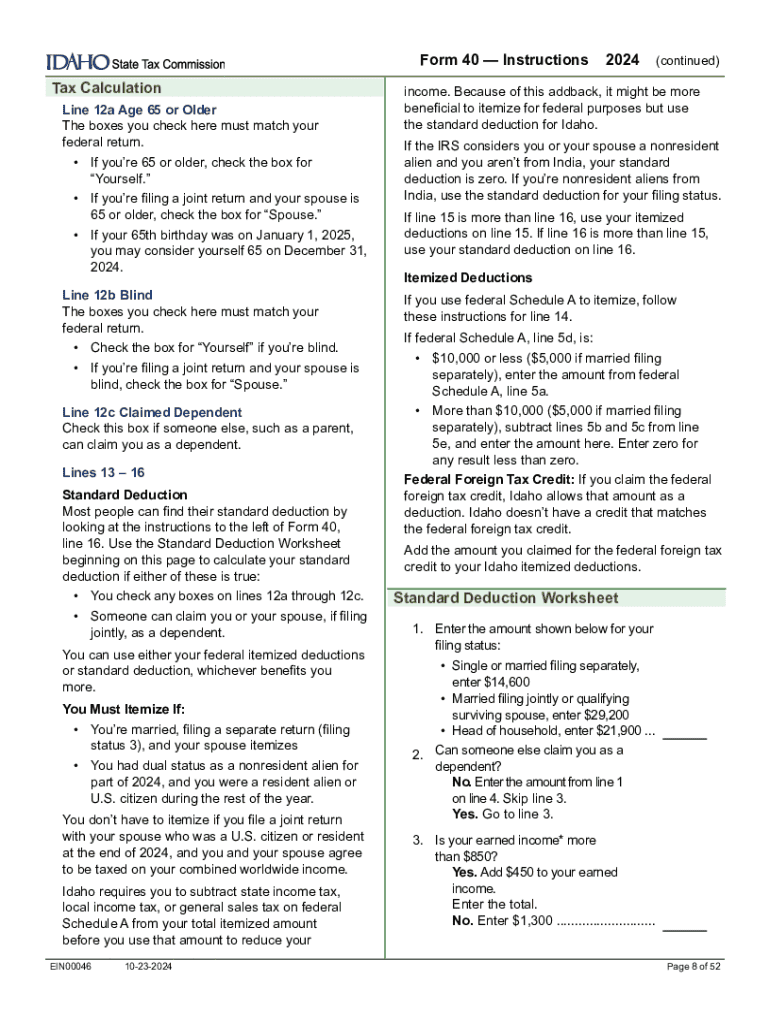

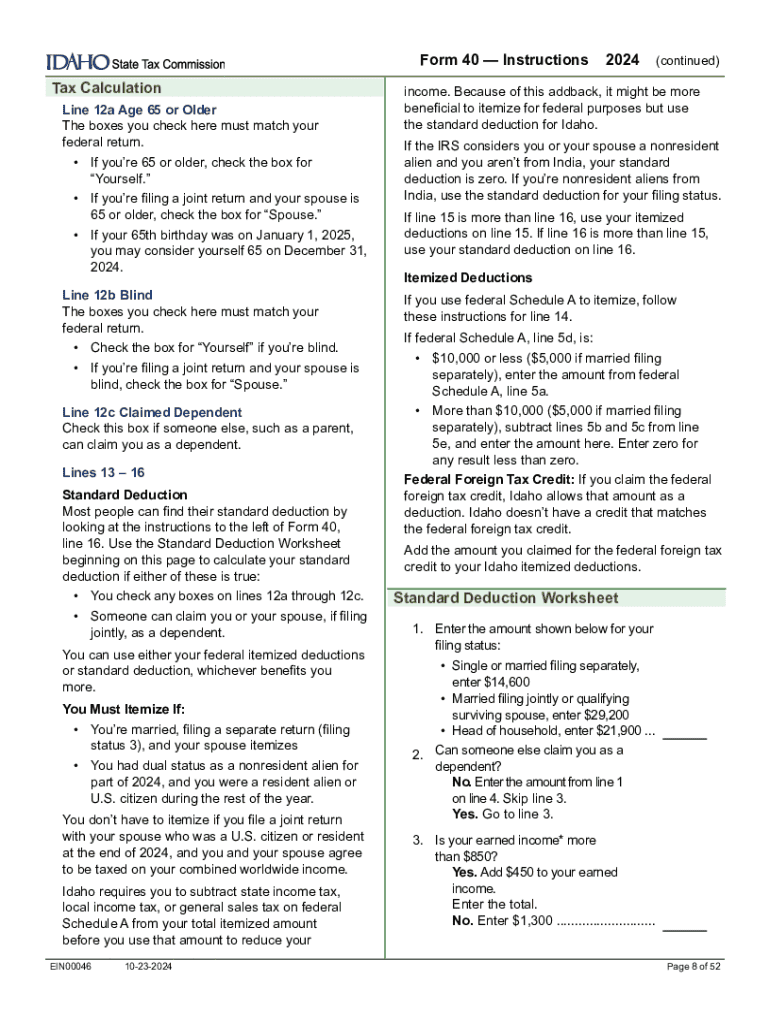

The individual income tax instructions form is essential for anyone looking to accurately file their annual tax returns. It serves as a guide that provides taxpayers with detailed instructions on how to complete various tax forms, ensuring they report their income and deductions correctly.

