Get the free Tax Deed template

Show details

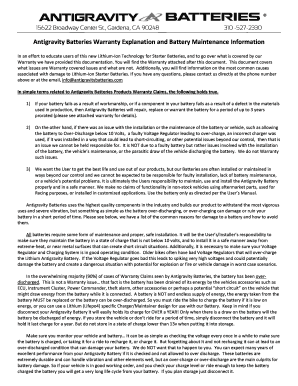

This is a legal document granting ownership of a property to a government body when the owner fails to pay any associated property taxes. A tax deed gives the government agency the authority to sell

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

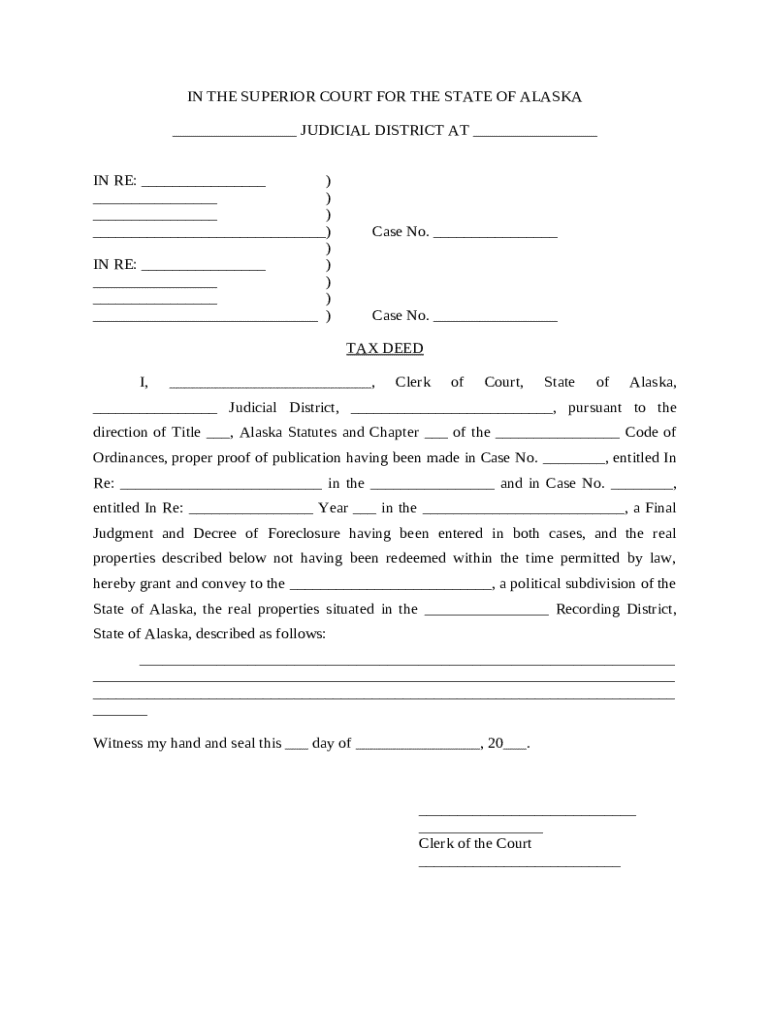

What is tax deed

A tax deed is a legal document that transfers ownership of a property to a purchaser due to the non-payment of property taxes.

pdfFiller scores top ratings on review platforms

Good software and make my works can…

Good software and make my works can complete very fast

GOOD transcription

Easy to use and very handy.

PDF Filler has excellent support. I highly recommend them. I used the mobile chat and they resolved my issue very quickly.

Awesome

Easy to use especially when I am doing work with my students

Who needs tax deed template?

Explore how professionals across industries use pdfFiller.

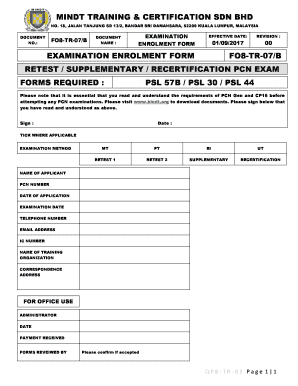

A complete guide to the tax deed form form

How to fill out a tax deed form?

Filling out a tax deed form is a straightforward process that involves several key steps. First, gather all necessary information, including details about the property and the involved parties. Next, follow detailed instructions for each section of the form to ensure accuracy and completeness, which minimizes the chances of delay or rejection.

