Get the free Collection Letter template

Show details

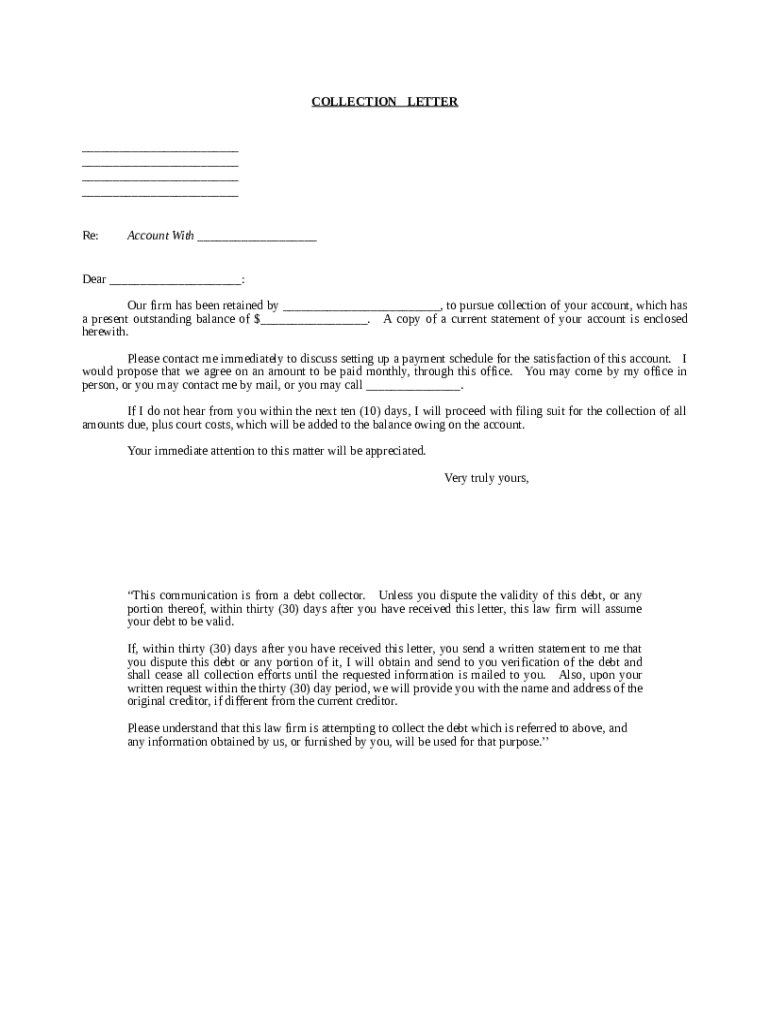

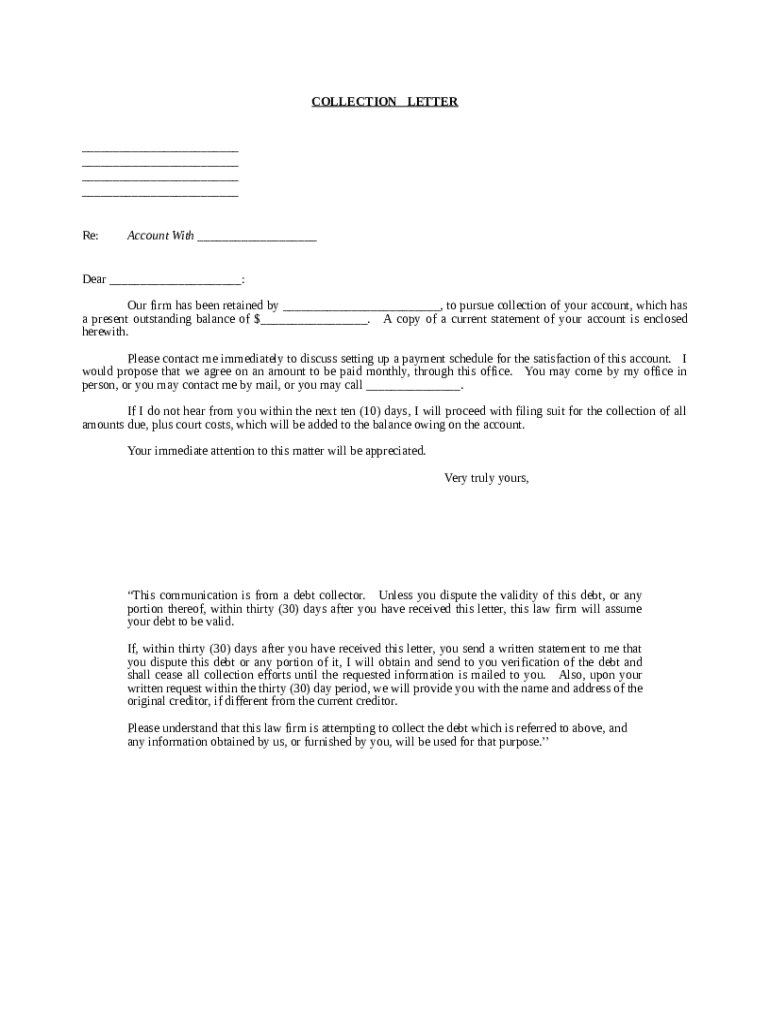

This form is used in the effort to collect money owed when one party is unable to pay a monetary debt to another. This form is available in Word and Wordperfect formats.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is collection letter

A collection letter is a formal notice sent to a debtor requesting payment of an overdue account.

pdfFiller scores top ratings on review platforms

Helped me understand the issue.

