Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Married Bene...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows a property owner to transfer their real estate interests to beneficiaries upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

great

Amazing app and feature.

Very Great

Good

good

Smooth Experience

From trial to billing, all steps were logically laid out and presented. The product is intuitive.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Transfer on Death Deed Form

How does a transfer on death deed work?

A transfer on death deed (TOD deed) enables property owners to transfer real estate to beneficiaries after their death without going through probate. This form allows individuals to designate one or more beneficiaries who will receive the property upon their passing. It's a popular option for those looking to directly pass on assets to loved ones seamlessly and efficiently.

Understanding the transfer on death deed

-

A TOD deed is a legal instrument that allows the owner of a property to name beneficiaries who will receive the title after the owner’s death.

-

It helps avoid the lengthy process of probate, allows for a smooth transfer of assets, and can keep the property out of the public eye.

-

Many believe TOD deeds are complicated; however, they are relatively straightforward and can be quite beneficial if executed correctly.

What are the legal implications of the transfer on death deed?

-

If not properly executed, a TOD deed may be contested in court, potentially leading to disputes among beneficiaries.

-

Legal advice can help ensure that the deed is compliant with state laws and accurately reflects the owner’s intentions.

-

Changes in marriage status, divorce, or death of beneficiaries can affect rights under the TOD deed, necessitating updates.

