Get the free Reconveyance, Release and Indemnification Agreement template

Show details

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid. Releases are used to transfer risk from one party to another and protect against the released party or

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is reconveyance release and indemnification

A reconveyance release and indemnification is a legal document that transfers the title of a property from the lender back to the borrower, often to confirm the fulfillment of a loan obligation.

pdfFiller scores top ratings on review platforms

It is easy and does what I need.

Enabled me to complete an important document quickly and efficiently

Mam rada jednoduché a přehledné aplikace nad kterými nemusím zbytečně přemýšlet, neboť to většinou vede k tomu, ze úplně ztratím hlavu a prvotní myšlenku, ktera mě tam zavedla. . Takže v jednoduchosti je krása.

it was fine, but I did not want to sign up for a free trial. I just need the form

It was real easy to find what I was looking for all had to do is downloaded the paper.

great experience as I was short of time and pdffiller got everything i needed done without flaws or complications

Who needs reconveyance release and indemnification?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the reconveyance release and indemnification form

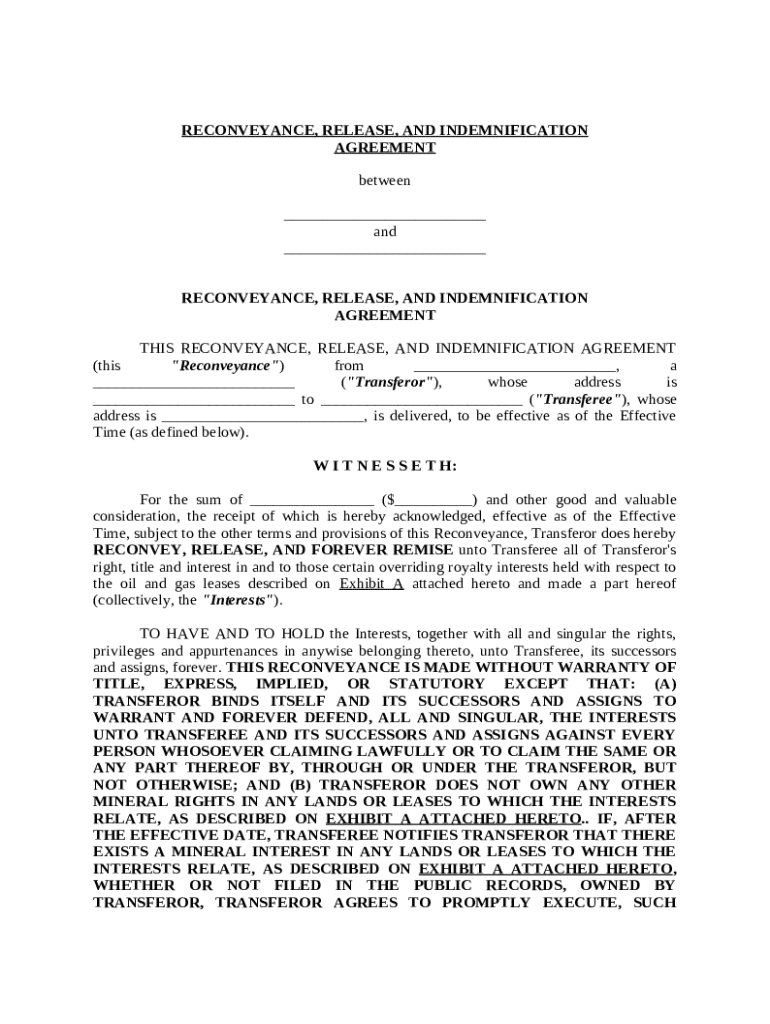

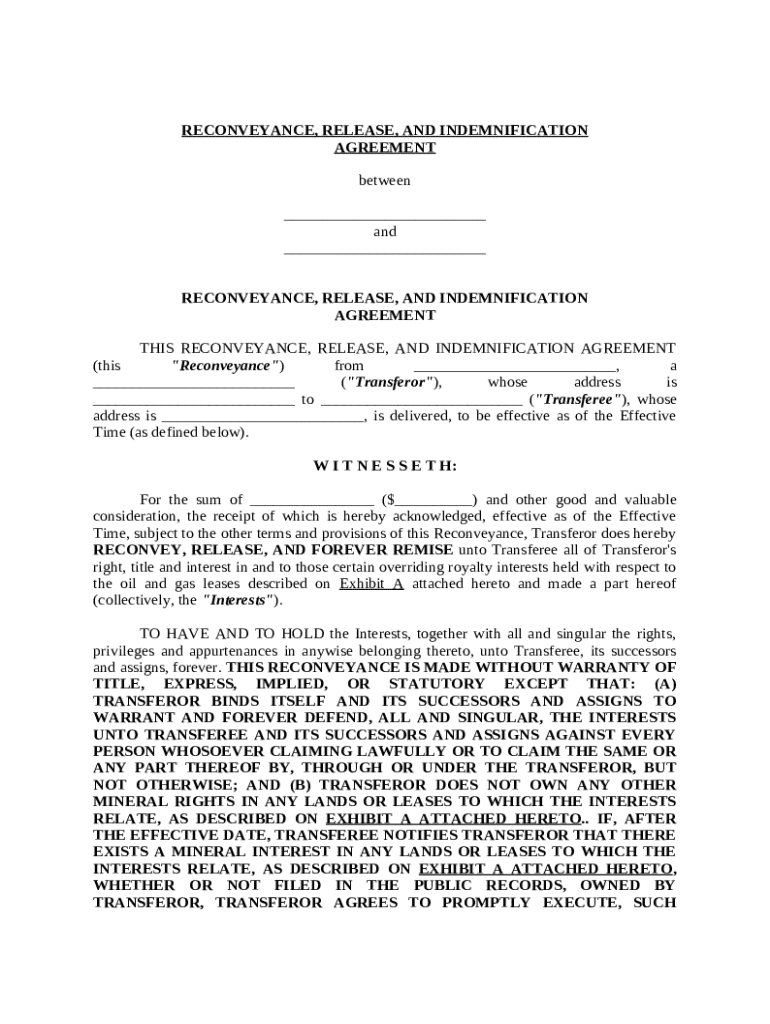

What is the reconveyance release and indemnification agreement?

The reconveyance release and indemnification agreement is a legal document that serves to transfer title from a lender (transferor) back to a borrower (transferee) after a loan has been repaid. It is crucial in property transactions, ensuring that the borrower's obligations are discharged, and the lender relinquishes any legal interest in the property. This document protects both parties, facilitating a clear and documented return of rights.

Why is the document essential in property transactions?

This form is critical as it provides a formal acknowledgment of the loan payoff, allowing the transferor to release any claims against the property. Without this document, the borrower could face potential liabilities or legal complications regarding the property in the future.

-

Provides legal clarity regarding ownership.

-

Reduces future disputes between parties.

-

Safeguards the borrower's rights against third-party claims.

Who are the parties involved in this agreement?

The primary parties involved in a reconveyance release and indemnification form are the transferor and the transferee. The transferor, usually a lender or financing company, holds a security interest in the property until the loan is repaid. The transferee is typically the borrower who secures property title upon fulfilling their payment obligations.

What are the key components of the agreement?

-

Include full name, address, and contact information for both parties.

-

This defines when the reconveyance takes effect—typically at the loan payoff date.

-

This should detail any encumbrances related to the property, illustrated in a supplementary document.

How do fill out the reconveyance release and indemnification form on pdfFiller?

Filling out this form on pdfFiller is straightforward. The platform provides a user-friendly interface that guides you through entering necessary details. This includes identifying the involved parties, the nature of the property, and attaching any required exhibits.

-

Gather personal and property details: ensure you have accurate information at hand.

-

Upload Exhibit A and related documents: ensure all supplementary paperwork is correctly attached.

