Get the free pdffiller

Show details

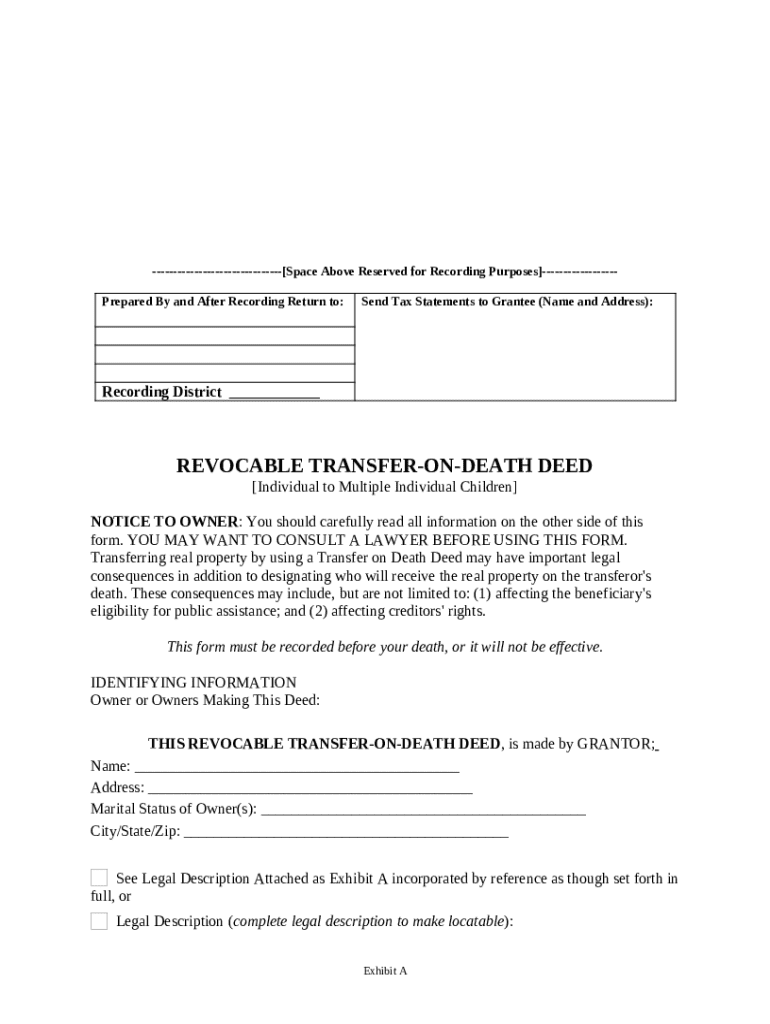

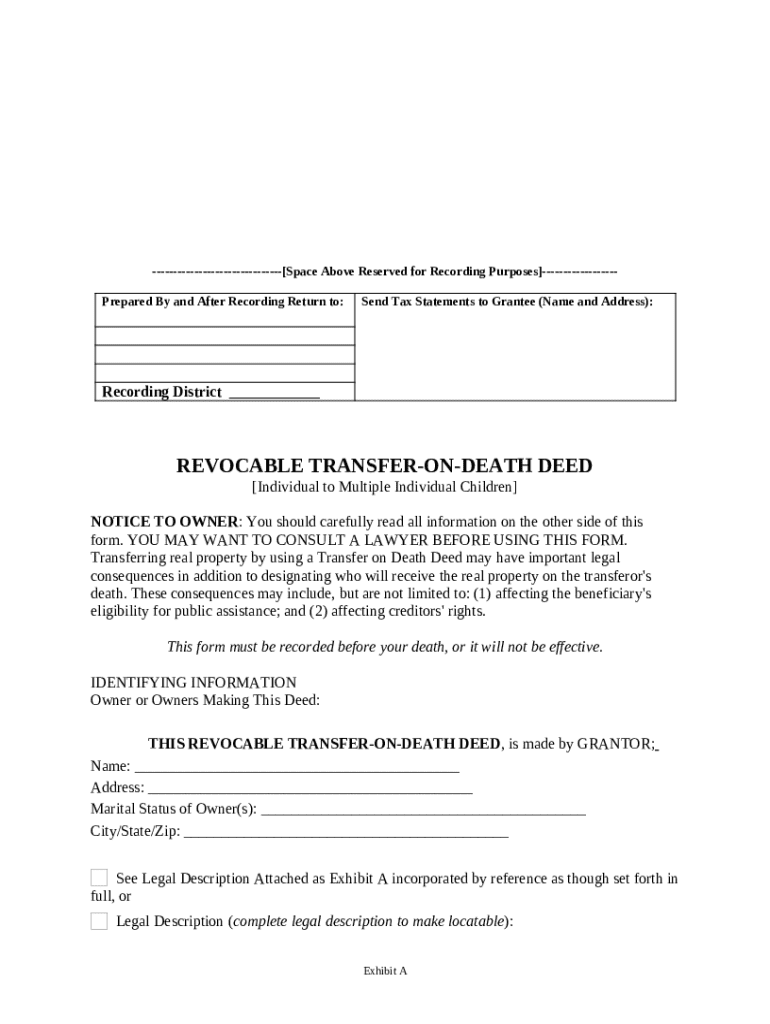

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer real estate property to a designated beneficiary upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

