Get the free Disclosures by Merchant to Consumer - Rental - Personal Property template

Show details

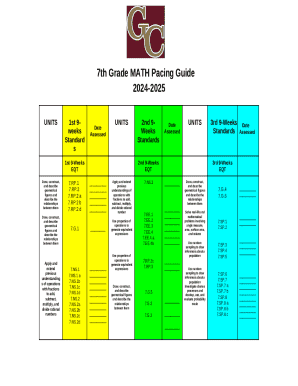

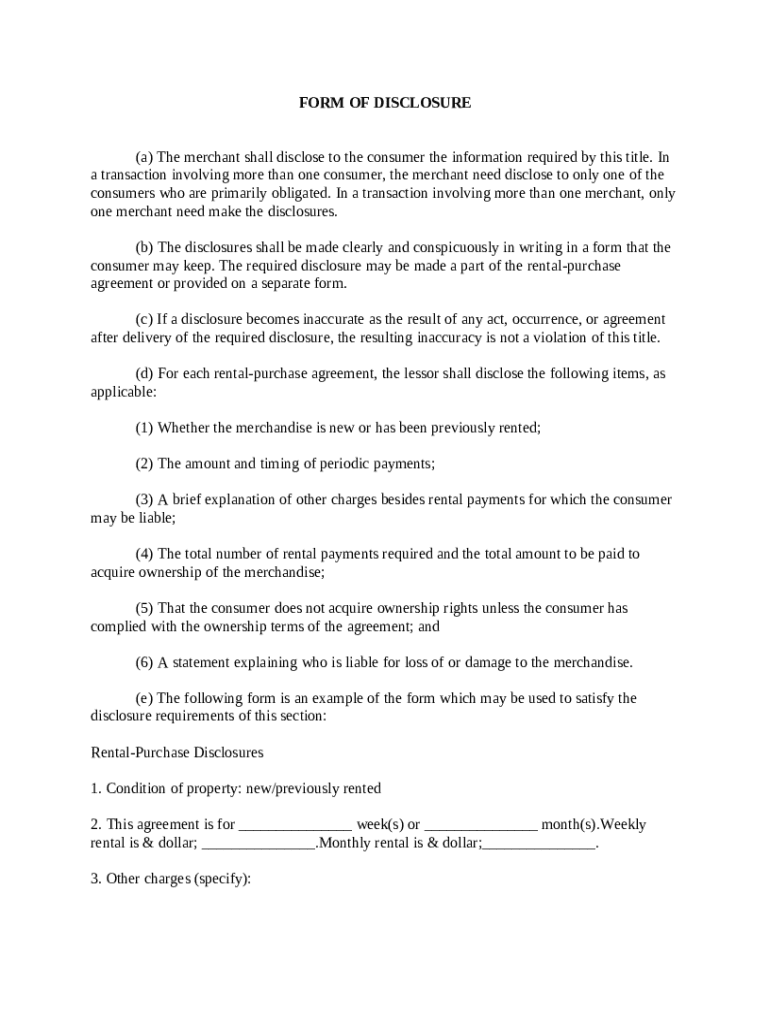

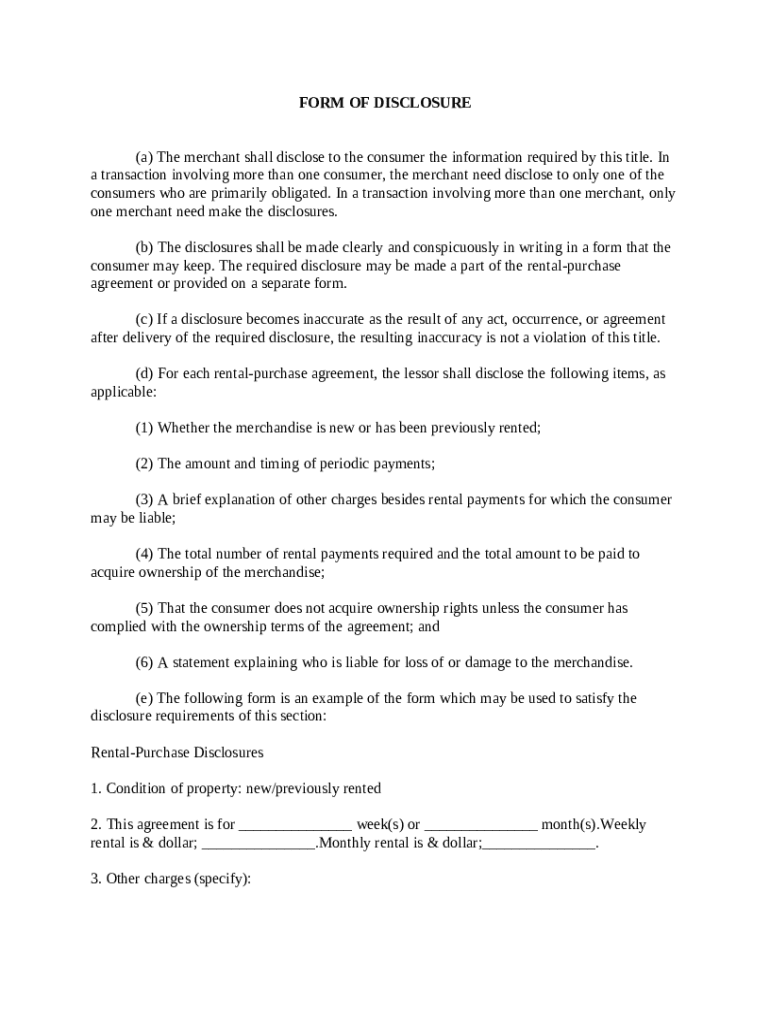

This Disclosures by Merchant to Consumer form details the disclosures by a merchant will make to a consumer as part of a rental-purchase agreement, including whether or not the merchandise is new

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is disclosures by merchant to

Disclosures by merchant to refer to the legal obligations of a merchant to inform customers about specific terms of a transaction.

pdfFiller scores top ratings on review platforms

So far so good. Was very helpful in completing government report on non-fillable .pdf document. That was the original purchase purpose. Now trying out modification / repair of existing fillable forms.