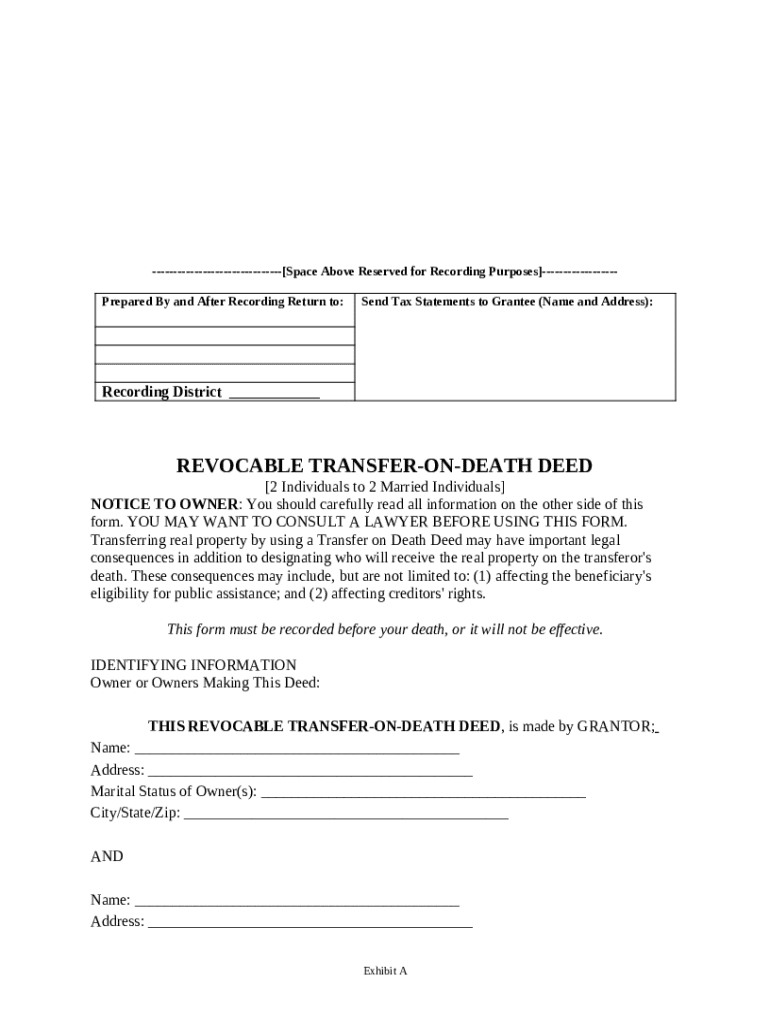

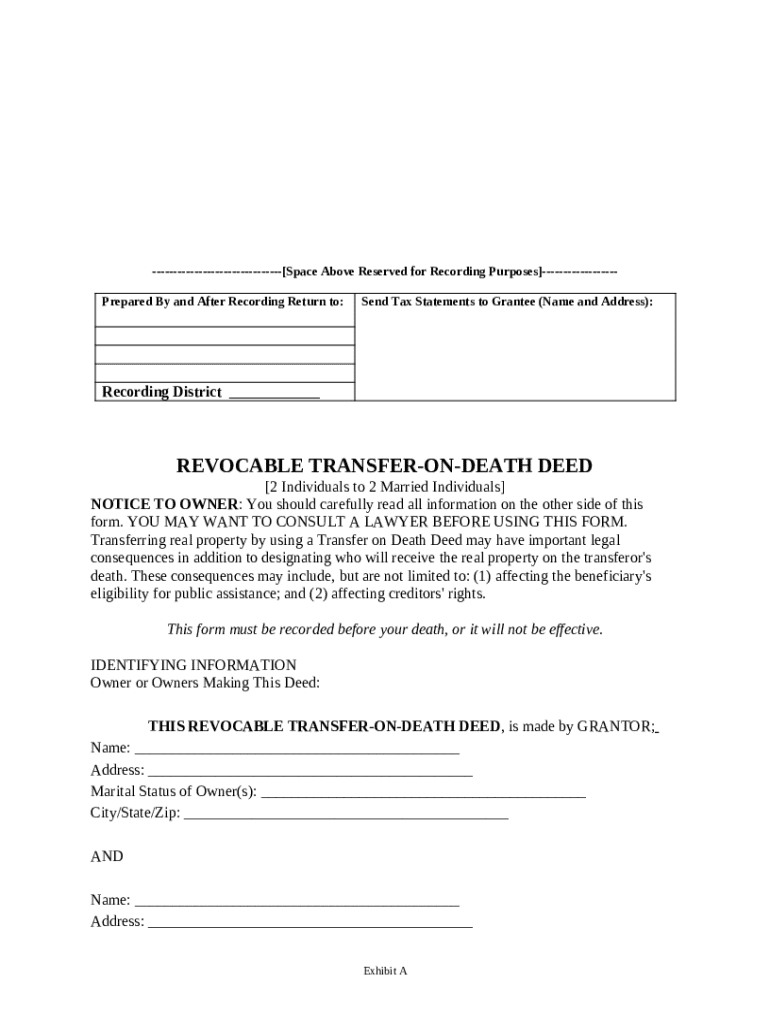

What are the essential elements of the transfer on death deed form?

-

This section offers an area for recording the deed with local authorities, which is crucial for its validity.

-

The form should clearly identify all property owners (grantors) to avoid confusion regarding ownership.

-

An accurate legal description is essential to clearly delineate the property being conveyed.

-

Each area may have specific formats or requirements for the deed, so check local regulations.

How to complete the transfer on death deed form?

-

Start by correctly filling in details about the property, including the grantor, beneficiary, and legal property description.

-

Ensure no information is omitted and that signatures are collected from all grantors.

-

Use the formal legal annotations from previous property deeds or current real estate records.

What should you know about beneficiary designations?

-

Consider choosing someone responsible who can manage the property effectively after you are gone.

-

It's wise to designate alternate beneficiaries to ensure property does not remain in limbo.

-

Having several beneficiaries can lead to disagreements on property management or sale unless clearly defined.

What are the post-filing considerations?

-

Notify all beneficiaries and maintain a copy of the recorded deed for personal records.

-

Keep track of any family dynamics or personal circumstances that might affect designated beneficiaries.

-

Understanding the tax implications of property transfer is important to avoid unexpected burdens on beneficiaries.

How can pdfFiller help you with your transfer on death deed?

-

pdfFiller provides a user-friendly platform to easily edit and complete your TOD deed form online.

-

Take advantage of the eSigning capabilities to involve the necessary parties while maintaining a digital trail.

-

With cloud storage, access your documents anytime, ensuring safety and quick retrieval.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.