Last updated on Feb 17, 2026

Get the free Mortgage template

Show details

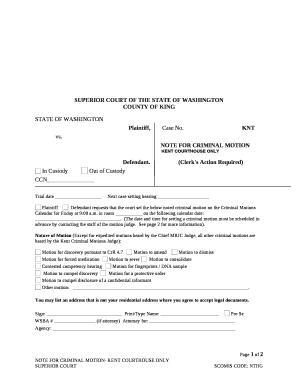

This form contains the details and duties of each party when obtaining a mortgage for real property. This form must be signed before a Notary Public, stating that all covenants and agreements are

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is mortgage

A mortgage is a loan used to purchase a property, where the property serves as collateral for the loan.

pdfFiller scores top ratings on review platforms

easy to use

easy to use, very helpful

Good product.

Good product.

very good application

very good application

I like this application it makes every…

I like this application it makes every thing easier.I recommended.

Pdf Filler Great Review

My overall experience with pdf filler has been great so far

I like the customizable features of pdf filler and being able to use pdf filler for my business and it makes my customers lives easier.

I dislike the third party integration as sometimes it loads slowly.

It could be a little better if you put hints on tools that explained how to set and adjust them, but only if the person hovers over the tool without clicking it.

Who needs mortgage template?

Explore how professionals across industries use pdfFiller.

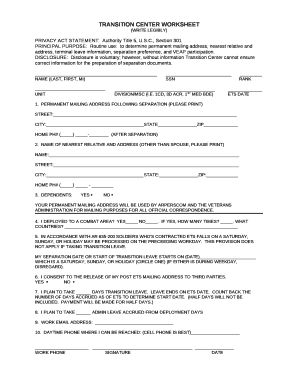

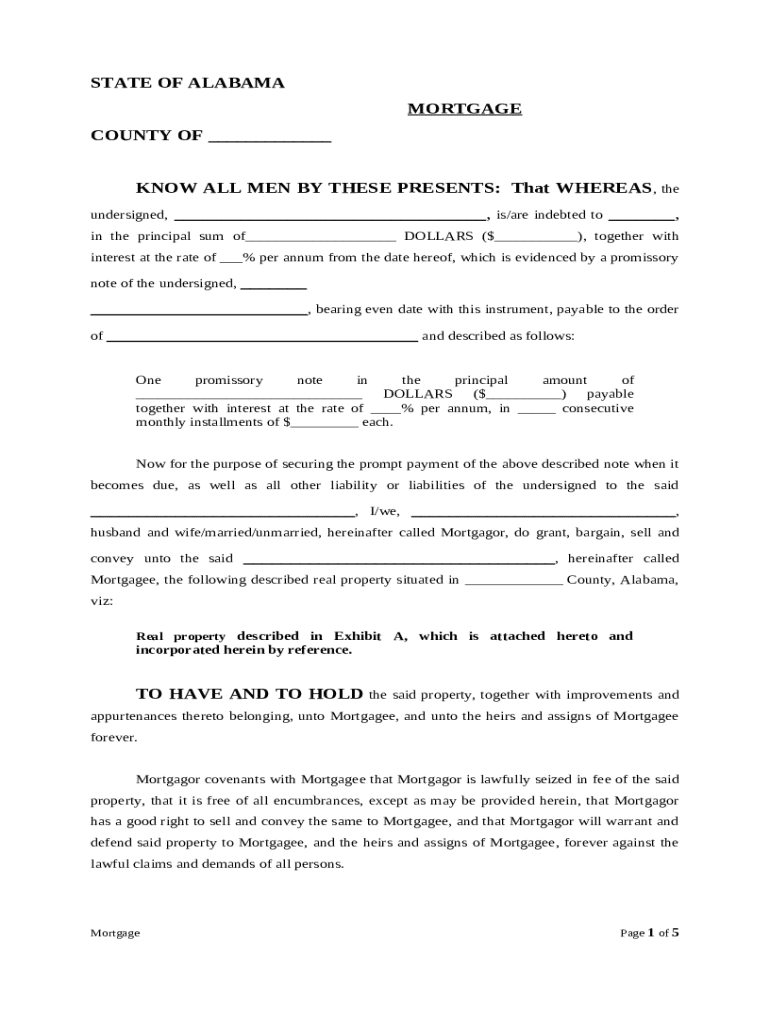

Complete Guide to the Alabama Mortgage Form on pdfFiller

Understanding how to fill out a mortgage form is essential for any prospective mortgagor in Alabama. This guide will walk you through the complexities of the Alabama mortgage form, ensuring you have the right information and insights needed to complete it.