Helped me understand the issue.

I have been surprised at how 'user…

I have been surprised at how 'user friendly' pdfFiller is. It is easy to download forms from my computer and I appreciate that.

perfect editor

perfect editor

I love it

I love it! I've been using PDFiller for my business for over two years. You will be surprised all the advantages it has to offer for documents. Enjoy!

Works as described!

Works as described!

I am very happy with this network

I am very happy with this network. Thank you.

Who needs collection letter template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Collection Letter Forms

How to fill out a collection letter form

Filling out a collection letter form is straightforward. Begin by ensuring you have all necessary recipient information, including name and address. Next, clearly state the amount owed and any relevant details regarding the debt. Finally, create a call to action for the debtor to respond or make a payment, ensuring compliance with legal requirements.

Understanding collection letter forms

Collection letter forms serve as formal notices sent to debtors regarding overdue payments. They play a crucial role in the debt collection process, as they outline the amount owed and offer an opportunity for the debtor to respond. Using correct language and structure in these letters boosts their effectiveness and asserts professionalism.

-

A collection letter formally communicates the debt to the debtor, prompting them to take action.

-

Proper language fosters a professional tone, improving the chances of a favorable response.

-

These letters are often the first step in the pursuit of overdue payments, establishing a paper trail.

What are the essential components of a collection letter?

A well-crafted collection letter contains key components that ensure clarity and legal compliance. The header should include the creditor's details, while recipient information clearly identifies the debtor. Additionally, an opening statement should explain the letter's purpose, followed by specifics about the account balance and any pertinent details.

-

Include your firm's name, address, and contact information.

-

Clearly state the debtor's name and address to avoid confusion.

-

Inform the debtor of the reason for the letter and the urgency of the situation.

-

Clearly outline the outstanding balance and any relevant account specifics.

-

Encourage the debtor to respond or make payment arrangements as soon as possible.

-

Include any required disclosures concerning debt collection regulations.

How can interactive tools assist in editing the collection letter?

Using tools like pdfFiller allows for easy customization of collection letters. These software features provide templates that can be filled and adjusted, promoting streamlined document management for teams. As a cloud-based solution, pdfFiller makes it convenient to manage documents from anywhere.

-

Personalize templates to fit specific debtor circumstances easily.

-

Edit text, add signatures, and other essential details without hassle.

-

Securely store and access documents from any device, facilitating teamwork.

Where can find a sample collection letter template?

A sample collection letter template is an excellent starting point for crafting your letters. It includes pre-filled fields illustrating how to present relevant information clearly. Moreover, it offers tips for customizing the template to align with specific situations or industry nuances.

-

View a practical template that includes all necessary fields.

-

Learn how to effectively communicate various details within the letter.

-

Adjust wording and content according to specific debtor scenarios or industries.

What are the best practices for writing effective collection letters?

Writing effective collection letters requires understanding your audience and maintaining professionalism. It's essential to adjust your tone and language based on who will read the letter. Additionally, avoiding common pitfalls will enhance the letter's impact and improve response rates.

-

Use a tone suited to the debtor's situation, whether firm or more conciliatory.

-

Clearly convey urgency and the importance of the matter while keeping a respectful tone.

-

Avoid aggressive language or convoluted paragraphs that can lead to misunderstandings.

What compliance and legal considerations should be acknowledged in collection letters?

Compliance with legal regulations, such as the Fair Debt Collection Practices Act (FDCPA), is crucial when drafting collection letters. This act ensures ethical treatment of debtors during the collection process. Understanding both federal and state-specific regulations is essential for avoiding legal complications.

-

This federal law regulates how debt collectors can communicate with debtors.

-

Be aware of additional laws that may impact how debt collection should be handled.

-

Communicating clearly and transparently enhances trust and encourages payment.

How should responses to collection letters be managed?

Effective management of debtor responses to collection letters is essential for successful debt recovery. Understanding the various types of responses enables creditors to strategize appropriately. If debtors dispute the debt, have a plan in place for escalation that adheres to legal guidelines.

-

Recognize when a debtor agrees to pay or challenges the debt.

-

Ensure you document the disputed claim and follow appropriate procedures.

-

Consider mediation or legal action if initial collection attempts fail.

How can pdfFiller enhance document management?

pdfFiller not only aids in creating effective collection letters but also offers extensive document management features. Users can leverage tools for editing, signing, and storing essential documents in the cloud, ensuring easy access and updates. This centralizes the entire process, making collaboration more efficient.

-

Innovative tools streamline the document creation and management process.

-

Familiarize yourself with features to optimize your document workflow.

-

Track correspondence and maintain version control effortlessly with cloud services.

How to fill out the collection letter template

-

1.Open pdfFiller in your web browser.

-

2.Search for 'collection letter' in the template library.

-

3.Select a template that fits your needs and open it.

-

4.Fill in the debtor's name and address in the appropriate fields.

-

5.Enter the date of the letter at the top of the document.

-

6.Clearly state the amount owed and any late fees applicable.

-

7.Include a payment deadline to encourage prompt action.

-

8.Add your contact information for any questions they might have.

-

9.Review the letter for accuracy and completeness.

-

10.Save the document and download it to your device or send it directly via email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.