Get the free Promissory Note template

Show details

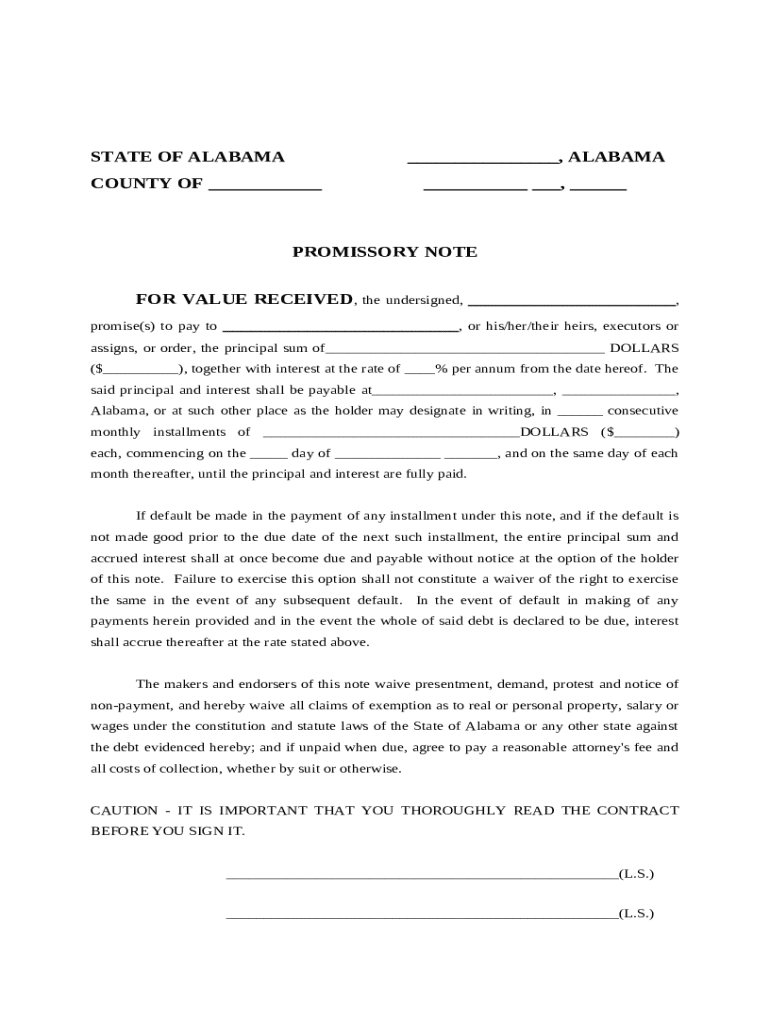

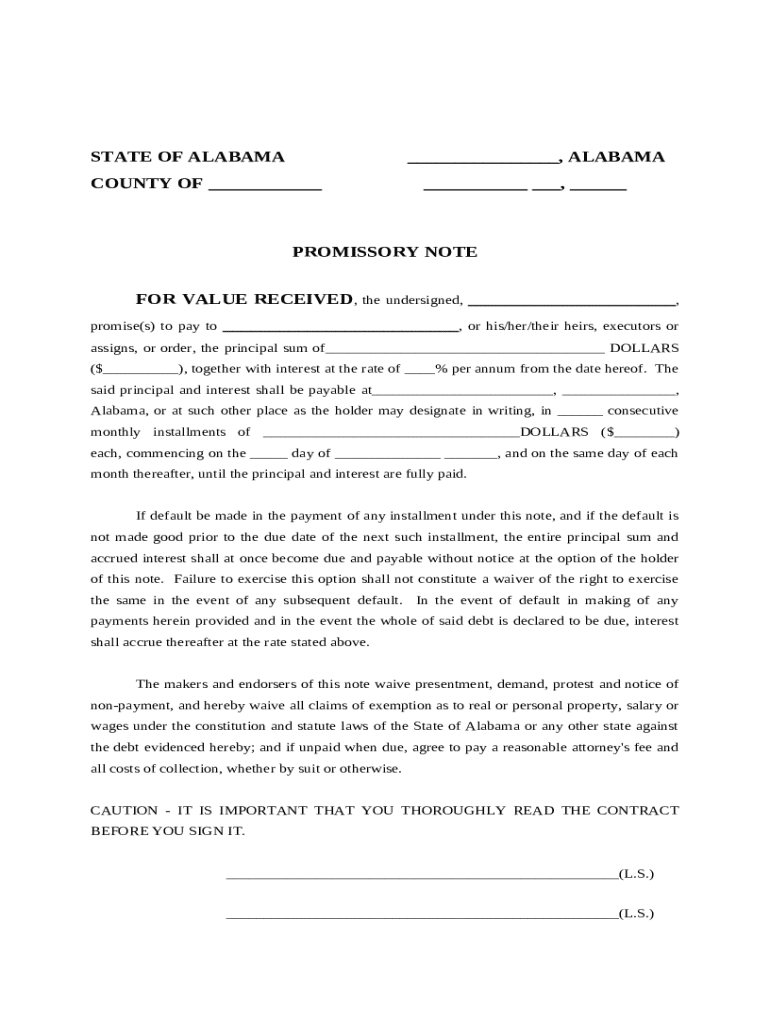

This form is a written promise to pay a debt. It is an unconditional promise to pay, on demand or at a fixed or determined future time, a particular sum of money to, or to the order of, a specified

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note

A promissory note is a written, legally binding promise to pay a specified amount of money to a designated party at a predetermined time or on-demand.

pdfFiller scores top ratings on review platforms

user friendly, and fast, great app

SG

EXCELLENT

It is great. For the "date", current date option could be provided.

needed to fill out some important documents ASAP. Availability is KEY.

user friendly

Great for now

Who needs promissory note template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Promissory Note Forms on pdfFiller

How do you define a promissory note?

A promissory note is a financial instrument wherein one party makes an unconditional promise to pay a specific amount to another party at a predetermined future date or on demand. This legally binding document establishes the terms of the loan and serves as evidence of the debt. By understanding the key elements of promissory notes, you can create an effective document that protects your interests and defines obligations clearly.

-

Promissory notes typically include the principal amount, interest rate, payment terms, and signatures. These components help clarify the agreement and safeguard the rights of both parties.

What essential elements must be included?

When drafting your promissory note, certain elements are crucial to ensure its validity and enforceability. These include the principal amount, interest rate, payee details, payment schedule, default clauses, and both parties' signatures.

-

Clearly specify the loan amount, as it forms the basis of the agreement.

-

Indicate the rate to be charged on the loan amount, which can affect total repayment.

-

Include the name and address of the person or entity lending the money.

-

Outline how and when payments will be made, such as monthly installments.

-

Protect your interests by specifying consequences for missed payments.

-

Ensure that both the borrower and lender sign the document for legal recognition.

How can you fill out a promissory note effectively?

Filling out a promissory note involves gathering the required information before you start and can be greatly facilitated using pdfFiller for digital completion. The platform allows for a detailed walkthrough of each form field, helping you avoid common mistakes while filling.

-