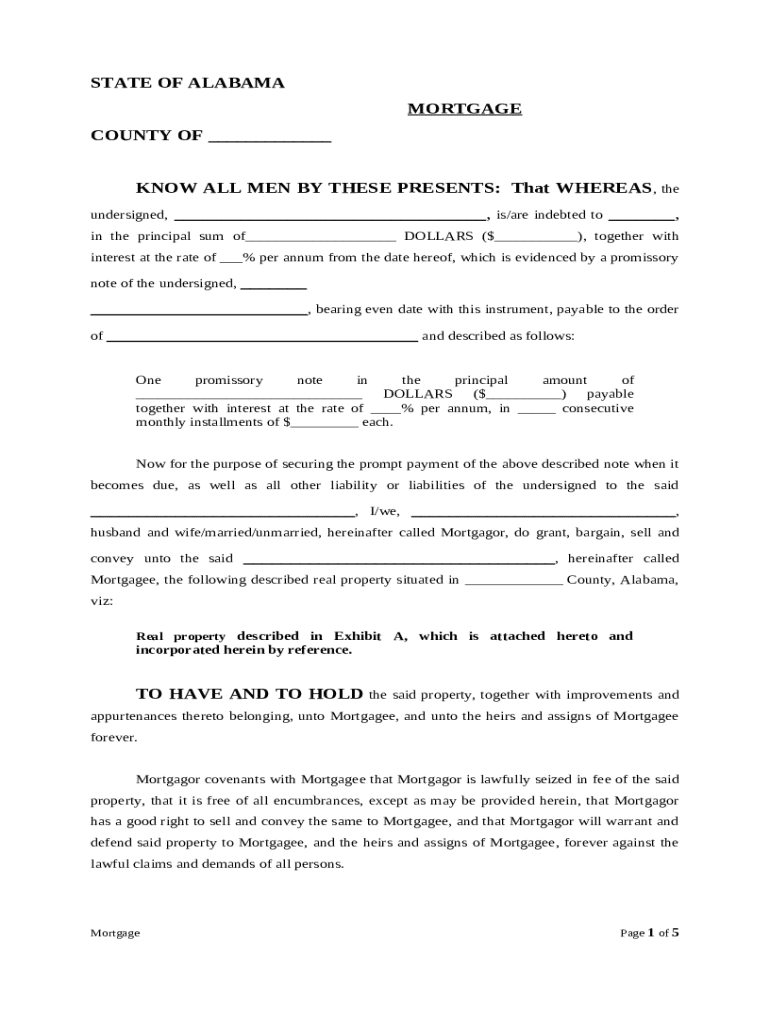

What is the Alabama mortgage form?

The Alabama mortgage form is a legal document used between buyers and lenders, representing the loan agreement and the property pledged as collateral. It establishes the terms of the mortgage, including payment schedules and interest rates, thus protecting the rights of both parties involved in the real estate transaction.

-

A mortgage form is used to secure a loan by pledging a property as collateral, outlining the terms and agreement between the lender and borrower.

-

The primary parties are the mortgagor (borrower) and mortgagee (lender), essential for establishing lending terms.

-

The mortgage form is crucial for formalizing the loan, protecting the lender’s investment in case of default.

What are the essential components of the Alabama mortgage form?

The Alabama mortgage form contains critical details that define the loan and property involved. Understanding these components ensures all necessary information is accurately presented, minimizing the risk of errors.

-

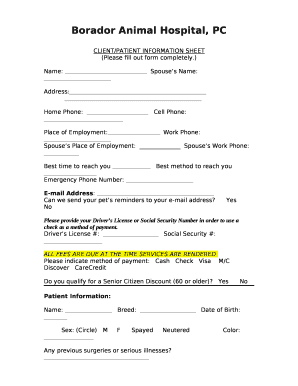

Each party must be clearly identified, including names and contact information for both the mortgagor and mortgagee.

