Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals t...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer property to heirs upon their death without going through probate.

pdfFiller scores top ratings on review platforms

highly completely step by step and understand guide to follow

WEll it was easy to save it, but I need to go check on it now to be fully satisfied. Thank you.

eal nice software helps add info to a drawing which saves paper and time with out having to resubmit change orders.

I an trying to learn what this systems able to do- so far it is ok

Once you can find a fillable form on line it works fine.

It is a great site for graduate school application.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the transfer on death deed form

How do you understand a transfer on death deed?

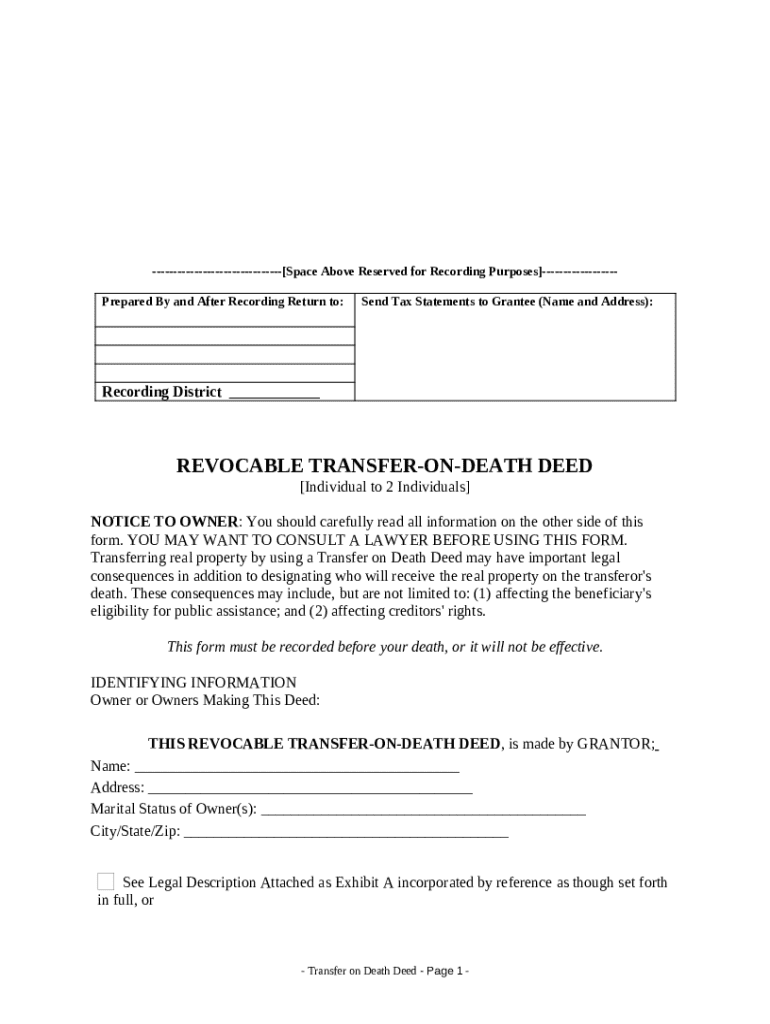

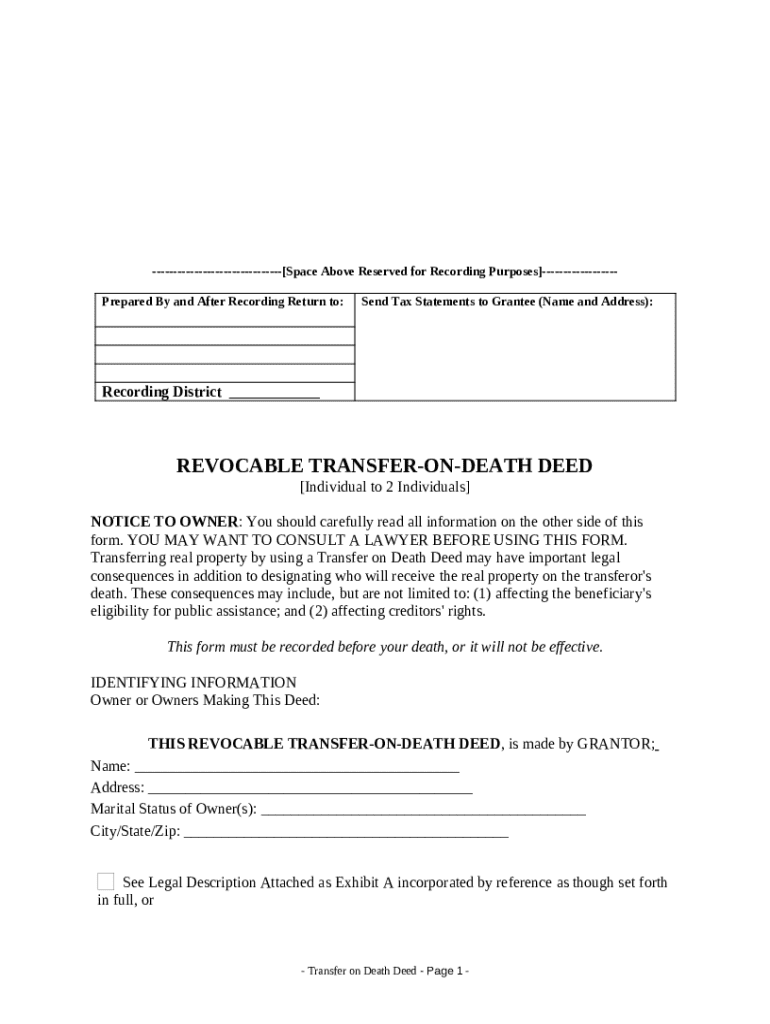

A transfer on death deed (TOD deed) is a legal document that allows a property owner to transfer real estate to a beneficiary upon the owner's death without going through the probate process. This deed is particularly significant because it allows for a smooth transition of assets while reducing tax implications and avoiding potential legal disputes. It is crucial for the deed to be properly recorded before the owner's death to ensure its validity.

What should you know before getting started?

Before using a transfer on death deed form, it’s important to consider several legal aspects. Consulting with a legal professional is strongly advised to navigate potential complexities that could affect your estate plan. Understanding eligibility requirements and the consequences for your beneficiaries is also essential, as this could impact their ability to inherit property.

-

You need to review specific state laws regarding transfer on death deeds as they can vary widely.

-

Having professional guidance can clarify your options and help avoid mistakes.

What identifying information is required from the grantor?

The grantor, or property owner, must provide specific information in the transfer on death deed. This includes essential details such as the grantor's name, address, marital status, city, state, and zip code, along with a comprehensive legal description of the property being transferred. Accurate information is critical for the recording process, as any discrepancies could render the deed invalid.

-

Provide full name, address, and marital status.

-

Include a detailed description of the property.

How to include beneficiary information?

When filling out the form, it’s important to clearly identify your beneficiaries. The primary beneficiary's name, address, marital status, city, state, and zip code should be included. If there are multiple beneficiaries, considerations for their listing must be made, ensuring all legal requirements are met. If desired, alternate beneficiaries may also be designated in case the primary beneficiary is unable to inherit.

