Get the free Chapter 3 Personal Financial Planning

Show details

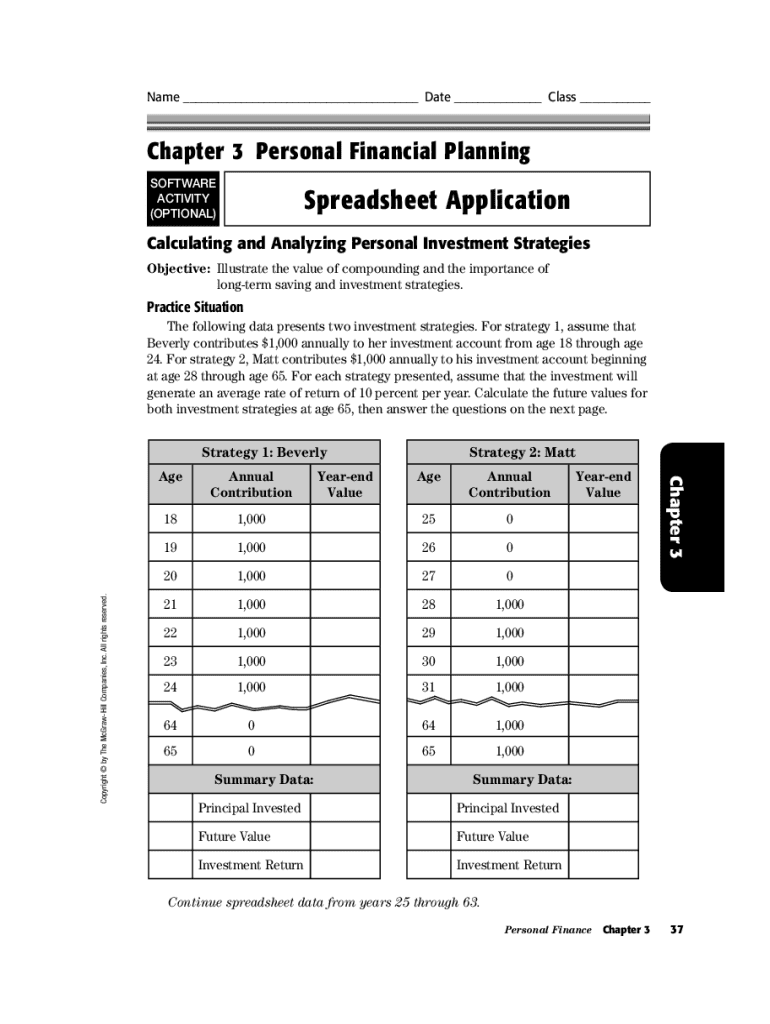

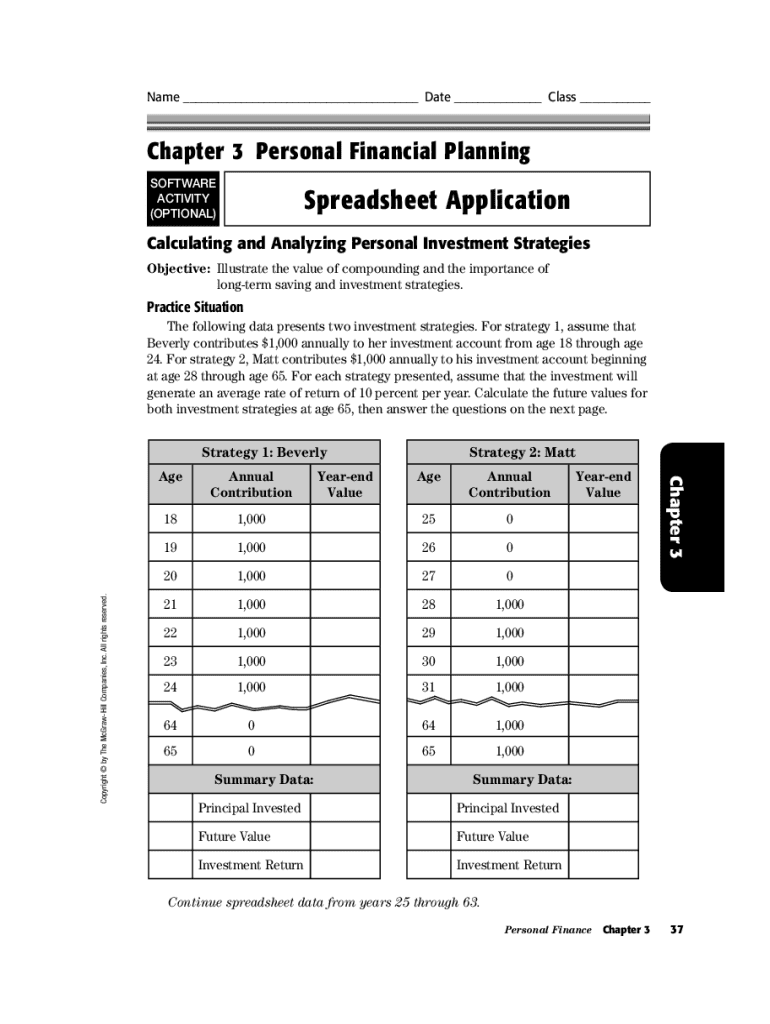

Name ___ Date ___ Class ___Chapter 3 Personal Financial Planning SOFTWARE ACTIVITY (OPTIONAL)Spreadsheet ApplicationCalculating and Analyzing Personal Investment Strategies Objective: Illustrate the value of compounding and the importance of longterm saving and investment strategies.Practice Situation The following data presents two investment strategies. For strategy 1, assume that Beverly contributes $1,000 annually to her investment account from age 18 through age 24. For strategy 2,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 3 personal financial

Edit your chapter 3 personal financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 3 personal financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 3 personal financial online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chapter 3 personal financial. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 3 personal financial

How to fill out chapter 3 personal financial

01

Gather your financial documents, including bank statements, pay stubs, and tax returns.

02

List your sources of income, such as salary, investments, or rental income.

03

Identify your fixed expenses, including rent or mortgage, utilities, insurance, and debt payments.

04

Estimate your variable expenses, such as groceries, entertainment, and transportation.

05

Create a budget by subtracting your total expenses from your total income.

06

Monitor your spending habits and adjust your budget as necessary.

07

Consider setting savings goals and emergency funds within your budget.

Who needs chapter 3 personal financial?

01

Individuals managing their personal finances.

02

Students learning about budgeting and financial planning.

03

Families looking to improve their financial literacy.

04

Anyone seeking to track their income and expenses effectively.

05

