Last updated on Feb 17, 2026

Get the free Subpoena Request Form

Show details

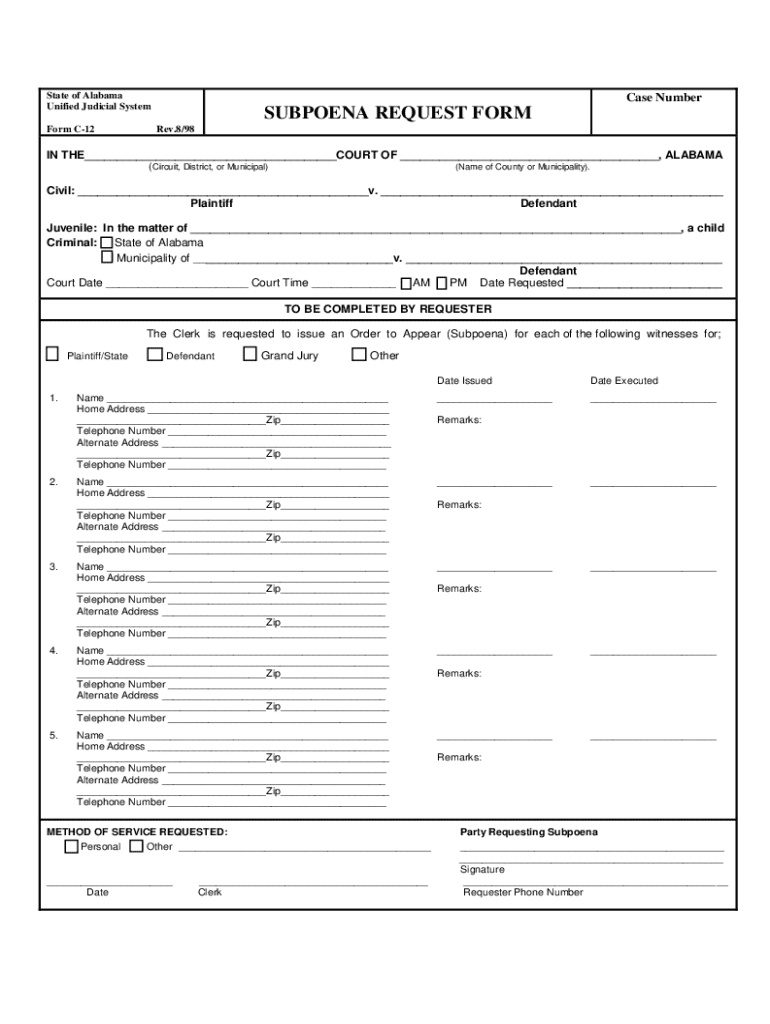

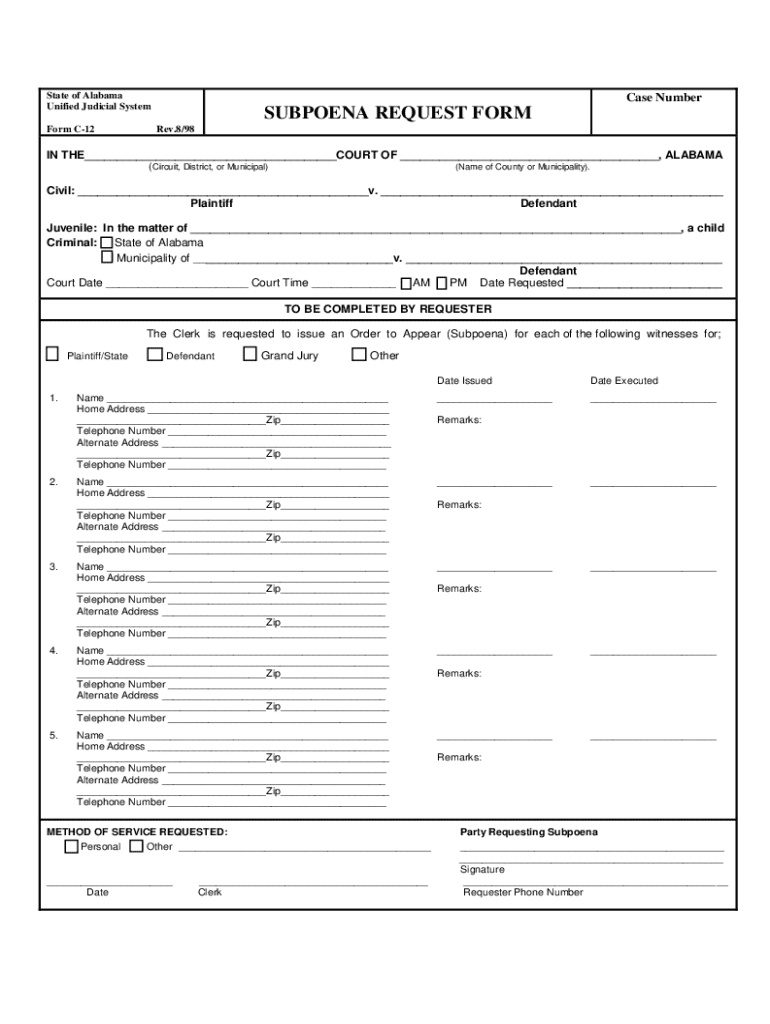

Subpoena Request Form - Official Circuit Court of Alabama form.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is subpoena request form