-

Utilize pdfFiller tools for easy edits and signing: the platform offers various editing tools to simplify this process.

What are the legal implications of the agreement?

Legal implications within this agreement are significant. The warranty of title provisions included in the document ensure that the transferor upholds that there are no legal defects in the title. Furthermore, the obligations surrounding mineral rights are critical, as they can affect the property's value and use.

-

Complete transparency regarding any claims against the title.

-

Includes shielding against future claims or liens, ensuring the property is free and clear.

What common mistakes should be avoided when completing the form?

Accurate and thorough filling of the form is paramount. Common pitfalls include inputting incorrect personal details or property descriptions, which can lead to disputes or delays. Additionally, overlooking the notarization process can invalidate the form, thus it’s crucial to ensure that this step is not missed.

-

Ensuring all names and addresses are correct helps avoid legal issues later.

-

Notarization is essential for the legal validity of the document.

-

Review the entire document to confirm all required information is provided.

What should be done after form submission?

After submitting the reconveyance release and indemnification form, it’s vital to ensure that it is properly recorded in local land records. Failure to record could result in complications regarding ownership in the future. Utilizing pdfFiller’s document management tools can aid in organizing and keeping these records for easy future reference.

-

Check with your local county office to ensure the document has been filed.

-

Keep copies and use pdfFiller for managing all relevant documents securely.

What local considerations should be made for users in California?

California has specific laws and regulations regarding property reconveyance that users should be aware of. For example, the nuances of compliance might differ greatly in regions like Los Angeles compared to other cities. Utilizing local resources for legal assistance can further help in navigating the intricacies involved.

-

Be up-to-date with the state regulations affecting property transactions.

-

Ensure all specific local ordinances are adhered to, especially in populated regions.

-

Utilize community resources to get legal assistance tailored to property law.

How to fill out the reconveyance release and indemnification

-

1.Open the PDF file containing the reconveyance release and indemnification form on pdfFiller.

-

2.Ensure all required fields are accessible for editing, including borrower and lender information as well as property details.

-

3.Begin with entering the date at the top of the form to establish the record's timeline.

-

4.Fill in the borrower's legal name and contact information as indicated on the form.

-

5.Next, input the lender's legal name in the designated section, verifying accuracy for proper identification.

-

6.Specify the property address, including all relevant details about the property being reconveyed.

-

7.If there are any specific restrictions or conditions outlined in the original agreement, include those in the designated area.

-

8.Review the form for completeness, ensuring no fields are left blank, which could delay processing.

-

9.Once all sections are completed, sign the document digitally, ensuring it complies with state or local regulations.

-

10.Submit the completed document through pdfFiller by following the instructions for filing or sending it to the necessary parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.