Get the free Interviewing Insurance Fraud template

Show details

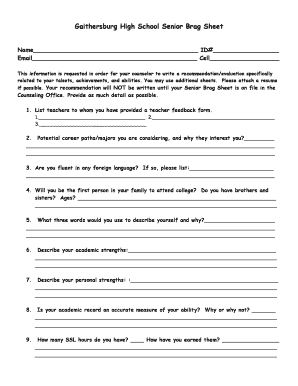

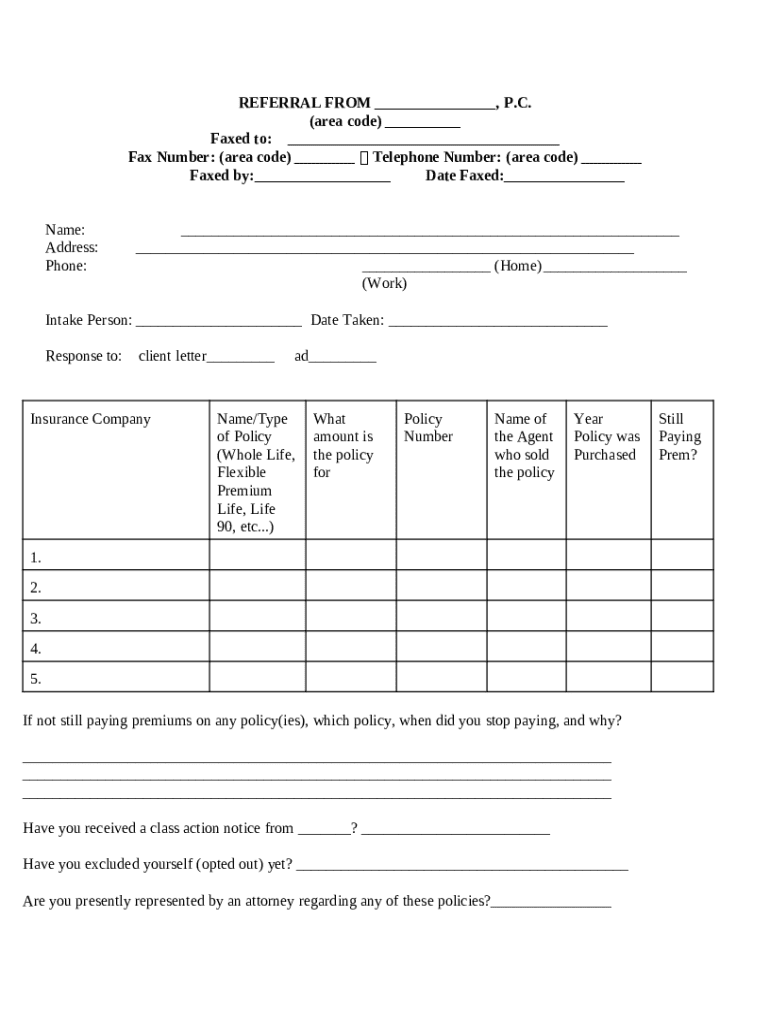

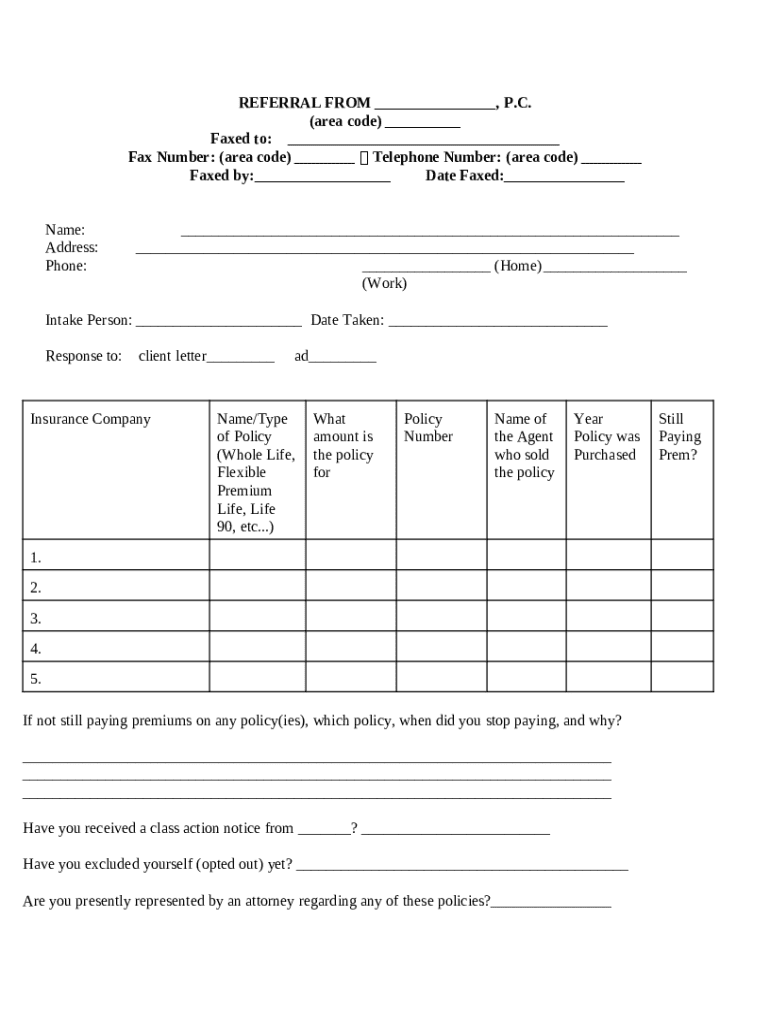

This is a sample interview sheet used by attorneys evaluating a client's claim against an insurance company where fraud is alleged.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is interviewing insurance fraud form

An interviewing insurance fraud form is a document used to gather information from individuals suspected of committing insurance fraud during an interview process.

pdfFiller scores top ratings on review platforms

PDF Filler Software

The pdfFiller is a game changer. The software saves the user time by allowing the user to complete customizable fields and then sign the documents right on the screen. It eliminates the need to print any paperwork if the user chooses not to. The document can be legibly completed by typing directly into the fields which eliminates the effort of having to physically write out what is needed.

The software helps to save time for the user.

I do not have any dislikes that I would like to share about this product. This product has been a game changer for my business.

The Most liked about PDF filler is very easy for my self and client to sign the documents and is one of the very best tools

still laerning

It's a great foldier to have with my education

FINDING FORMS IS A LITTLE DIFFICULT BUT I MANAGED

Good so far. Just want to see how else PDFfiller can be of use for me.

Who needs interviewing insurance fraud template?

Explore how professionals across industries use pdfFiller.

How to fill out the interviewing insurance fraud template

-

1.Download the interviewing insurance fraud form from pdfFiller.

-

2.Open the PDF file using pdfFiller’s online editor.

-

3.Read the instructions included on the first page to understand the purpose of the form.

-

4.Begin filling in the respondent's information, including full name, address, and contact details.

-

5.In the designated section, provide details about the incident related to the suspected fraud.

-

6.Document any previous claims made by the individual in the appropriate fields provided.

-

7.Add spaces for additional comments or statements from the respondent to clarify their position.

-

8.Review the completed form for accuracy and completeness before submission.

-

9.Save the filled-out form to your device or submit it directly through pdfFiller's submission options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.