A subpoena request form is a legal document that requests the court to order an individual or entity to appear for a deposition or produce documents related to a case.

pdfFiller scores top ratings on review platforms

Works great and not nearly as expensive as ADOBE

So far it is been a good experience you send a PDF filler Stephanie could have a little bit too exciting but I'm just starting to get yes of it

Sometimes it jumps and brakes the sequence of filling. Also sometimes character size is not the same

I am a first time user. I've experienced some difficulty but the Support Team is right on it and I expect it to be resolved soon.

Your support is outstanding!

All the features available are really useful.

My Only Request is if possible get an offline editor.

Overall , The Best Available Online PDF Editor.

PDF filler is incredibly fast, easy to use and well thought out. This program saves me time and money

Who needs subpoena request form?

Explore how professionals across industries use pdfFiller.

How to fill out a subpoena request form form

Filling out a subpoena request form is crucial for obtaining necessary documents or witness testimony in legal proceedings. This form plays a pivotal role in ensuring that all parties involved abide by court regulations. In this guide, we will cover the essentials of this form, key components, and best practices to make the process more efficient.

Understanding the subpoena request form

A subpoena request form is a legal document that compels an individual or entity to produce evidence or testify in a legal matter. Its primary purpose is to gather crucial information necessary for a trial, allowing both sides to prepare adequately. The requirements and structure of this form can vary by jurisdiction, so understanding the specific rules governing your area is essential.

What are the key components of the subpoena request form?

-

For example, the State of Alabama Unified Judicial System Form C-12 must be correctly identified.

-

Ensure you include essential information such as case number, court name, and involved parties.

-

This form is applicable for civil, juvenile, and criminal cases, each potentially having unique requirements.

How do you fill out the subpoena request form?

Filling out the subpoena request form accurately is vital for its acceptance. Start with a step-by-step guide that details each section of the form.

-

This includes details about the case and the specific information or documents being requested.

-

Identifying Plaintiff and Defendant witnesses accurately is crucial, including their names and contact information.

-

Make sure to note the correct dates to ensure compliance with legal timelines.

What witness information do you need?

Accurate witness information is crucial for the subpoena to be effective. This includes full names, addresses, and any pertinent details that could affect their availability.

-

Ensure you gather sufficient information to identify each witness clearly.

-

Mistakes in names and addresses can delay proceedings or render the subpoena ineffective.

-

If requesting multiple witnesses, organize their information neatly to avoid confusion.

What service method options are available?

The method of service for a subpoena can impact its effectiveness. Different jurisdictions allow various methods, including personal delivery and mailing.

-

Handing the subpoena directly to the witness guarantees they receive it.

-

When personal service isn't possible, consider certified mail or other approved delivery methods.

-

Choosing the correct service method ensures the subpoena is legally binding and recognized by the court.

What happens after submitting the subpoena request?

Once the request is submitted to the court, several procedures follow to ensure compliance. Understanding these can help you navigate the post-submission landscape smoothly.

-

The court will review the subpoena to determine if it is valid before issue.

-

After issuance, comply with any specific requirements provided by the court.

-

If a witness fails to comply, you may have to resort to legal recourse to enforce the subpoena.

How can you use pdfFiller to simplify the process?

pdfFiller is an excellent resource for managing the subpoena request form efficiently. Its features streamline the process significantly.

-

Start with templates tailored for subpoena requests to ensure accuracy.

-

Engage your team in real-time, making document management simpler.

-

Utilize eSigning for expedited processing and stronger compliance across parties.

What interactive tools and resources are available?

pdfFiller offers various interactive tools and resources that enhance understanding and streamline the handling of subpoena requests.

-

Access interactive versions of the subpoena request form for better engagement.

-

Find additional legal information and guidelines to clarify any complex points.

-

Use templates to expedite future submissions and maintain consistency.

How to fill out the subpoena request form

-

1.Access the subpoena request form on pdfFiller.

-

2.Download the form in PDF format or open it directly in the browser.

-

3.Begin with filling out the case information, including the court name, case number, and parties involved in the case.

-

4.Specify the type of subpoena: whether it's for testimony, documents, or both.

-

5.Fill in the name and address of the person or entity you are requesting the subpoena against.

-

6.Clearly state the documents or information you seek if applicable, ensuring specificity to avoid confusion.

-

7.Review all entered information for accuracy and completeness.

-

8.Sign and date the form if required, depending on jurisdiction.

-

9.Save the completed form and print out copies as needed for filing.

-

10.Follow local court procedures to submit the form, either online or in person, to the appropriate court.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.