Get the free Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors template

Show details

This is a form is used to revoke a transfer on death or beneficiary deed. It must be executed before the death of the owner who executes the revocation and recorded in the office of the county recorder

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revocation of transfer on

Revocation of transfer on is a legal document used to annul a previous transfer of property or rights.

pdfFiller scores top ratings on review platforms

hkknhjkmhijukjgjhklhhjjjjmgnfhfhhkjhjkjkkjljhkhjgjhkjkjl

Easy and awesome !!

PdfFiller allowed to to complete an important document

A+++

GREAT APP

Combining two files was relatively easy once I read the How to Guide three times to figure it out. But editing text in the file resulted in a change in the font that was not particularly satisfying and could not be corrected.

Who needs revocation of transfer on?

Explore how professionals across industries use pdfFiller.

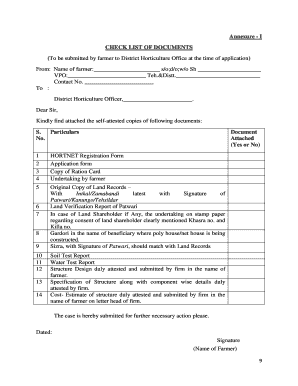

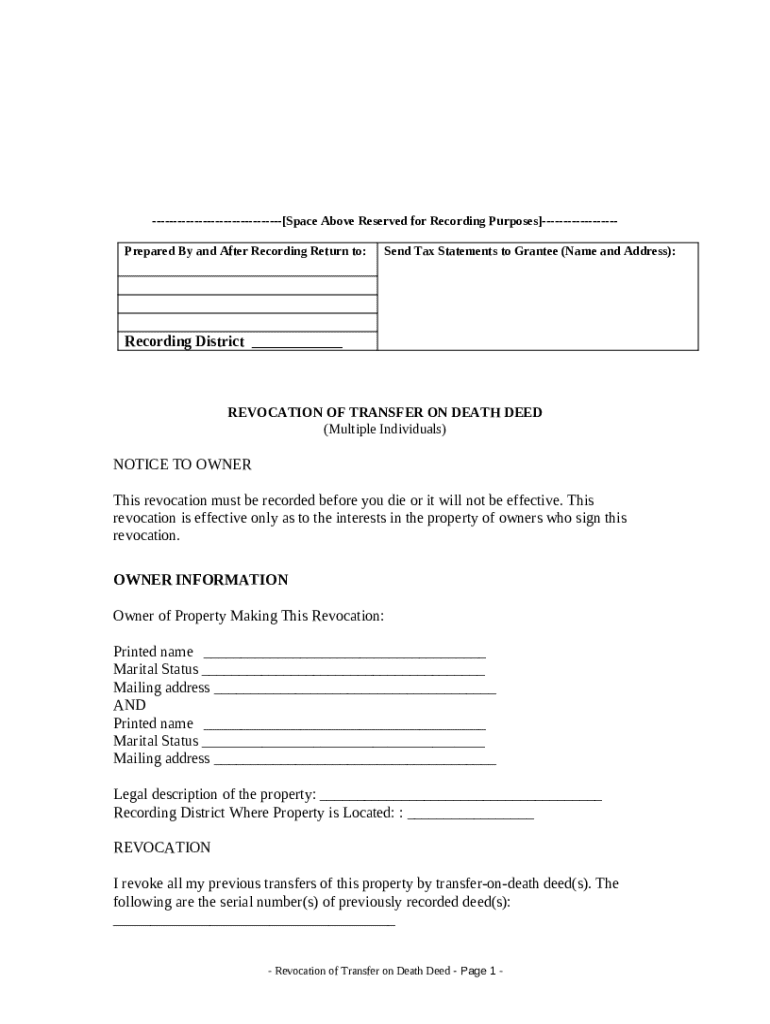

Revocation of Transfer on Death Deed Guide

What is a revocation of transfer on death deed?

A revocation of transfer on death deed is a legal document used to annul a previously recorded transfer of property upon death. This process is vital for those looking to change their estate plans, ensuring assets go to the intended beneficiaries. Failing to record a revocation can lead to unintended distributions of property.

-

Revocation allows individuals to maintain control over their property after altering circumstances, such as divorce or a changed relationship.

-

Without a recorded revocation, the original transfer on death deed remains valid, potentially causing conflicts among heirs or resulting in undesired property transfers.

What are the key elements of the revocation form?

-

The form should specify the correct procedures for recording the revocation to ensure its legal efficacy.

-

Accurate details of the property owner and other relevant parties must be included to validate the revocation.

-

A clear template stating the intent to revoke must be presented, to avoid ambiguity.

-

The form must be signed by the owner (and possibly witnesses) to affirm the authenticity of the revocation.

How to fill out the revocation form on pdfFiller?

Filling out the revocation form on pdfFiller is straightforward, thanks to its user-friendly interface. Users can edit specific fields and ensure accuracy before submission.

-

Begin by selecting the revocation form template, then follow the prompts to input required information accurately.

-

pdfFiller allows users to collect electronic signatures easily, saving time and ensuring documents are legally binding.

-

Users can invite co-owners to review and sign the document, facilitating a smoother process.

-

Documents are securely saved in the cloud for easy access and future editing, ensuring you can manage your forms effectively.

What are local compliance considerations in Virginia?

When revoking a transfer on death deed in Virginia, it's essential to understand the specific state laws to ensure compliance. Different judicial districts may have unique requirements.

-

Virginia law outlines specific procedures that must be followed for a revocation to be legally recognized.

-

Local regulations may dictate additional steps or requirements for filing a revocation.

-

Care should be taken to protect personal information when submitting forms, especially in public records.

What is the submission and recording process?

Submitting a revocation of transfer on death deed involves specific steps to ensure it is properly recorded. Understanding the fees and relevant processes can simplify the task.

-

Revocations are typically submitted to the local county recorder's office or equivalent authority, ensuring compliance with local regulations.

-

There may be small fees required for recording the revocation, which can vary by jurisdiction.

-

Upon successful recording, the revocation is officially recognized, and the previous transfer is rendered invalid.

What are best practices for handling revocations?

Handling revocations needs careful planning and review to avoid pitfalls. Regular assessments of estate documents can aid in ensuring everything aligns with current intentions.

-

Make it a habit to review your estate documents annually or after significant life events to ensure your wishes are still represented.

-

Consulting with a legal professional can provide clarity and ensure compliance with all laws involved in revocation.

-

Platforms like pdfFiller assist in managing all documents in one place, making the process easier and more efficient.

How to fill out the revocation of transfer on

-

1.Open PDFfiller and locate the 'Revocation of Transfer On' form.

-

2.Select the option to fill out a new document or upload an existing one if applicable.

-

3.Start with the top section, entering the names and addresses of the parties involved in the transfer.

-

4.Provide the details of the original transfer, including date and nature of assets transferred.

-

5.Indicate clearly the intention to revoke the transfer by checking the appropriate box or statement.

-

6.Fill in any additional information required by the form, like signatures or witnesses if necessary.

-

7.Review all the entered data for accuracy before submitting the document. Ensure all sections are complete.

-

8.Click the 'Save' or 'Submit' button to finalize the form, following any on-screen instructions for printing or emailing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.