Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficia...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to pass their real estate assets to designated beneficiaries upon their death without going through probate.

pdfFiller scores top ratings on review platforms

Easy

very fast and effective

Very user friendly.

Great

I am quite satisfied thus far but I need to learn more about what it can help me with.

Never had a problem.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

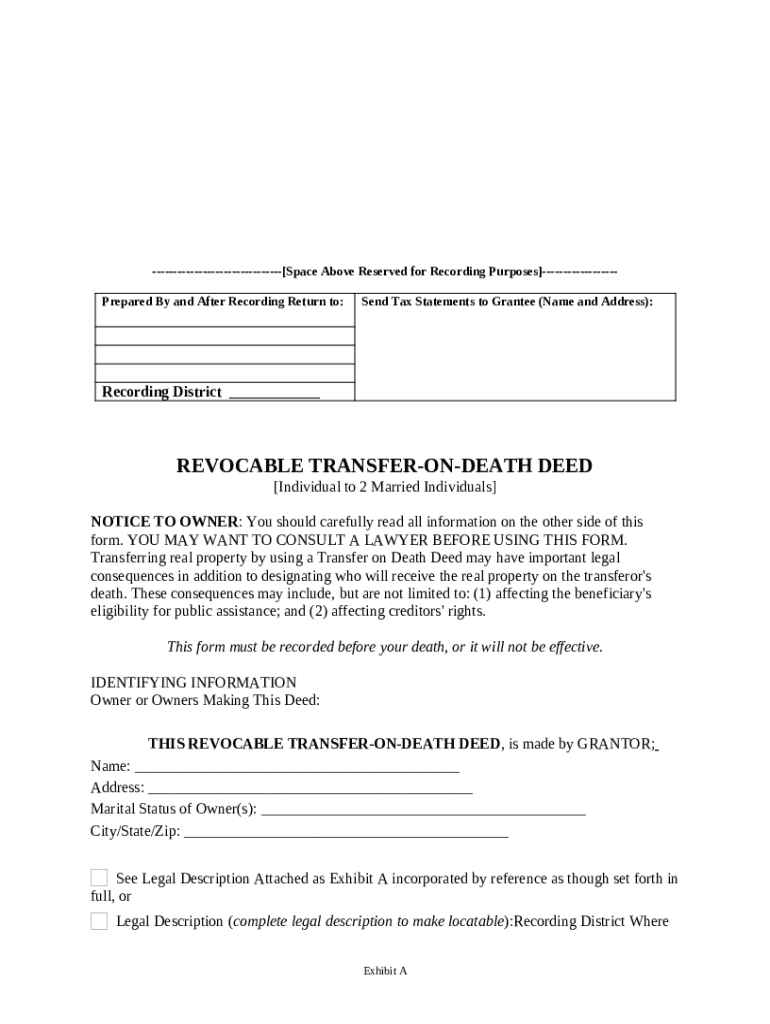

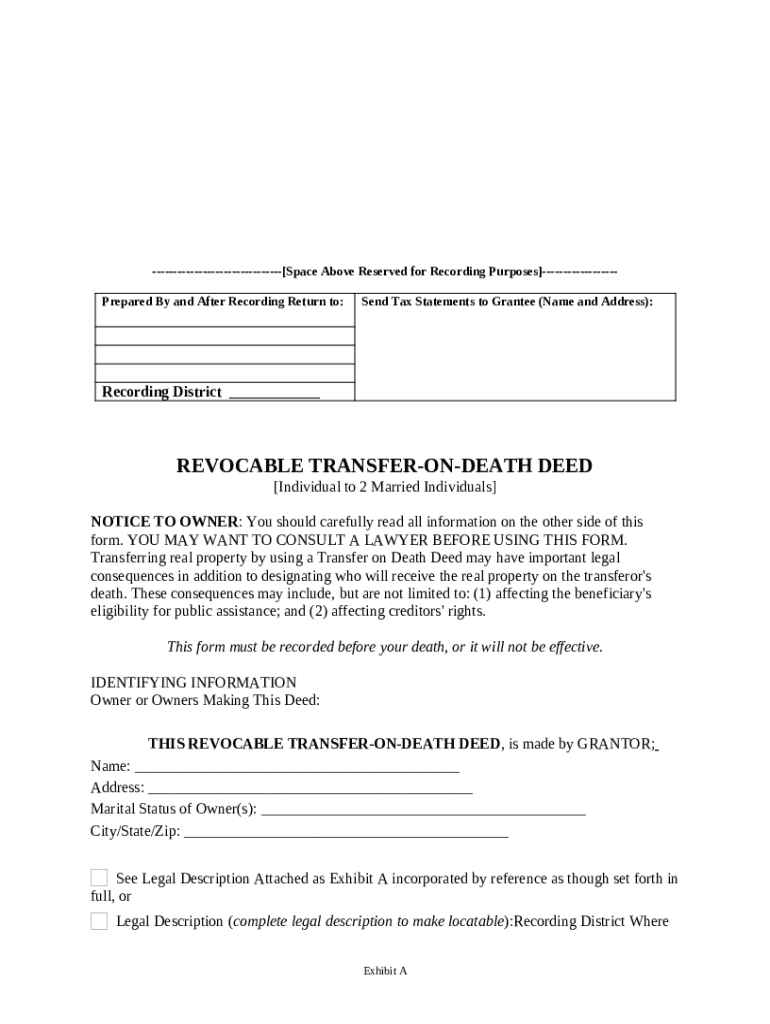

Comprehensive Guide to Transfer on Death Deed Form

How to fill out a transfer on death deed form

Filling out a transfer on death deed form can ensure your property is passed on seamlessly to your loved ones after your death. Begin by consulting a lawyer, gathering required documentation, and following the designated steps to correctly complete the deed. This guide will provide you with essential information and guidelines to assist you.