Before filling out the note, have all necessary details on hand, including the loan amount and payment schedule.

-

This tool simplifies the completion process, allowing for online forms and easy edits.

-

Ensure you double-check details such as names and figures to avoid any potential disputes later.

How do you edit and customize your promissory note?

Editing your promissory note on pdfFiller is straightforward. It provides features to upload your completed form, utilize interactive editing tools, and add eSignatures securely. These tools ensure that your note is tailored to meet your specific requirements.

-

Easily import your existing document into pdfFiller for editing.

-

Make changes seamlessly with the platform's user-friendly interface.

-

Securely include eSignatures to certify your document and engage in smoother transactions.

What are the best practices for regulatory compliance?

When drafting a promissory note, it’s essential to adhere to state-specific regulations, particularly if you’re in Alabama. Legal considerations vary by region, impacting how the note will be enforced if disputes arise.

-

Different regulations in states like Alabama can affect how you draft your note.

-

Understanding the obligations related to interest income can guide your financial planning.

-

Awareness of common issues helps ensure the note is enforceable and protects both parties.

In what common scenarios are promissory notes used?

Promissory notes are utilized in various contexts, from personal loans between friends and family to formal agreements in business loans and real estate transactions. Understanding these scenarios helps ensure proper application and protection of interests.

-

Different regulations and expectations apply depending on the loan type.

-

Promissory notes can facilitate the buying and selling process in real estate.

-

Utilizing a promissory note allows structuring of terms for easier repayment.

How to fill out the promissory note template

-

1.Open pdfFiller and upload the promissory note template.

-

2.Begin filling out the borrower's information in the designated fields.

-

3.Enter the lender's name and contact information clearly.

-

4.Specify the principal amount being borrowed in numeric and written form.

-

5.Choose the repayment terms, including the interest rate and payment due dates.

-

6.Add any conditions or clauses relevant to the agreement, such as prepayment options.

-

7.Review the document for accuracy, ensuring all essential information is included.

-

8.Sign the document electronically, and have the other party sign as well.

-

9.Download and save a copy of the signed document for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.