You can search for fillable forms and save them to your work space, edit them, save them print them. Helpful for completing YE forms

IT'S EXTRMELY EASY TO ENTER THE INFORMATION ON THE FORM

I love the system how ever is hard for me to find the forms I want I don't know how to navigate

After a brief learning curve on the program everything was easy to do. I have not been successful using the e-signature feature.

Overall Good but couldn't get it to print.

Who needs disclosures by merchant to?

Explore how professionals across industries use pdfFiller.

How to create disclosures by merchants to form form

Fill out a disclosure by merchant to form form by clearly stating the necessary information, ensuring compliance with legal requirements, and documenting thoroughly. This form serves as an essential guide for both merchants and consumers in understanding their rights and obligations.

What is the legal framework governing disclosures?

Merchants are required by law to provide certain disclosures to consumers. This legal framework is rooted in consumer protection laws designed to inform consumers of their rights and the details of transactions.

-

This ensures that consumers are fully aware of the financial commitments involved in a transaction.

-

Failure to comply can lead to significant penalties, damaging the merchant's reputation and financial stability.

-

Consumers may face unexpected charges, while merchants risk legal actions and financial repercussions.

What key elements are included in disclosures by merchants?

Effective disclosures must encompass certain crucial information. Merchants should communicate what is expected from consumers to eliminate misunderstandings and foster transparency.

-

Consumers should easily understand the information being presented, reducing the chance of confusion.

-

When disclosures involve multiple parties, concise arrangements lead to better comprehension.

-

Different consumers may have varying rights or responsibilities; disclosures must reflect these distinctions.

What types of disclosures are required?

Merchants need to provide specific types of disclosures about the goods and services offered. This ensures consumers understand exactly what they are committing to in any transaction.

-

Whether products are new or previously rented affects consumer expectations and satisfaction.

-

This includes outlining schedules for periodic payments to avoid confusion during transactions.

-

Beyond rental fees, any potential costs should be detailed to prevent unanticipated expenses.

-

Understanding liability helps consumers make informed decisions about their agreements.

How can disclosures be effectively documented?

Documenting disclosures is critical in maintaining transparency and protecting both merchants and consumers. A well-organized system can simplify this process considerably.

-

This approach ensures that consumers receive disclosures in conjunction with the terms of their agreements.

-

Creating standalone disclosure forms can be easier with software designed for document management.

-

Providing consumers with a copy fosters trust and reinforces their understanding of the terms.

What to do when disclosures become inaccurate?

Accuracy in disclosures is paramount, but sometimes inaccuracies occur post-delivery. Navigating these situations requires careful documentation and responsiveness.

-

Noting discrepancies as they arise allows merchants to take corrective actions swiftly.

-

Maintaining thorough records can protect merchants against potential legal challenges connected to errors.

-

This software can help track changes, making it easier to maintain accurate disclosures.

Are there template examples for rental-purchase disclosures?

Utilizing templates can significantly enhance the efficiency of creating disclosures by merchants. These templates simplify the form completion process.

-

Templates provide clear examples of how disclosures should be formatted and what information should be included.

-

Merchants can customize templates to align with specific service offerings, enhancing clarity.

-

Using features from platforms like pdfFiller allows for a more efficient document handling experience.

How to ensure compliance with local regulations?

Different regions may have specific legal requirements around merchant disclosures. Understanding and adapting to these requirements is essential for compliance.

-

Regulations can vary significantly, necessitating appropriate adaptations in disclosure forms.

-

Some sectors might require unique disclosures; tailoring these can enhance merchants' compliance efforts.

-

Platforms like pdfFiller can assist in adapting documents to meet specific regional laws effectively.

How can technology simplify the disclosure process?

Technology significantly streamlines the disclosure process, saving time and resources. This efficiency can benefit both merchants and consumers.

-

Merchants can create, edit, and manage disclosures from anywhere, facilitating flexibility in operations.

-

Teams can work together on disclosures in real-time, reducing errors and improving communication.

-

This platform offers tools that help ensure compliance and improve overall document workflow.

How to fill out the disclosures by merchant to

-

1.Open the PDF filler and upload the 'disclosures by merchant to' document.

-

2.Begin by entering the merchant's name in the designated field at the top of the form.

-

3.Next, provide the business address of the merchant in the address section.

-

4.Fill out the contact information for customer inquiries, including phone number and email.

-

5.In the terms and conditions section, clearly outline any relevant fees or charges associated with the transaction.

-

6.Specify the goods or services being offered in the appropriate section, ensuring clarity for the customer.

-

7.Include any applicable warranties or guarantees that the merchant provides, clearly stating the terms.

-

8.Lastly, review the completed document for accuracy and ensure all required fields are filled out before submitting or saving the document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.