Get the free pdffiller

Show details

A guaranty is a legally binding commitment by a party, referred to as the guarantor, to pay or perform the obligations of another entity, typically an affiliate of the guarantor, if that other entity

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is guaranty

A guaranty is a formal promise made by one party to assume the financial responsibility of another party's debt or obligation if that party fails to meet their commitment.

pdfFiller scores top ratings on review platforms

Very helpful for a contract paralegal working from home!

Very easy to use verses other "filler" type programs I have worked with in the past. Very affordable!

filling our immigration docs that were not savable and this app totally helped me to save them and get back to the docs when I have more info. Awesome. One recommendation: I would like to be able to save to a specific file in my computer rather than have to move from the download file :-)

It came in handy when I needed something right away.

Exactly what I was looking for in editing a PDF file!

Amazing I do all of my important documents on here and it is so user friendly

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

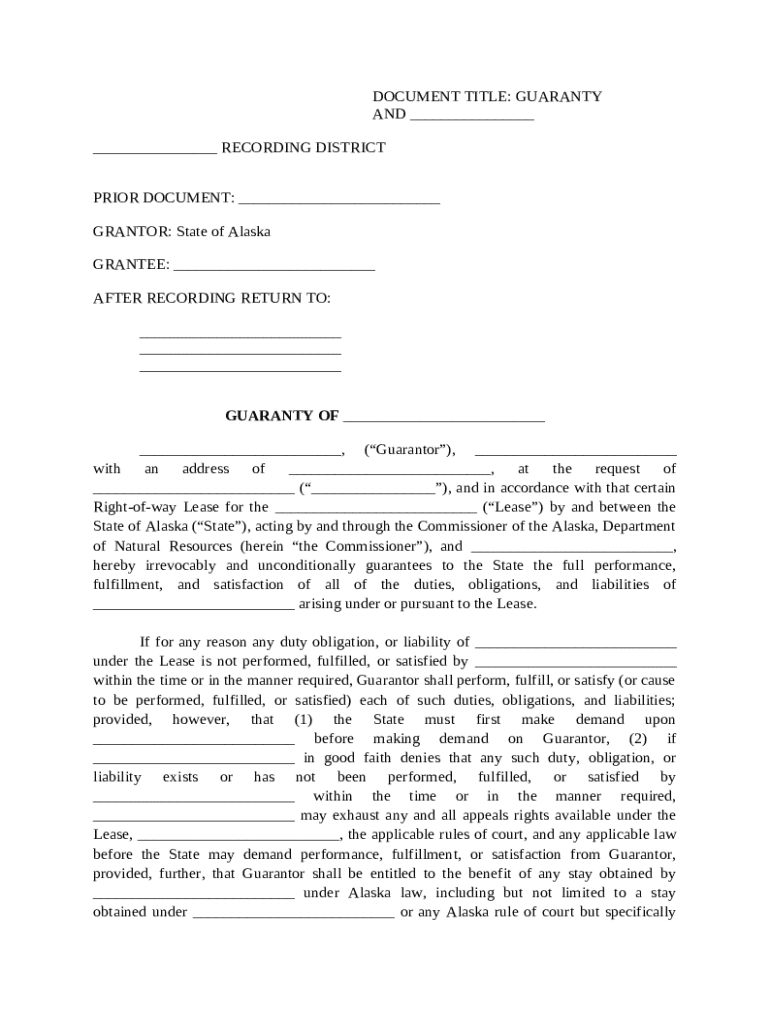

Comprehensive Guide to the Guaranty Form on pdfFiller

The guaranty form is a crucial document often utilized in legal and financial agreements. This guide aims to provide a complete understanding of the guaranty form, its components, and how to effectively manage the form through pdfFiller.

What is a guaranty form and why is it important?

A guaranty form outlines the commitments made by a guarantor to uphold the obligations of another party. This document typically serves to protect the interests of a grantee (the party receiving the guarantee) against potential defaults by the principal borrower. By clarifying these roles and obligations, the guaranty form contributes significantly to legal transparency and contract enforcement.

Key terms explained: Grantor, Grantee, Lease obligations

-

The grantor is the individual or entity that provides the guarantee, agreeing to assume responsibility for an obligation if the primary party fails to fulfill it.

-

The grantee is the party benefiting from the guarantee, typically the lender or lessor, who seeks assurance against default.

-

These are the responsibilities outlined in a lease, which the grantor assures will be fulfilled, minimizing risk for the grantee.

What are the main sections of the guaranty form?

-

The title should clearly indicate the nature of the document, helping all parties quickly understand its purpose.

-

Details regarding the grantor and grantee must be accurately included to establish clear identification.

-

This clause outlines the specific obligations being guaranteed, providing context for the grantor's responsibilities.

-

This section describes the expectations for fulfilling the obligations, essentially listing what must be done under the agreement.

-

The procedure that the grantee must follow before reaching out to the grantor, ensuring that the process is compliant with legal standards.

-

This part informs the grantor of their rights and potential defenses in cases of claims against them.

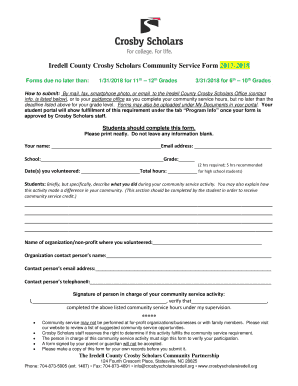

How do you fill out the guaranty form on pdfFiller?