Understanding the tax deed form

A tax deed is a legal document that grants ownership of a property when the previous owner fails to pay property taxes. Its significance lies in the transfer of title and the legal backing it provides to new property owners. Individuals involved in tax sales or auctions often require this form, making it a crucial element of property law.

-

The tax deed form turns a tax lien into a formal deed, protecting the rights of the new owner.

-

Property buyers from tax auctions or individuals acquiring properties due to tax foreclosures typically complete this form.

-

This form serves as proof of ownership and is necessary for any legal claims or sales concerning the property.

What are the key components of the tax deed form?

A tax deed form typically includes several essential components. Understanding these components not only simplifies the process of filling it out but also ensures compliance with legal requirements.

-

This typically includes the name and contact information of the Clerk who oversees court records.

-

This section specifies the district where the property is located, which is necessary for jurisdiction.

-

The case number documents the specific transaction and must match court records.

-

Proof that the tax deed sale was appropriately advertised in local media, as required by law.

How do you fill out the tax deed form step-by-step?

Filling out a tax deed form involves straightforward steps to ensure that all necessary information is correctly recorded. Begin by gathering all required documents, including past tax records and details about the property.

-

Collect information on the property, tax payments, and personal details of the involved parties.

-

Follow a systematic approach for filling each section to avoid mistakes and omissions.

-

Common errors include missing signatures, incorrect case numbers, and failing to provide proof of publication.

How can you edit and customize your tax deed form with pdfFiller?

pdfFiller offers features that simplify editing and customizing your tax deed form. With its intuitive design and powerful tools, you can easily upload your document, modify text, and add necessary fields.

-

Simply drag and drop your tax deed form into pdfFiller to begin editing.

-

Customize fields for specific requirements, including additional text or options applicable to your situation.

-

Electronic forms reduce physical paperwork, simplify storage, and streamline sharing and collaboration.

How does digital signing and collaboration work on your tax deed?

Utilizing digital signatures enhances the efficiency and security of your tax deed process. pdfFiller facilitates eSigning and collaboration, allowing multiple parties to work on the document seamlessly.

-

Create a digital signature directly in pdfFiller and apply it to your document easily.

-

Share your document with others and allow real-time edits or comments for a comprehensive review.

-

pdfFiller ensures your documents are protected and maintains their integrity throughout the signing process.

What are the legal considerations for tax deeds in Alaska?

In Alaska, specific laws govern the issuance and documentation of tax deeds, making it essential to be informed of these regulations. This understanding helps prevent legal disputes and ensures compliance.

-

Alaska Statutes outline the procedures and requirements for tax deed transactions, including timeframes and fees.

-

Knowledge of local ordinances related to tax deeds can aid in compliance and dispute resolution.

-

Having a clear understanding of local laws can help effectively address any potential disputes from tax deed transactions.

Where should you submit and manage your tax deed?

Submitting your completed tax deed form accurately is crucial for the validity of your claim. Be aware of where and how to submit your document to ensure timely processing.

-

Typically, the completed tax deed form must be submitted to the county clerk or financial office responsible for property tax collections.

-

Understanding the timeline for processing can help you manage expectations regarding ownership claims.

-

pdfFiller provides tracking and management features, allowing you to monitor the status of your submissions seamlessly.

What are the best practices for record keeping and future management of tax deeds?

Good record keeping is essential for successful tax deed management. Retaining documentation ensures future reference and can aid in resolving disputes if they arise.

-

Maintain multiple copies of your tax deed and related documents, keeping them in a secure and organized manner.

-

Documenting every step of the process ensures clarity and legal backup for property ownership.

-

pdfFiller can assist in organizing your documents, providing a cloud-based solution to ensure ease of access.

How to fill out the tax deed template

-

1.Open the PDF document that contains the tax deed form.

-

2.Begin by filling in the property identification details, including the tax map number and parcel address.

-

3.Next, provide the name of the current owner as it appears on the tax records.

-

4.Specify the name of the new owner to whom the tax deed is being transferred.

-

5.Indicate the amount covered by the taxes due and any fees associated with the sale.

-

6.Include the date of the tax sale and any relevant tax authority information.

-

7.Carefully review all entered information for accuracy and completeness.

-

8.If required, sign the document in the designated area and obtain necessary witness or notary signatures.

-

9.Save the completed document and print copies for record-keeping and submission to the appropriate tax authority.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.