Understanding the transfer on death deed

A transfer on death deed (TOD deed) allows property owners to pass on their real estate assets to designated beneficiaries without the need for probate, significantly streamlining the transfer process. Unlike traditional wills that may require court processes, a TOD deed takes effect automatically upon the owner’s death, thus avoiding delays and potential disputes.

-

The primary purpose of a transfer on death deed is to enable a smooth transition of ownership to beneficiaries, making estate planning more efficient.

-

There are specific legal requirements that must be met for a TOD deed to be valid, which vary by state.

-

Unlike traditional wills that may go through probate, a TOD deed allows for a direct transfer of ownership, simplifying the process.

Essential information before you begin

It’s critical to consult with a lawyer before proceeding with a transfer on death deed, as the specifics can vary significantly based on jurisdiction. Understanding the necessary documentation and legal considerations can prevent potential issues related to public assistance and creditors’ rights in the event of death.

-

Consulting a lawyer can help ensure you understand the legal implications and avoid potential pitfalls.

-

Gather all required legal documents to identify the grantor and grantee effectively.

-

Authors must consider how this deed affects creditors' rights and public assistance claims.

Completing the transfer on death deed form

To effectively fill out your transfer on death deed form, follow a step-by-step approach to ensure accuracy and compliance with legal standards. It's essential to accurately provide the information for both the grantor (the property owner) and grantee (the beneficiary).

-

Follow a structured guide to fill in all required fields on the form.

-

Clearly identify the names and details of both parties involved.

-

Indicate marital status, as it can impact the transfer process or beneficiaries' rights.

Beneficiary designation: Key considerations

Designating beneficiaries is a crucial step when executing a transfer on death deed. It's essential to outline both primary and alternate beneficiaries to ensure your property is distributed as intended.

-

Provide clear instructions on how to designate beneficiaries on the form.

-

Consider how to address shares and interests among multiple beneficiaries.

-

Ensure that your beneficiaries are alive at the time of your death; if not, alternative arrangements need to be made.

Recording the transfer on death deed

Recording the completed transfer on death deed in the appropriate district is vital to ensure its legality. Each state may have different requirements concerning timing and submission processes.

-

Locate the relevant recording district and follow the required steps to submit your document.

-

Failing to record the deed in a timely manner may result in its ineffectiveness.

-

Research and comply with the legal requirements based on your state or region.

What to expect after completing the form

After successfully recording your transfer on death deed, it’s important to confirm the recording and follow through with any necessary post-actions. Understanding how this deed impacts future property rights can help prevent misunderstandings.

-

Verify that the deed has been duly recorded and accessible.

-

Understand how this deed will affect property rights and ownership for your beneficiaries.

-

Be aware of common misunderstandings and how to mitigate them.

Utilizing pdfFiller for your document needs

pdfFiller offers an array of tools to facilitate the editing and signing of your transfer on death deed form, enabling you to manage your documents efficiently. With collaborative features, you can share and work on documents seamlessly with your team.

-

pdfFiller streamlines document management through easy-to-use editing and e-signing tools.

-

Utilize collaborative tools to allow for team input and revisions.

-

Access your documents from any location with pdfFiller's cloud-based platform.

Assessing the suitability of a transfer on death deed

When considering a transfer on death deed, evaluate your unique circumstances and compare it with other estate planning options. Real-life scenarios can illustrate potential advantages and limitations of using this deed.

-

Analyze whether a TOD deed fits well with your estate planning needs.

-

Look at how this option compares with other strategies, like living trusts.

-

Examine examples of effective use of a TOD deed to understand its application.

How to fill out the transfer on death deed

-

1.Start by downloading the Transfer on Death Deed template from pdfFiller.

-

2.Open the document in pdfFiller and enter the name of the property owner(s) in the designated fields.

-

3.Next, provide a detailed description of the property you wish to transfer, including its address and legal description.

-

4.Specify the beneficiary or beneficiaries who will receive the property upon your death; include their full legal names.

-

5.Indicate whether the property will be transferred to multiple beneficiaries and outline their respective shares, if applicable.

-

6.Review all entered information for accuracy and completeness.

-

7.Sign the document in the appropriate section; most states require notarization, so ensure you have a notary public witness your signature.

-

8.Once signed, you may need to record the deed with your local county recorder’s office to make it legally effective.

-

9.Keep a copy for your records and provide copies to your beneficiaries for their reference.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.