Filling out the guaranty form using pdfFiller is straightforward with the platform's user-friendly interface. Begin by following a step-by-step guide that walks you through essential fields including grantor and grantee details, and the guarantee clause.

-

Enter the document title and parties involved.

-

Complete the guarantee clause with accurate obligations.

-

Review for any common mistakes, ensuring all fields are filled correctly.

-

Utilize interactive tools on pdfFiller to edit or adjust the document as necessary.

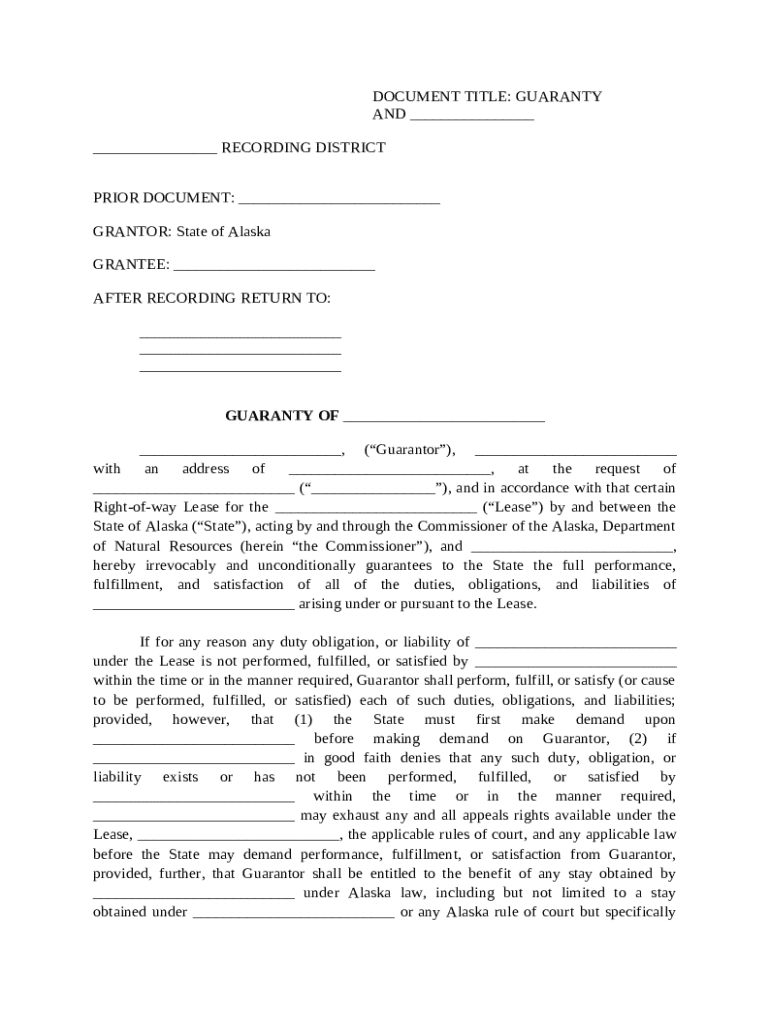

What are the steps for editing and signing the guaranty form?

Editing the guaranty form is simple with pdfFiller's streamlined editing features. Users can easily make adjustments to the document as needed before signing.

-

Use the editing tools to modify any part of the form, accommodating any changes in obligations or parties.

-

Explore various methods for legally signing the document, ensuring compliance with local eSignature regulations.

-

Share the form with team members for feedback before finalizing and securing the signed document.

-

Utilize pdfFiller’s features to secure your signed document, preventing unauthorized edits or access.

How can you manage your guaranty form after submission?

Once your guaranty form is submitted, effective document management is crucial. pdfFiller allows users to store, retrieve, and monitor compliance effortlessly.

-

Store the completed guaranty form in your pdfFiller account for easy access.

-

Implement best practices such as regular document reviews and retrieval strategies to maintain compliance.

-

Understanding local requirements, especially in Alaska, is vital for legal documentation and record-keeping.

-

Set reminders for any lease obligations and renewal dates to ensure you remain compliant.

What are the final tips for using the guaranty form?

Effective use of the guaranty form facilitates smoother financial agreements. It is essential to regularly review your obligations and utilize tools available on pdfFiller for best results.

-

Always verify that all information is accurate and up to date before submission.

-

Evaluate any changes in legal obligations and adjust the guaranty form as needed.

-

For ongoing or future agreements, consider how similar documents can facilitate your business processes.

How to fill out the pdffiller template

-

1.Open the guaranty form on pdfFiller.

-

2.Begin by entering the date at the top of the form.

-

3.Fill in the name and contact information of the guarantor in the designated fields.

-

4.Next, input the name and details of the primary debtor to clarify who the guaranty relates to.

-

5.Specify the exact debt or obligation that the guaranty covers, including any relevant amounts.

-

6.Review and ensure that all information is accurate, checking for any typographical errors.

-

7.Sign the form in the signature section with the guarantor's signature.

-

8.If required, have the guaranty notarized by a certified notary.

-

9.Save the document in your account and download it if you need a physical copy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.