-

It must specify the principal amount of the loan and the applicable interest rate, which forms the basis of the mortgage agreement.

-

The form should provide a complete legal description of the property being mortgaged to avoid ambiguities.

How do you fill out the Alabama mortgage form step by step?

Filling out the Alabama mortgage form requires attention to detail to avoid potential future disputes. Here are the essential steps you should follow.

-

Identify the parties involved by entering their full names and contact details.

-

Input the principal amount of the loan along with the interest rate to clarify the financial details.

-

Accurately describe the property being mortgaged, using Exhibit A as a reference for dimensions and location.

-

Include any specific covenants and agreements that apply to the mortgage, clarifying both parties' obligations.

-

Ensure the document is signed by all relevant parties and notarized to validate the agreement.

What common mistakes should you avoid when completing the mortgage form?

Mistakes on the mortgage form can lead to significant legal issues or financial losses. Awareness of common errors helps ensure a smooth transaction.

-

Failing to include all required signatures can invalidate the agreement and lead to disputes.

-

Errors in this section can complicate the enforcement of the mortgage and possibly affect ownership.

-

Not indicating covenants can affect the mortgage's validity and the lender's security.

-

Improperly calculated interests can lead to incorrect payment amounts, impacting financial obligations.

What legal considerations and compliance issues should be noted for Alabama mortgages?

When dealing with mortgages, understanding Alabama’s specific laws is essential for compliance and protection. Certain state regulations govern the terms of mortgages and protect both lenders and borrowers.

-

Familiarizing yourself with Alabama's mortgage laws ensures compliance and awareness of your rights.

-

Understanding the implications of existing liens can affect your mortgage terms and property rights.

-

It's crucial to disclose any additional debts or obligations on the property to avoid potential issues.

How can you utilize pdfFiller to manage your mortgage forms?

pdfFiller offers comprehensive tools for managing your mortgage documents seamlessly online. Its cloud-based platform ensures that you can edit, fill, and sign forms from anywhere.

-

Easily edit PDF documents and fill out forms with user-friendly tools tailored for your needs.

-

Utilize tools that allow multiple parties to collaborate on the mortgage form to streamline the process.

-

Option for secure digital signing ensures your documents are legally binding while being conveniently accessible.

What are the next steps for mortgagors after form submission?

Once your mortgage form has been submitted, it’s crucial to understand what comes next. This understanding allows mortgagors to manage their obligations efficiently.

-

Regularly track your mortgage payments to ensure you remain compliant with your obligations.

-

Stay informed of your rights and responsibilities as outlined in the mortgage agreement.

-

Understand your options for modifying or refinancing your mortgage if your financial situation changes.

Where can you find resources for further assistance with Alabama mortgages?

Accessing the right resources can provide further insights or assistance with Alabama mortgages. Here are some valuable tools and references.

-

Consult local attorneys specializing in mortgage law for personalized assistance and advice.

-

Use mortgage calculators to estimate payments and plan your financial future effectively.

-

Visit Alabama state government websites for the latest mortgage regulations and consumer protections.

How to fill out the mortgage template

-

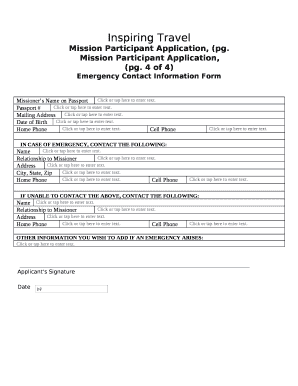

1.Obtain the mortgage application form, preferably from your lender's website or pdfFiller.

-

2.Start by entering your personal information, including your name, address, and contact details in the designated sections.

-

3.Provide your financial information, which may include your income, employment details, and credit history.

-

4.Indicate the property details, including the address, market value, and any additional relevant information.

-

5.Select the type of mortgage you're applying for and the amount you wish to borrow.

-

6.Review all sections of the application for accuracy and completeness before submission.

-

7.Sign the application electronically if required, ensuring you understand the terms and conditions.

-

8.Submit the completed form through pdfFiller, following any additional instructions provided by your lender.

-

9.Keep a copy of the submitted application for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.