Professionals preparing to apply for loans or mortgages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in chapter 3 personal financial?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your chapter 3 personal financial to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit chapter 3 personal financial on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing chapter 3 personal financial.

How do I edit chapter 3 personal financial on an Android device?

With the pdfFiller Android app, you can edit, sign, and share chapter 3 personal financial on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is chapter 3 personal financial?

Chapter 3 personal financial refers to a specific section in the U.S. tax code that outlines the reporting requirements for certain individuals regarding their personal financial status, typically associated with income tax reporting.

Who is required to file chapter 3 personal financial?

Individuals who have specific types of income or meet certain criteria set by the IRS, including non-resident aliens and U.S. citizens with foreign accounts, are required to file chapter 3 personal financial.

How to fill out chapter 3 personal financial?

To fill out chapter 3 personal financial, you must gather your financial information, complete the appropriate forms as specified by the IRS, providing details on your income, deductions, and any foreign assets as required.

What is the purpose of chapter 3 personal financial?

The purpose of chapter 3 personal financial is to ensure proper reporting of taxable income and compliance with U.S. tax laws, helping to identify tax obligations for individuals with international financial interests.

What information must be reported on chapter 3 personal financial?

The information that must be reported includes detailed income information, foreign bank account details, any applicable exemptions, and other financial assets as required by the IRS guidelines.

Fill out your chapter 3 personal financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 3 Personal Financial is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.