Accurate completion of this form is crucial, as it helps avoid potential errors that could lead to audits or penalties from the state tax authorities. Proper understanding can save time and stress at tax season, especially for those new to filing taxes. Typically, you will need to reference multiple forms like the IRS Form 1040 and potentially state-specific forms depending on where you live, such as Georgia's state income tax forms.

Who needs the individual income tax instructions form?

Almost every individual who earns income is required to file an income tax return, which makes understanding the individual income tax instructions form critical. Eligibility criteria often include anyone earning above a certain income threshold, which can vary based on filing status, age, and other factors.

You will need this form if you have income from various sources, such as wages, self-employment, rental income, or dividends. Particular situations like being a first-time filer or claiming certain deductions and credits can also necessitate careful review of the instructions form. Many first-time filers mistakenly overlook important fields, especially concerning residency status and income types, which can complicate their tax returns.

Accessing the individual income tax instructions form

Finding the individual income tax instructions form is straightforward. The IRS provides these forms through their official website, and additional resources are often available via government websites specific to your state, like the state of Georgia's tax site.

To get started: visit the pdfFiller landing page where you can utilize the search functionality. Simply enter 'individual income tax instructions form' in the search bar to locate the latest versions. Once located, you can easily download the form in PDF format and print it, making it accessible for filling out by hand or digitally.

Step-by-step instructions for completing the form

Completing the individual income tax instructions form involves careful attention to detail. Here's a breakdown of the essential sections:

Section 1: Personal information

In this section, you need to provide your name, Social Security number, and address. Accuracy is paramount—double-check that your name matches your Social Security card. Also, ensure your address is correct to avoid miscommunication from the tax authorities.

Section 2: Income reporting

Here you will report various types of income that apply to you. Common income sources include W-2 wages, self-employment income, and interest from savings accounts. For self-employment income, you'll need to maintain detailed records of your earnings and expenses to accurately reflect your financial situation.

Section 3: Deductions and credits

This part allows you to claim eligible deductions, such as student loans, mortgage interest, and medical expenses. It's essential to review available tax credits too, as they can significantly reduce your tax liability. Familiarize yourself with common credits like the Earned Income Tax Credit (EITC) or child tax credits.

Section 4: Sign and submit

Before submitting your form, you'll need to sign it, confirming the accuracy of the information provided. If you're filing electronically, follow the provided instructions for eSigning. Various submission methods exist, such as e-filing directly through government platforms or mailing a paper form to your local IRS office.

Interactive tools to assist with form completion

pdfFiller enhances your experience with interactive tools designed to optimize efficiency. With pdfFiller’s easy-to-use online editors, you can fill out, edit, and eSign documents seamlessly. These tools allow you to collaborate with team members, which is particularly beneficial for those working together to prepare taxes.

Excel in form submission by using eSignature tools that ensure your signature is secure and legally recognized. Additionally, pdfFiller enables collaborative features, allowing users to share the form with tax advisors or fellow team members easily. This streamlined communication helps maintain clarity and reduces the chances of errors.

Troubleshooting common issues

Many users face common issues while filling out the individual income tax instructions form. For example, a frequent question involves understanding specific terms used in the instructions. To avoid confusion, be sure to refer back to related documentation available on government websites.

In addition to terms, ensuring figures match corresponding forms can be a hurdle. It's essential to cross-verify numbers from your W-2 or other income statements. Checklists can simplify this process by breaking down essential items to validate before submission.

Additional support and resources

For direct access to the individual income tax instructions form, visit the IRS website or your state taxation website for the current year’s forms. These platforms also provide guidelines and updates on any changes in tax regulations pertinent to your filing.

Using pdfFiller’s cloud-based platform can enhance your experience with document management. The cloud functionality allows you to access your saved forms anytime, which is crucial for retrieving documents during tax season. If you have questions or need personalized assistance, pdfFiller offers contact support options for users.

Popular searches related to individual income tax

When researching the individual income tax instructions form, many users often explore related topics like other important tax forms to consider, such as the 1099 forms for freelancers or the W-4 for tax withholding. Tax planning resources are also sought after, helping individuals and businesses strategize for future filings.

Additionally, state-specific tax information remains a valuable resource. Resources that provide localized guidance, particularly for states like Georgia, ensure taxpayers remain compliant with both federal and state regulations.

Staying updated on tax regulations

Tax laws frequently change, hence the continued importance of staying informed about these updates. Changes may include adjustments to tax brackets, deductions, and credits applicable to taxpayers each year. It is advisable to check on changes even before the tax filing season begins.

pdfFiller enhances user experience by providing alerts and updates about significant regulatory changes, ensuring you won't miss vital information that could impact your tax filings.

Collaborating with tax professionals

Consider consulting a tax professional if you find yourself overwhelmed by the filing process, especially if you have complex income sources or peculiar deductions. Tax advisors can provide expert guidance and help you navigate the nuances of tax regulations.

For teams, easily sharing forms with tax advisors via pdfFiller fosters collaboration and simplification of the tax preparation process. This feature ensures all necessary documents are readily available and seamlessly integrated into the advising process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send individual income tax instructions for eSignature?

Where do I find individual income tax instructions?

How can I fill out individual income tax instructions on an iOS device?

What is individual income tax instructions?

Who is required to file individual income tax instructions?

How to fill out individual income tax instructions?

What is the purpose of individual income tax instructions?

What information must be reported on individual income tax instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.