PDF filler takes the hassle out of Contracts! Find what your looking for OR import it. Even the imported files are writable. It's wonderful. No more sloppy handwritten forms. Everything looks professional.

its an awesome program! I had no idea something could work this great.

I think the documents are really easy to fill out and to print.

IT IS A WONDERFUL TOOL TO USE IF USED PROPERLY

TAKES TOO LONG TO USE AND DIFFICULT TO EDIT WHEN COME BACK TO DOCUMENT.

Made filling out a 6=page form very easy

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form: A Comprehensive Guide

How can fill out a transfer on death deed form?

To fill out a Transfer on Death (TOD) deed form, first gather the necessary property details and owner information. Clearly define your beneficiaries and ensure that they understand their roles. Finally, complete the form accurately and file it according to your state's requirements.

Understanding transfer on death deeds

A Transfer on Death (TOD) deed is a legal document allowing for the direct transfer of real estate upon the death of the property owner without probate. This type of deed is beneficial as it simplifies the inheritance process and provides clarity for property distribution.

-

Avoids probate costs and delays, ensuring beneficiaries receive the property quickly.

-

Can lead to disputes if beneficiaries are not clearly defined or communicated.

However, potential legal consequences include issues with claims against the estate if proper procedures are not followed, potentially leading to disputes.

Before you get started

-

Evaluate if a TOD deed aligns with your estate planning goals and whether it fits into your overall strategy.

-

Consulting a lawyer is essential to understand the legal implications associated with the deed.

-

Take the time to reflect on how you wish your property to be distributed and who your beneficiaries will be.

These steps are crucial for ensuring a smooth transfer process and avoiding complications in the future.

Preparing the Transfer on Death deed

-

Clearly list the property that is to be transferred, including all important details.

-

Ensure all relevant legal documents and titles are at hand before completing the form.

-

Clearly state who the beneficiaries are, along with any specific roles or stipulations.

Filling out the Transfer on Death deed form

Filling out the TOD deed form can be straightforward with a clear guide. Follow each instruction closely, ensuring accuracy in details.

-

Begin by entering your name and property location, then adding beneficiary details.

-

Include the legal names and addresses of all beneficiaries.

-

Clarify the difference between primary and alternate beneficiaries to avoid confusion.

Recording your Transfer on Death deed

Once the TOD deed is completed, it is crucial to have it recorded in a timely manner. Recording the deed ensures legal recognition and protects the interests of the beneficiaries.

-

Delays in recording can complicate the transfer process and lead to legal challenges.

-

Laws vary by location, so determine the appropriate filing office for your jurisdiction.

-

Check for any fees linked to filing the TOD deed and factor them into your budget.

After you finish: what comes next?

-

Ensure that the deed has been recorded correctly to avoid future disputes.

-

Provide your beneficiaries with copies of the deed and inform them about the arrangements.

-

Keep the original and any copies of the form safe for future reference.

Additional tools available on pdfFiller

pdfFiller simplifies document editing and management for users who need a flexible solution for legal documents. With features for eSigning and collaboration, pdfFiller enables a seamless document creation process.

-

Easily edit your transfer on death deed form using our user-friendly tools.

-

Simplify the signing process and ensure all parties can review and sign electronically.

-

Access a vast library of templates to assist in creating various legal documents.

How to fill out the pdffiller template

-

1.Obtain a blank transfer on death deed form from a trusted source or legal website.

-

2.Begin by entering your full name as the property owner in the designated section.

-

3.Provide the legal description of the property you wish to transfer, including its address.

-

4.Clearly designate the beneficiary by entering their name and any relevant identifying information.

-

5.Include a second beneficiary if desired by listing their name and details, noting any specific conditions.

-

6.Review the document for accuracy, confirming all information is correct and complete.

-

7.Sign the deed in the presence of a notary public to validate it.

-

8.Ensure the notary signs and stamps the document appropriately.

-

9.File the completed deed with the appropriate local government office, usually the county clerk or recorder.

-

10.Keep a copy of the filed deed in a secure location and inform the beneficiary of its existence.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.