-

All essential information like name and address needs to be filled accurately.

-

Clarify how beneficiaries should be designated and the implications.

What are the steps to record the transfer on death deed?

Preparing your transfer on death deed for recording involves a series of important steps. It is essential to ensure that the document meets the local recording district's specifications and requirements. Failure to properly record the form may lead to complications regarding the transfer of property upon the grantor's death.

-

Double-check all fields are filled correctly.

-

Each district has unique requirements, so it's important to know these.

What actions should be taken post-recording?

After recording the transfer on death deed, it’s crucial to understand the responsibilities that come with it. Both the grantor and the beneficiary will have specific duties, including updating relevant documents and ensuring that all involved parties are notified of the change. Regular check-ins can help ensure that the deed remains effective and that changes in the beneficiary's circumstances are addressed timely.

-

Both parties should have a clear understanding of their roles.

-

Any changes in status should be documented and communicated.

How can pdfFiller help with your transfer on death deed?

PdfFiller provides users with a seamless experience when editing the transfer on death deed template. You can easily fill out the form, eSign it, and collaborate with other parties involved directly from the cloud-based platform. The tools for document storage and access enhance your capability to manage important legal documents efficiently.

-

Customize your transfer on death deed form easily.

-

Access your documents anytime, anywhere.

Understanding the transfer on death deed form is essential for ensuring a smooth transition of property. By following the outlined steps and using resources like pdfFiller, you can effectively manage this important aspect of estate planning. Taking these proactive measures can significantly reduce stress for your loved ones during times of loss.

How to fill out the transfer on death deed

-

1.Obtain the transfer on death deed template from pdfFiller.

-

2.Open the template with pdfFiller.

-

3.Fill in the full legal name of the property owner in the designated field.

-

4.Enter the full legal description of the property being transferred, including address and parcel number.

-

5.List the beneficiaries who will receive the property, including their full names and relationship to the owner.

-

6.Specify if the transfer applies to all or a percentage of the property.

-

7.Review the filled form for accuracy and completeness.

-

8.Sign the deed in the presence of a notary public to ensure legal validity.

-

9.File the signed transfer on death deed with the local county recorder's office to finalize the transfer.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.